Samsung Electronics Faces Weakness in Both Foundry and Memory Sectors

SK Hynix Strengthens HBM Position

Reflected in Q3 Results

Investor Sentiment Divided by Performance and Outlook

The preference for SK Hynix is strengthening in foreign investors' domestic semiconductor stock portfolios. Over the past month, SK Hynix recorded net purchases, while Samsung Electronics saw net sales. This is interpreted as an indicator showing that the investment keyword in the semiconductor sector is artificial intelligence (AI).

According to the Korea Exchange on the 22nd, SK Hynix was the top net purchase stock by foreigners over the past month (September 19 to October 18), with 1.0654 trillion KRW. Conversely, Samsung Electronics was the top net sold stock, with 6.8463 trillion KRW. The second was Samsung Electronics preferred shares at 275.5 billion KRW.

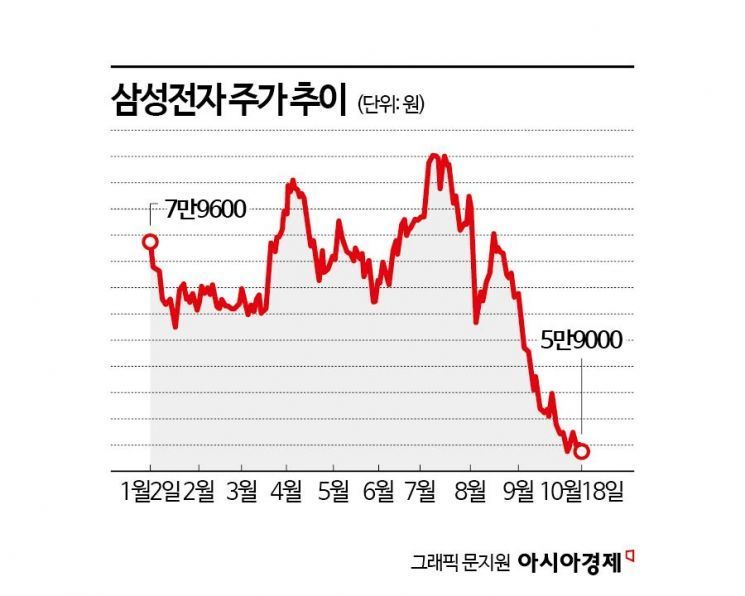

The stock prices show completely different trends. Samsung Electronics hit a 52-week low intraday at 58,500 KRW on the 21st and closed at 59,000 KRW. This is a 25.8% decrease compared to the first trading day of this year (January 2), when it was 79,600 KRW. However, SK Hynix rose 34.0% during the same period, from 142,400 KRW to 190,900 KRW.

Investment sentiment within the semiconductor sector appears polarized. Currently, the semiconductor market is fiercely competitive between foundry and high-bandwidth memory (HBM). Investment sentiment toward SK Hynix, which holds overwhelming competitiveness in the HBM market, is interpreted as positive.

Researcher Shin Seok-hwan of Daishin Securities said, "SK Hynix has secured a monopolistic position in the 8-layer and 12-layer HBM3E markets, resulting in differentiated profitability," and analyzed, "Operating profits for 2024 and 2025 are expected to increase to 23.1 trillion KRW and 35.5 trillion KRW, respectively." He added, "Although there will be some initial costs in the fourth quarter, from 2025, the supply volume of 12-layer HBM3E will expand significantly, contributing greatly to profits."

Consequently, expectations for SK Hynix's third-quarter earnings are also rising. According to FnGuide, SK Hynix's sales are projected at 18.037 trillion KRW, with operating profit at 6.7628 trillion KRW. These figures represent a 98.9% increase year-on-year and a return to profitability.

On the other hand, Samsung Electronics faces negativity in both foundry and memory sectors. Samsung Electronics competes with Taiwan's TSMC in the foundry sector but is recording losses due to sluggish orders and low utilization rates. The non-memory sectors, including foundry and system LSI, are estimated to have incurred losses exceeding 1 trillion KRW in the third quarter of this year.

Researcher Lee Seung-woo of Eugene Investment & Securities pointed out, "The gap between companies with technology and strategy in the foundry field and those without is deepening," and noted, "TSMC's AI-related demand is still in the early stages, and growth is expected to continue for several years."

In the memory (HBM) sector, Samsung Electronics has lost market leadership to SK Hynix. In the first half of this year, Samsung Electronics' stock price rose on expectations of supplying HBM to Nvidia, but concerns have increased due to the failure to deliver.

Researcher Lee Ui-jin of Heungkuk Securities said, "Samsung Electronics' operating profit forecasts have been adjusted downward by 11% and 17% to 36.6 trillion KRW in 2024 and 45.7 trillion KRW in 2025, respectively, compared to previous estimates," diagnosing that "As the memory market diversifies, risks related to legacy products are becoming more prominent."

An executive at a private equity firm said, "The performance of Samsung Electronics and SK Hynix clearly diverges depending on HBM competitiveness," adding, "SK Hynix's price-to-earnings ratio (PER) is around 4 to 5 times, while Samsung Electronics is about 15 times, so from an investor's perspective, SK Hynix is inevitably preferred over Samsung Electronics." The official said, "With peak-out forecasts for the semiconductor industry emerging, if Samsung Electronics does not present remarkable indicators in the HBM sector, this trend is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.