177% Increase This Year... Expectations for Prostate Cancer Diagnostic and Therapeutic Agents

Recent Big Pharma Radioisotope Drug M&A Approximately 2 Trillion Won

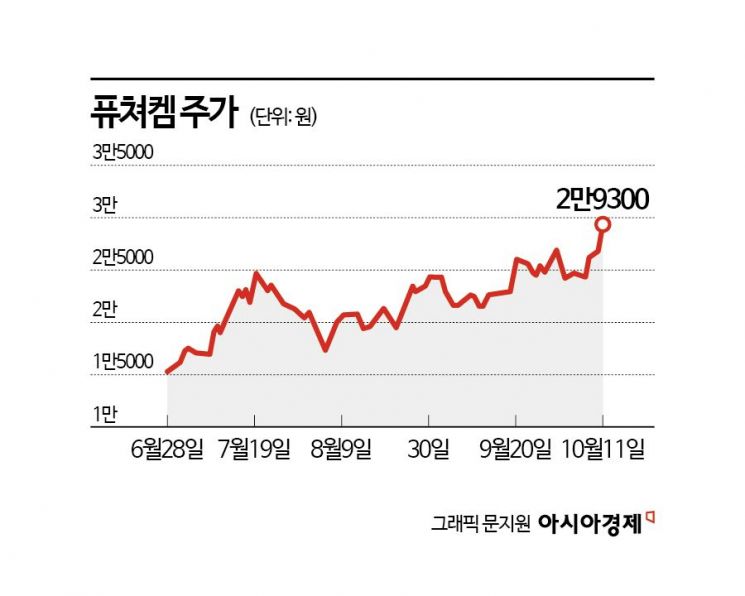

The stock price of FutureChem, which is developing a radioactive isotope-based prostate cancer anticancer drug, has reached an all-time high. As the radioactive pharmaceuticals market rapidly grows, expectations for the new drugs being developed by FutureChem are increasing.

According to the financial investment industry on the 14th, FutureChem's stock price has risen 178% since the beginning of this year. Considering that the KOSDAQ index fell 11% during the same period, the market-relative return rate reaches 189 percentage points (P). FutureChem's market capitalization has swelled to 650 billion KRW.

FutureChem is developing new radioactive pharmaceutical drugs that diagnose and treat specific diseases using radioactive isotopes. Unlike general pharmaceuticals, radioactive pharmaceuticals use radioactive isotopes to play roles in diagnosis and treatment. From a production standpoint, there is a risk of exposure to radioactive materials, so radiation-related permits and approvals must be obtained. They are manufactured in facilities that meet Good Manufacturing Practice (GMP) standards, where synthesis, purification, and formulation can be automatically performed in shielded environments.

FutureChem is conducting a domestic Phase 3 clinical trial for its prostate cancer diagnostic agent (FC303). It has completed Phase 1 clinical trials in the United States. The prostate cancer therapeutic agent (FC705) received approval from the Ministry of Food and Drug Safety in May 2022 to proceed with Phase 2 clinical trials, which are currently underway. It also received clinical trial plan approval from the U.S. Food and Drug Administration (FDA) and is conducting a Phase 2a trial.

As expectations for the growth of the radioactive pharmaceuticals market increase, FutureChem's corporate value is also rising. On July 10th of this year, the U.S. Centers for Medicare & Medicaid Services (CMS) proposed individual insurance reimbursement for prostate cancer radioactive pharmaceutical diagnostics. Starting next year, insurance reimbursement will be applied exclusively to prostate cancer diagnostic agents. With reimbursement applied to diagnostic agents costing approximately $630 or more per day, the related market is expected to grow.

Global pharmaceutical companies anticipate growth in the radioactive pharmaceuticals market and acquired radioactive isotope therapy (RLT) companies last year. Last year, Novartis acquired Bicycle and 3BP for $1.7 billion and $325 million, respectively. Eli Lilly purchased Point Biopharma for $1.4 billion, and BMS acquired Rays Bio for $4.1 billion. AstraZeneca invested $2 billion in March to acquire Fusion Pharma.

Minyong Eom, a researcher at Shinhan Investment Corp., explained, "Over the past two years, the average acquisition price of six companies has exceeded 2 trillion KRW," adding, "We believe that domestic FutureChem currently holds the highest clinical results worldwide." He further stated, "It is a small-cap biotech with the greatest expectations for big pharma technology transfers or mergers and acquisitions."

The prostate cancer diagnosis and treatment market that FutureChem focuses on is also growing rapidly. In the United States, approximately 250,000 people are diagnosed with prostate cancer annually. This is twice the size compared to lung and bronchial cancers. The global prostate cancer market size is expected to grow from 19.7 trillion KRW in 2020 to 30 trillion KRW by 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)