Record-Breaking Boom in Defense Industry, Earnings Pillar

Increased Copper Demand Due to China's Economic Stimulus

"Both Defense and Copper Sectors Show Positive Outlook"

Market attention is focused on whether Pungsan's stock price will continue its strong performance. This is because the company’s value could be re-evaluated amid the defense industry’s record-high conditions and expectations for China’s economic stimulus measures boosting copper demand.

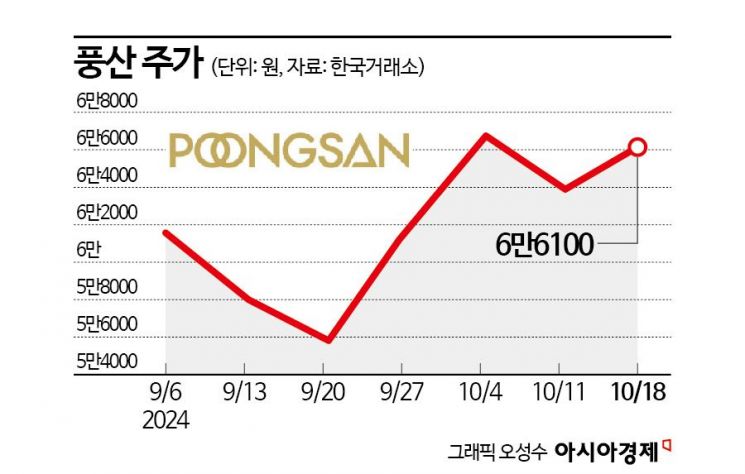

According to the Korea Exchange on the 21st, Pungsan recorded 66,100 KRW based on the previous trading day’s closing price, up 24.96% from last month’s intraday low of 52,900 KRW. Engaged in the non-ferrous metal and defense businesses, Pungsan experienced a stock price correction while copper prices stalled in the second quarter of this year, but recently rebounded as the attractiveness of its defense sector became more prominent.

Brokerages analyzed that the negative impact from weak copper demand in China will be limited going forward. Lee Gyu-ik, a researcher at SK Securities, said, “Pungsan projected third-quarter non-ferrous metal sales at 44,000 tons, but due to weak demand in China, the actual figure is estimated to be around 43,000 tons. However, this has already been reflected in the stock price, so the possibility of further declines related to this is low.”

Lee also mentioned the possibility of copper prices rising as consumer goods demand improves due to China’s recently announced stimulus measures. He said, “In the near term, stock prices may be influenced by the direction of copper prices. Since the copper import premium at Yangshan Port in China is at its highest point of the year and the Chinese government’s stimulus focuses on improving consumption, further improvement in copper demand is expected.”

There are also forecasts that copper prices will rebound due to seasonal factors. Choi Moon-seon, a researcher at Korea Investment & Securities, noted, “In recent years, copper prices have shown an upward trend from winter to spring. Supply constraints such as insufficient development of new mines in Latin America, a major copper-producing region, have not been resolved, and we are now approaching winter in Korea and summer in Latin America.” He added, “At this time, Latin America experiences severe water shortages due to high temperatures, requiring adjustments to working hours. This is believed to be the reason copper prices have risen from winter to spring. The expected copper price strength in winter will act as a driving force for stock price increases.”

Analysts also expect recognition of value not only from the recovery of the copper segment’s performance but also from the defense sector. Kim Yoon-sang, a researcher at iM Securities, said, “The fact that the defense industry is enjoying an all-time high boom is a basis for upward corporate valuation. In the third-quarter results, the defense segment will maintain top-level margins of around 20% due to strong exports of large-caliber ammunition. Furthermore, with defense sales concentrated in the fourth quarter, performance is expected to improve compared to the previous quarter.”

Lee Tae-hwan, a researcher at Daishin Securities, also pointed out, “Momentum in the defense sector is concentrated in the fourth quarter, and the global ammunition market remains prosperous. Seasonal increases in domestic sales and export deliveries make it possible to achieve the highest quarterly defense sales.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)