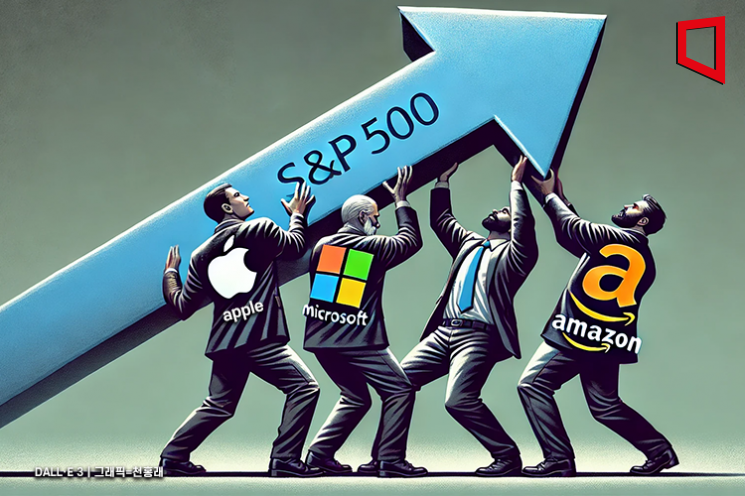

Excessive Dependence on Major Big Tech Companies

The U.S. New York stock market has ended its long-term rally with an average annual return in double digits over the past decade, and it is now forecasted to yield only around 3% annually going forward. The high dependence on the top 10 big tech companies, including Apple, is cited as the reason for this outlook.

According to Bloomberg and CNBC on the 21st (local time), U.S. investment bank Goldman Sachs projected in a report released on the 18th that the S&P 500 index, which is centered on large-cap stocks, will record a 3% return over the next 10 years. This is significantly lower than the historical long-term average return of 11% and the average return of 13% over the past decade.

Goldman Sachs also estimated a 72% probability that the S&P 500 index’s return will underperform U.S. Treasury yields through 2034. They analyzed that there is also a 33% chance it will fall short of the inflation rate.

Goldman Sachs pointed to the fact that a few big tech stocks have driven the New York stock market rally in recent years as a factor for their bearish outlook. Although the S&P 500 index has risen 23% so far this year, most of the gains are attributed to large technology stocks. According to Goldman Sachs, the top 10 companies, including Apple, Microsoft (MS), and Amazon, account for 36% of the total index value, and most of the returns come from these companies.

David Kostin, Goldman Sachs’ chief strategist, said, "The valuation premium of the top 10 stocks is the highest since the peak of the dot-com bubble in 2000," adding, "Investors should prepare for U.S. stock returns over the next 10 years to fall at the lower end of the performance probability distribution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)