The Korea Deposit Insurance Corporation (KDIC) provided approximately 27 trillion won in public funds related to the 'Savings Bank Crisis' that occurred in 2011, but it has been revealed that the recovery rate is only half.

According to the 'Recovery Performance of Support Funds by Savings Bank' submitted by KDIC to Kang Min-guk, a member of the National Assembly's Political Affairs Committee from the People Power Party, on the 14th, KDIC created a 'Mutual Savings Bank Restructuring Special Account' to restructure 31 savings banks from 2011 and supported 27.2 trillion won. Of this, the amount recovered by the first half of this year was 14 trillion won, resulting in a recovery rate of only 51.7%.

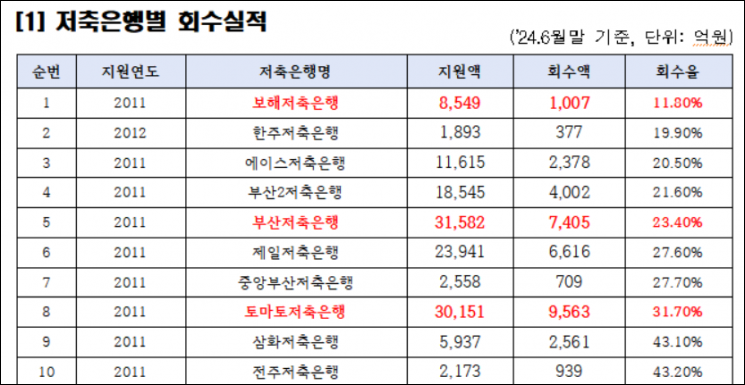

The savings bank with the lowest recovery rate is Bohae Savings Bank, which received 850 billion won in support and has recovered only 100 billion won so far, with a recovery rate of 11.8%. Including Bohae Savings Bank, 12 out of the total 31 banks, accounting for 38.7%, have a recovery rate below the average of 51.7%.

The recovery rates for Busan Savings Bank (support amount 3.1 trillion won, recovery amount 700 billion won) and Tomato Savings Bank (support amount 3 trillion won, recovery amount 900 billion won), which received more than 3 trillion won in public funds, are 23.4% and 31.7%, respectively, showing poor performance.

The validity period of the Mutual Savings Bank Restructuring Special Account is until December 31, 2026. With less than three years remaining until the special account ends, and only half of the support funds recovered, it is expected to be difficult to repay the entire support amount within the deadline. If debts remain after the special account's validity period expires, KDIC is likely to repay the savings bank support funds directly using deposit insurance premiums.

Currently, it has been understood that KDIC does not even have target figures for the expected recovery amounts by year. The annual recovery amounts have been decreasing: 337.4 billion won in 2021, 265.7 billion won in 2022, and 217.9 billion won in 2023, with only 12.5 billion won recovered in the first half of this year.

Assemblyman Kang Min-guk said, "With the special account's end approaching, it is regrettable that KDIC is responding lukewarmly to improving the recovery rate and appears to be shifting the remaining debt burden onto financial consumers. Even now, they should reset the target recovery amounts and prepare company-wide measures to improve the recovery rate."

Top 10 savings banks with low public fund recovery rates based on the 'Mutual Savings Bank Restructuring Special Account'. [Source: Office of Assemblyman Kang Min-guk]

Top 10 savings banks with low public fund recovery rates based on the 'Mutual Savings Bank Restructuring Special Account'. [Source: Office of Assemblyman Kang Min-guk]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.