Recorded Market Cap of 20.2163 Trillion KRW on the 18th

Surpassed Samsung Life to Rank 3rd in Financial Stocks by Market Cap

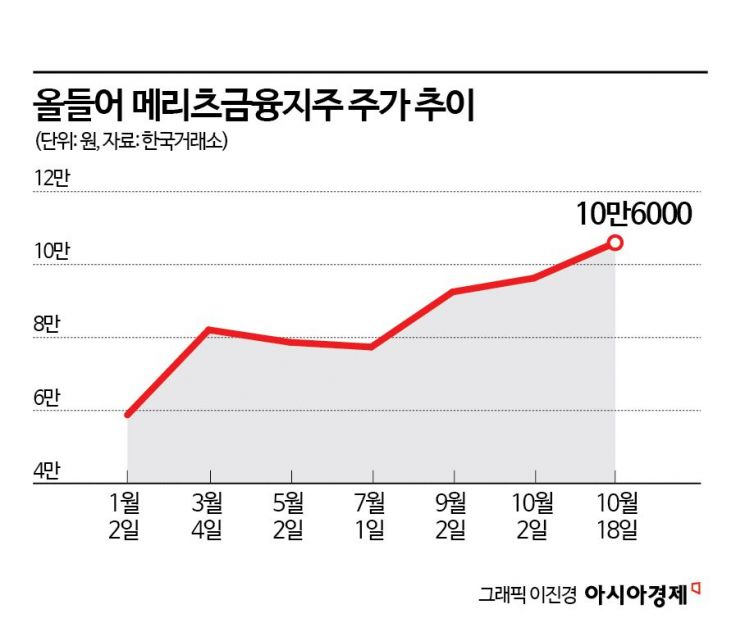

Stock Price Rose Nearly 80% This Year, the Largest Increase Among Financial Stocks

Active Shareholder Returns Cited as the Driving Force Behind Stock Price Rise

Meritz Financial Group's market capitalization has surpassed 20 trillion won. With this, Meritz Financial Group has risen to become one of the top three financial stocks by market capitalization, alongside KB Financial Group and Shinhan Financial Group.

According to the Korea Exchange on the 21st, Meritz Financial Group closed at 106,000 won on the 18th, up 2,300 won (2.22%) from the previous day. Its market capitalization reached 20.2163 trillion won, surpassing Samsung Life Insurance (20 trillion won) to rank third among financial stocks by market capitalization. Its overall market capitalization ranking rose one notch from 17th to 16th.

While financial stocks have shown strength reflecting value-up expectations since the beginning of the year, Meritz Financial Group demonstrated a particularly remarkable upward trend. Meritz Financial Group has risen nearly 80% this year, recording the largest increase among financial stocks. As of the 18th, Meritz Financial Group's stock price increased by 79.36% year-to-date. During the same period, KB Financial Group rose 74.49%, Hana Financial Group 51.15%, JB Financial Group 49.34%, DB Financial Investment 46.23%, Samsung Life Insurance 46.16%, and Shinhan Financial Group 40.72%. The stock price, which was in the 50,000 won range at the beginning of the year, recently surpassed 100,000 won. On the 18th, it reached an intraday high of 106,400 won, marking a 52-week high. Fueled by this upward momentum, its market capitalization ranking jumped from 33rd at the start of the year to 16th.

An active shareholder return policy is cited as the driving force behind Meritz Financial Group's stock price increase. As of the end of June this year, Meritz Financial Group's three-year average total shareholder return (TSR) was 58%, about three times higher than the average for domestic financial holding companies. TSR is a concept that includes not only stock price returns but also dividend income, representing the total return shareholders can earn over a certain period. Since implementing the shareholder return policy in 2023, the cumulative TSR has steadily increased to 91% as of the first half of this year, up 47 percentage points from 44% at the end of last year.

Last year's shareholder return ratio reached 51.2%. This year, the target remains above 50%. From 2017 through last year, Meritz Financial Group repurchased about 1.3 trillion won worth of treasury shares and then canceled all of them, maintaining a 100% treasury share cancellation rate. This year, following a 500 billion won treasury share acquisition trust contract signed in March, another 500 billion won treasury share acquisition trust contract was signed last month. Accordingly, a total of 1 trillion won worth of treasury shares will be acquired and fully canceled. Thanks to these shareholder return efforts, Meritz Financial Group was included in the value-up index announced by the Korea Exchange last month.

Seol Yong-jin, a researcher at SK Securities, said, "The core of Meritz Financial Group's capital allocation mechanism is to use capital primarily where returns are most efficient when capital is allocated." He added, "They compare the internal rate of return on investment with the inverse of the price-earnings ratio (PER) to decide on internal investment and shareholder returns, making all decisions centered on stock price and profitability. This aligns perfectly with the value-up program, which focuses on efficient capital allocation within the stock market."

Performance is also favorable. Park Hye-jin, a researcher at Daishin Securities, said, "Meritz Financial Group's third-quarter consolidated net profit is expected to be 581 billion won, in line with consensus (average securities firm forecast)." She analyzed, "The stable profit flow from fire insurance will be maintained, and securities are key, with factors for provisioning and reversal related to real estate project financing (PF). The reversal of provisions is due to project completions, while provisioning is related to participation in new deals." She added, "They are continuing their corporate finance expansion trend by participating in a series of large-scale deals recently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)