KB Financial, 7 Consecutive Trading Days of Gains...Intraday Record High

Meritz Financial Group, Korea Financial Group, JB Financial Group Also Hit Intraday Record Highs

Strong Earnings and Shareholder Return Expectations Support Financial Stocks Rally

Focus on Stocks Announcing Corporate Value Enhancement Plans

Financial stocks, which had been sluggish for a while, are showing strength again. Investors seem to be turning their attention back to financial stocks due to solid earnings and expectations of expanded shareholder returns. As interest in dividend stocks tends to increase toward the end of the year, attention to financial stocks, which are considered representative high-dividend stocks, is expected to continue.

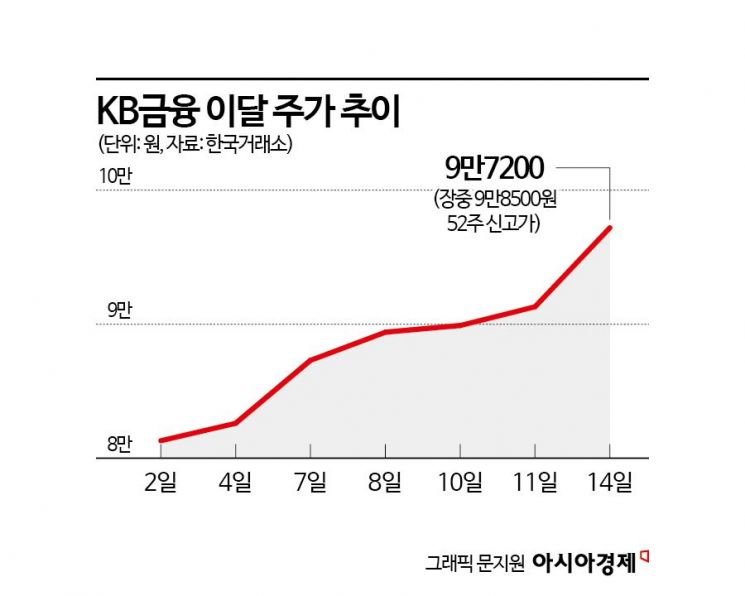

According to the Korea Exchange on the 15th, financial stocks recorded consecutive 52-week highs the previous day. KB Financial, the leading financial stock, closed at 97,200 KRW, up 6.46%, continuing its seven-day consecutive rise. During the session, it rose to 98,500 KRW, setting a new 52-week high. Meritz Financial Group also reached a new 52-week high during the session at 105,200 KRW, up 1.97%, and Korea Financial Group and JB Financial Group also recorded 52-week highs during the session.

In addition, financial stocks broadly showed strength with Shinhan Financial Group up 1.04%, Hana Financial Group up 4.59%, and Woori Financial Group up 3.96%.

Financial stocks, which were considered major beneficiaries after the government announced its value-up program, showed remarkable strength in the first half of the year but were somewhat sluggish in the second half. Concerns over interest rate cuts were reflected, and especially last month, the value-up index unexpectedly included fewer financial stocks, negatively impacting stock prices.

After a correction, financial stocks have recently been on the rise again. This is because, amid generally lowered expectations for third-quarter corporate earnings, the solid earnings outlook for financial stocks and expanded shareholder returns have been highlighted.

Choi Jung-wook, a researcher at Hana Securities, said, "Last week, bank stocks rose 5.2%, significantly outperforming the KOSPI's 1.1% increase," adding, "Concerns about an additional 'big cut' (0.5 percentage point interest rate cut) in the U.S. in November have almost disappeared, and although the probability of a 25bp (1bp=0.01 percentage point) cut remains high, the possibility of a rate freeze has also been raised, causing the U.S. 10-year Treasury yield to exceed 4% again, showing an upward trend in long-term interest rates." He continued, "Last week, bank stocks worldwide all outperformed the market, showing overall strength in global financial stocks. Notably, domestic bank stocks saw foreign investors net buying over 220 billion KRW last week alone, marking a significant shift to large-scale net buying after several months," he analyzed.

Third-quarter earnings are expected to exceed market expectations. Researcher Choi said, "The estimated net profit of bank holding companies (including Industrial Bank of Korea) for the third quarter is about 6.1 trillion KRW, a 14.9% increase compared to the same period last year, exceeding the consensus (average securities firm forecast) of about 5.9 trillion KRW." He explained, "Despite a decline in net interest margin (NIM), the loan growth rate is quite high, so the decrease in interest income is expected to be limited. Additionally, the size of additional provisions for real estate project financing (PF) is not as large as feared, so bad debt costs are estimated to decrease compared to the previous quarter."

Expectations for value-up remain strong. Ha In-hwan, a researcher at KB Securities, said, "On the day the value-up index was released at the end of September, some financial stocks plummeted as they were not included in the index contrary to market expectations, but this does not change the fact that financial stocks are the primary beneficiaries of the value-up program." He added, "This year, financial stocks showed strength in January and February when the value-up program was officially mentioned, and again in April-May and July-August, which correspond to the earnings announcement periods for financial stocks. The mention of shareholder return plans during earnings announcements was a major factor behind the strength of financial stocks, and a similar seasonal characteristic can be expected again in October-November." He noted that attention should be paid to companies that have not yet disclosed plans to enhance corporate value. Ha said, "If companies announce value-up plans along with earnings announcements, not only the effect of the announcement itself but also the possibility of new inclusion during future value-up index rebalancing can be expected."

KB Financial is expected to announce its corporate value enhancement plan along with its third-quarter earnings report. Kim Eun-gap, a researcher at Kiwoom Securities, said, "Since the corporate value enhancement plans announced by other banks were specific and challenging, it may not be easy to include content beyond that, but it is expected that the announcement will meet market expectations as much as possible." Jeong Jun-seop, a researcher at NH Investment & Securities, said, "Since KB Financial was unexpectedly not included in the value-up index components, its future capital policy is likely to be clearer and more proactive than before." He added, "KB Financial plans to announce its corporate value enhancement plan on the October earnings announcement date, which is expected to include raising the target price-to-book ratio (PBR), which will serve as the standard for share buybacks and cancellations, and a rapid expansion of shareholder return rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)