Court Dismisses Second Injunction Request, Company Continues Share Buyback

Neither Side Secures Majority, Prolonging Dispute with Shareholder Meeting Vote Battle

MBK Expected to Call Early Meeting, Korea Zinc Likely to Delay Response

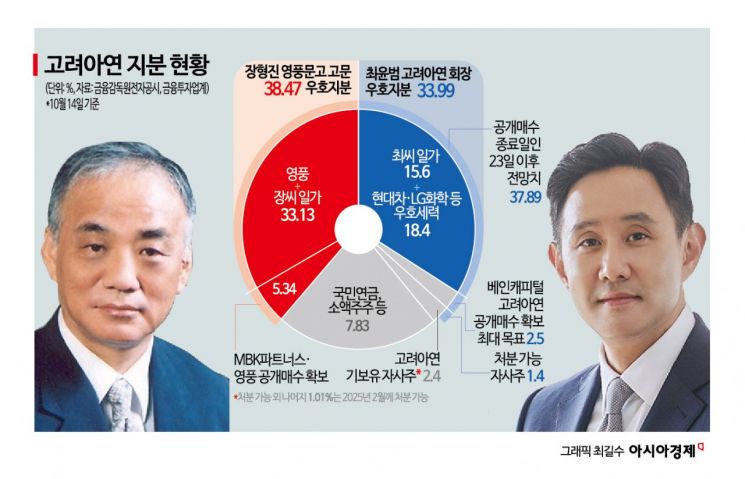

With the dismissal of the injunction request filed by Youngpoong and MBK Partners to prohibit Korea Zinc's tender offer for its own shares, Korea Zinc will be able to proceed with the tender offer as scheduled until the 23rd. Both sides are confident of 'victory' in their respective management rights disputes, but since neither has secured a majority, the competition for securing and delegating voting rights is expected to be fierce until the very last moment of the shareholders' meeting vote battle. After confirming the results of the tender offer for treasury shares ending on the 23rd, Youngpoong and MBK are expected to immediately convene an extraordinary shareholders' meeting.

MBK Side: "Full-Scale Preparation for Extraordinary Shareholders' Meeting... The 'Vote Battle' Is Worth Trying"

On the 22nd, an MBK official said, "We plan to fully prepare for the extraordinary shareholders' meeting," adding, "The opposing side is likely preparing as well, and the vote battle is worth trying." The reason MBK claims it is worth trying is that if Chairman Choi Yoon-beom of Korea Zinc and Bain Capital fill their target stake of 20%, the voting rights share of Youngpoong·MBK and Korea Zinc sides are estimated to be 48.03% and 45.6%, respectively. MBK is reportedly planning to use the extraordinary shareholders' meeting to introduce a large number of Youngpoong directors into the Korea Zinc board, which currently consists of 12 members from Korea Zinc and 1 from Youngpoong. However, if the Korea Zinc board refuses the extraordinary shareholders' meeting, court approval will be required to convene it, potentially delaying the meeting until early next year. Alongside the shareholders' meeting vote battle, MBK plans to continue legal battles. In a statement released immediately after the injunction decision, MBK said, "It appears the court was not sufficiently persuaded of the negative impact this injunction decision will have on Korea Zinc, as well as the significant adverse effects it will have on the domestic capital market and corporate governance in the future," expressing regret. They reaffirmed their position, stating, "Since Korea Zinc's tender offer for treasury shares is financed by a massive loan amounting to 2.7 trillion won, the company's financial structure will be damaged for a long period, causing harm to the remaining shareholders." They added, "While respecting the court's decision, we plan to hold Korea Zinc's current management accountable for the tender offer of treasury shares through future damages claims and substantive lawsuits such as breach of fiduciary duty."

Korea Zinc Board Expected to Employ 'Delay Tactics'... Full Effort to Gather Shares

Korea Zinc is expected to first successfully complete the tender offer for treasury shares, then focus on delaying the extraordinary shareholders' meeting requested by Youngpoong·MBK while trying to increase its voting rights stake by even 0.1%. It is also reportedly considering reviving voting rights on some of the 2.4% treasury shares it previously held. The existing treasury shares are tied up in a treasury share trust contract with Korea Investment & Securities, and can only be disposed of around February next year. This is because the financial authorities interpret that the trust contract can only be terminated after six months from the most recent contract date. However, the Enforcement Decree of the Capital Markets Act recognizes several exceptions, such as granting treasury shares as bonuses to employees or disposing of them to employee stock ownership associations. At the same time, after the tender offer ends, Korea Zinc is expected to compete to secure remaining shares in the market to gather even one more share. Additionally, it will likely make every effort to protect its 'core supporters' by contacting 'weak links' among friendly shareholders such as Hyundai Motor and LG Chem to persuade them to delegate voting rights. Korea Zinc emphasized, "We will complete the legally conducted tender offer for treasury shares in accordance with the court's decision," and added, "We will continue to strengthen voting rights to prevent the Youngpoong·MBK alliance from damaging the nation's key industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.