Key Issues in the Second Injunction Lawsuit Different from the First

Whether the Decision on Treasury Stock Tender Offer Constitutes Breach of Fiduciary Duty

Whether the Limit on Distributable Earnings Requires Approval at the General Shareholders' Meeting, etc.

The Yeongpung-MBK Partners alliance, which secured an additional 5.34% stake in Korea Zinc through a public tender offer, gaining an advantageous position in the management rights dispute, will focus on legal battles to prevent Korea Zinc from acquiring treasury shares through a public tender offer for the time being. Although Yeongpung-MBK lost the first round of the injunction to prohibit treasury share acquisition, they expressed a strong determination to seize victory in the second round of the ongoing injunction lawsuit on another key issue.

On the 16th, a senior MBK Partners official stated, "This week, we plan to go all-in on the injunction procedure to stop Korea Zinc's treasury share public tender offer rather than acquiring additional shares." The first hearing date for the injunction application filed by Yeongpung-MBK to prohibit Korea Zinc from acquiring its own shares is scheduled for the 18th. The result of the injunction lawsuit is expected around the 21st, ahead of Korea Zinc's public tender offer closing date on the 23rd.

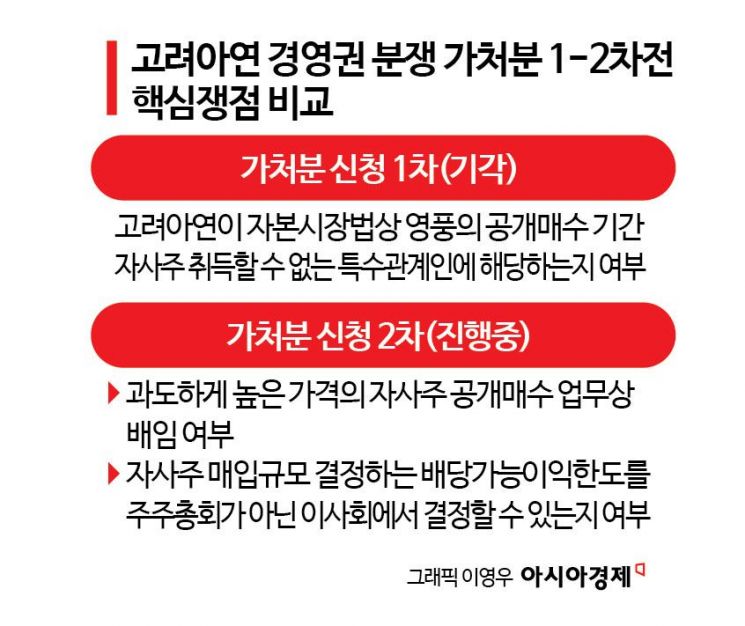

The core issue of the first round of the injunction lawsuit to prohibit treasury share acquisition was a request to prevent Korea Zinc from purchasing shares through treasury share acquisition rather than the public tender offer method during the tender offer period. The core issue of the second round of the injunction lawsuit concerns whether Korea Zinc’s treasury share public tender offer constitutes breach of fiduciary duty and whether the limit on distributable profits, which determines the scale of treasury share purchases, can be decided by the board of directors rather than the shareholders' meeting. This differs significantly from the issues in the first round.

Is the Treasury Share Public Tender Offer at a Price 40% Higher a Breach of Fiduciary Duty?

On the 2nd, Yeongpung filed an injunction application with the Seoul Central District Court, requesting to halt the resolution by Korea Zinc’s board of directors to acquire treasury shares through a public tender offer, claiming it is a breach of fiduciary duty that harms the company and all shareholders. Yeongpung argues that treasury shares cannot be disposed of until six months after acquisition, so the stock price tends to revert to the previous market price (around KRW 550,000 per share) after the tender offer ends. They expect that if Korea Zinc acquires treasury shares at a price higher than the current tender offer price, the value of the acquired shares will drop by at least 40%, constituting a breach of fiduciary duty causing damage to the company.

Converting the Company’s Voluntary Reserve Fund for Treasury Share Purchases: Directors’ Authority or Shareholders’ Authority?

The Yeongpung-MBK alliance emphasizes that during the first injunction, they could not dispute the specific conditions of the tender offer, especially the part related to distributable profits, which is the limit for acquiring treasury shares, was not addressed. The current injunction lawsuit includes claims that Korea Zinc’s use of the company’s voluntary reserve fund for treasury share purchases is illegal. They argue that the authority to change the purpose of the voluntary reserve fund lies with the shareholders' meeting, not the board of directors. Regarding the amount, Korea Zinc claims that the company’s distributable profits, including the voluntary reserve fund, exceed KRW 6 trillion, allowing for a treasury share public tender offer of about KRW 2.7 trillion. In contrast, Yeongpung-MBK argues that excluding the voluntary reserve fund, Korea Zinc’s distributable profits amount to only about KRW 60 billion. Legal and accounting experts are divided on this issue, drawing significant attention to the court’s forthcoming decision.

Large Legal Teams Including Law Firms Sejong and Kim & Chang Formed... Injunction Results to Be Announced Before Public Tender Offer Ends

Both sides have assembled large legal teams to win this injunction lawsuit. Yeongpung, which received support from Law Firm Sejong and KL Partners in the first injunction trial, continues to receive their assistance in the second injunction lawsuit, increasing the number of Sejong lawyers from 8 to 10. In response, Chairman Choi Yoon-beom’s side has formed a legal team identical to that of the first injunction, led by attorney Cho Hyun-duk from Kim & Chang law firm, who attended a press conference with Chairman Choi on the 2nd, with a total of 14 lawyers expected to respond. Industry insiders view the conclusion of Yeongpung-MBK’s public tender offer and the results of this injunction lawsuit as the second turning point in the management rights dispute.

Meanwhile, the Financial Supervisory Service (FSS) notified Korea Zinc and Yeongpung on the previous day that it will commence an accounting review. The accounting review is a preliminary investigation based on previously disclosed corporate financial statements to identify any unusual matters. It typically lasts about three months, and if explanations are insufficient during this process, it may escalate to a full audit. The FSS is expected to scrutinize allegations raised during the recent management rights dispute, such as provisions for liabilities and impairment of investment securities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.