Trump's Winning Odds in Betting Market Reach Highest in Three Months

Similar Level to Post-July Assassination Attempt

Leading in Swing States with 20 Days Left Until Election

Trump-Related Stocks Surge One After Another

Bitcoin's Upward Rally Continues

Meanwhile, Harris-Related Stocks Weaken

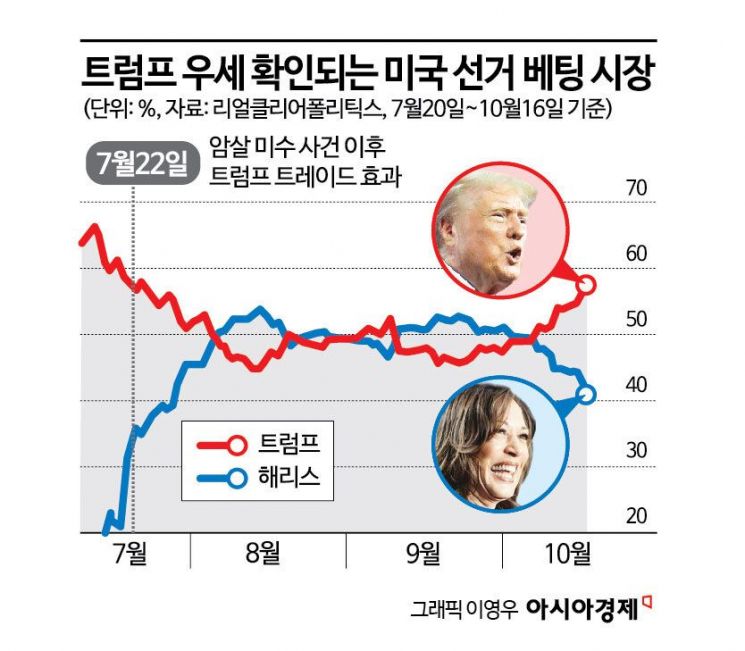

With the U.S. presidential election just 20 days away, the betting market has seen the highest winning probability for former Republican President Donald Trump in three months. This level is similar to when his approval rating surged following the assassination attempt by shooting in July.

Trump Leads in U.S. Election Betting Market

On the 16th (local time), the average winning probability for former President Trump across seven U.S. election betting sites compiled by the polling analysis site RealClearPolitics was 57.7%, the highest since July 22 (58.7%). Meanwhile, Vice President Kamala Harris's winning probability was recorded at 41.3%. Trump's winning probability surpassed Harris's 49.3% on the 6th, when he recorded 49.4%, and has since widened the gap.

Trump's winning probability surged once due to a rallying effect among his supporters after he was shot during a campaign speech in Pennsylvania on July 13. This also led to President Joe Biden, who was then embroiled in cognitive and age-related controversies, deciding to withdraw from the race. Harris, who became the new presidential candidate, maintained an upward trend after being evaluated as leading Trump in the September TV debate. However, recently, she has faltered amid criticisms that her economic policies are not distinctly different from Biden's and that her support base among Black voters is weak.

Trump Holds Advantage in Swing States with 20 Days Left Until Election

Some polls even show Trump holding a significant lead in certain swing states. A Quinnipiac University poll conducted from the 10th to 14th among 1,328 likely voters in Georgia (margin of error ±2.7 percentage points) showed Trump receiving 52% support, ahead of Harris's 45% outside the margin of error.

The U.S. presidential election, which uses the Electoral College system, is not heavily influenced by the traditional strongholds of the Democratic or Republican parties. Therefore, it is no exaggeration to say that the outcome hinges on seven battleground states (Pennsylvania, Michigan, Wisconsin, North Carolina, Georgia, Arizona, Nevada) where the race is extremely close. With Trump leading in these swing states three weeks before the election, the betting market is placing large bets on him.

However, experts have warned about potential distortions in the betting market. Tobin Marcus, U.S. policy and politics head at Wolfe Research, said, "It appears the betting market has shifted in favor of Trump," but cautioned, "We need to be wary of an overly reflected mood." The financial media MarketWatch emphasized, "Betting markets can be distorted by unreliable polls, and political gamblers are mainly right-leaning males, which should be noted."

Market Embraces the ‘Trump Trade’

In financial markets, Trump's confirmed lead has triggered the so-called ‘Trump trade.’ The stock of Trump Media, the parent company of Truth Social, a social networking service founded by Trump, surged 15.5% that day, rising 157% since its September low. Software company Funware, which designed the app for Trump's 2020 campaign, also saw its stock rise 17.6% that day.

Bitcoin prices have continued their rally. Since Trump has positioned himself as a pro-cryptocurrency advocate, it is expected that if elected, he will ease regulations on the cryptocurrency industry, including mining and exchanges. According to Investing.com, Bitcoin was trading at $67,626 per coin at 7:50 p.m. Eastern Time (8:50 a.m. KST on the 17th), up 0.8% from 24 hours earlier, marking its highest price since July. Cryptocurrency-related stocks such as mining company Marathon Digital Holdings (6.8%) and exchange Coinbase (7.2%) also showed gains.

On the other hand, ‘Harris-themed stocks’ are weak. Renewable energy, such as solar power, is a representative example. For instance, the Invesco Solar ETF (TAN) and iShares Clean Energy ETF (ICLN) have fallen 13% and 8%, respectively, since the beginning of this month.

Meanwhile, nationwide polls still show Vice President Harris holding an advantage. According to a Marist poll conducted from the 8th to 10th among 1,401 likely voters nationwide (margin of error ±3.9 percentage points), Harris recorded 52% support, while Trump had 47%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.