Forest to Raise Subscription Fee by 36% Starting Next Month 13

Competition Enters '2R' from User Expansion to Monetization

Streaming platform SOOP (formerly AfreecaTV) is raising its subscription fees for the first time in seven years since introducing the subscription model in 2017. This move comes as user growth slows down, prompting the platform to enhance its revenue model. Analysts interpret this as SOOP entering a full-fledged competition with Naver Chijijik, which had previously competed mainly on user acquisition, now focusing on monetization.

According to the IT industry on the 21st, SOOP will revamp its subscription model and increase subscription fees starting from the 13th of next month. The subscription service will be divided into Tier 1 and Tier 2, with the existing Tier 1 price rising from 3,300 KRW per month (PC/web basis) to 4,500 KRW, a 36.4% increase. The newly introduced Tier 2 subscription will be priced at 14,500 KRW per month.

The subscription service allows users to regularly support their favorite streamers with a fixed amount and provides various benefits when watching broadcasts. These benefits include ad-free viewing and immediate entry regardless of the number of participants in the broadcast.

The difference in subscription fees translates into increased streamer support funds and additional user benefits. Features that enhance intimacy with streamers include displaying subscription ceremonies in the chat window at desired times and using Tier 2 emoticons set by the streamer.

SOOP’s decision to raise subscription fees aims to improve profitability. Initially, SOOP focused on securing popular streamers and diversifying content. This was to absorb Twitch users who withdrew from the domestic market in February this year and to outpace the new competitor, Naver Chijijik. However, as the Twitch spillover effect slowed, SOOP appears to have shifted toward refining its revenue model. A SOOP representative explained, "We are adjusting subscription fees to reflect inflation and enhancing benefits in line with rebranding."

Considering that Naver Chijijik, a competitor in the streaming market, has already launched similar subscription products, it seems the competition between the two has entered round two. Chijijik released subscription products divided into Tier 1 and Tier 2 in February this year, priced at 4,900 KRW and 14,900 KRW respectively.

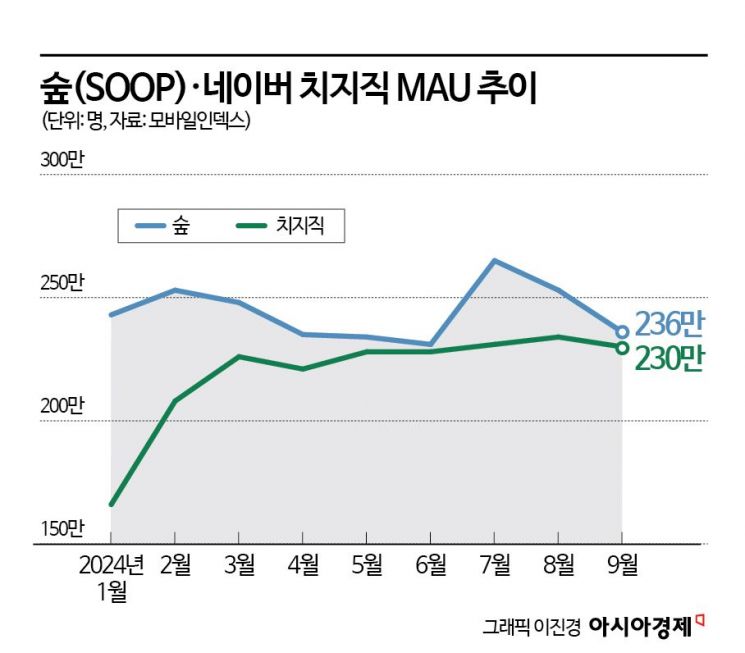

Both companies, which had focused on traffic acquisition, are now concentrating on refining their revenue models. Chijijik has narrowed the gap with SOOP by securing 2 million monthly active users (MAU) this year. According to Mobile Index, an app analytics platform, last month SOOP and Chijijik had MAUs of 2.36 million and 2.3 million respectively, showing a narrow difference. Chijijik introduced a support currency called ‘Cheese,’ similar to star balloons, and added a subscription model linked to Naver Membership. In June, it diversified its revenue model further by introducing mid-roll ads.

Currently, most of SOOP’s revenue comes from the platform segment, which includes streamer support through ‘star balloons.’ In the second quarter, the platform segment accounted for 78% of total revenue of 106.5 billion KRW, amounting to 82.7 billion KRW. Over 90% of this is from star balloon charges, with subscriptions and other sources making up a minimal portion. To sustain revenue growth, increasing the contribution of subscription products is necessary. Samsung Securities analyst Oh Dong-hwan said, "The revamp of the paid subscription model will increase revenue contribution. Although it is difficult to expect an expansion of the domestic user base now that Twitch user inflow has ended, revenue growth through an increase in average revenue per paying user (ARPPU) will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)