"Increase in Household Loans from Secondary Financial Sector May Exceed 1 Trillion Won"

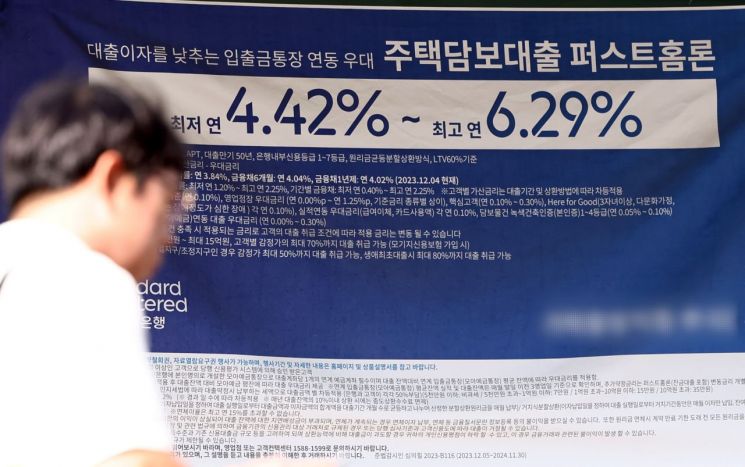

Financial authorities have issued a red alert over the rising household debt in the secondary financial sector. On the 15th, they plan to urgently convene the secondary financial sector to order strengthened household debt management. This swift response comes as signs of a 'balloon effect' caused by tightened bank lending are beginning to emerge.

According to the financial sector on the 13th, the Financial Services Commission and the Financial Supervisory Service will hold a meeting on the 15th with representatives from mutual finance, insurance companies, savings banks, credit specialized financial companies, and associations to strengthen household debt management. This separate gathering of the secondary financial sector comes just four days after a review meeting held on the 11th with related agencies, the Korea Federation of Banks, secondary financial sector associations, and the five major commercial banks. This is due to the observed phenomenon of loan demand shifting to the secondary financial sector as banks tighten lending.

Financial authorities believe that, based on the current trend, the increase in household loans in the secondary financial sector this month could exceed 1 trillion won. If the increase in household loans in the secondary financial sector surpasses 1 trillion won in October, it will be the first time in about two and a half years since May 2022 (+1.4 trillion won).

The meeting, led by the Financial Services Commission, will include not only financial associations but also individual financial companies such as Saemaeul Geumgo, NongHyup Central Association, Samsung Life Insurance, and Kyobo Life Insurance. These are entities where household loan increases, particularly in mortgage loans, have recently appeared or are a concern.

In particular, Saemaeul Geumgo saw household loans increase by 200 billion won last month, marking a return to an upward trend. A significant portion of this is mortgage loans in the Seoul metropolitan area, making it a focus of regulatory attention. The mutual finance sector overlaps with banks in terms of customer base and has a relatively relaxed total debt service ratio (DSR) limit of 50%, which could attract borrowers who are blocked from bank loans. Authorities are also expected to order strengthened management measures centered on large companies with substantial mortgage loan balances, such as Samsung Life Insurance.

Financial authorities plan to implement additional measures if the shift of loans from banks to the secondary financial sector becomes full-fledged. One option under consideration is to align the DSR limit for the secondary financial sector, currently at 50%, with that of the primary financial sector (40%).

However, authorities are also concerned that if the secondary financial sector simultaneously reduces lending sharply, low-income households might exit the formal financial system. For this reason, despite card loan and cash service loan volumes reaching record highs, individual card companies were not included in this meeting.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.