"Korea Zinc's Treasury Stock Tender Offer, Tax and Net Receipt Advantage"

"Most Domestic and Foreign Institutional Investors and Individuals Benefit More"

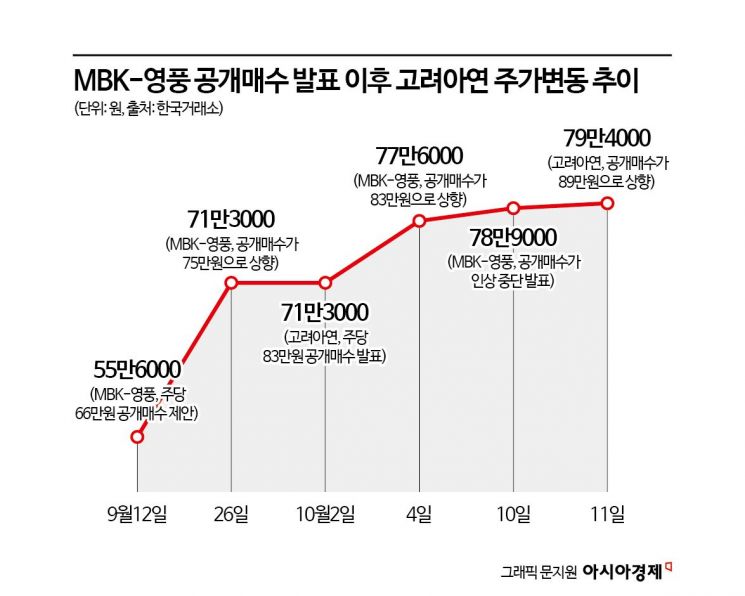

Korea Zinc raised its tender offer price for treasury shares, and an analysis suggests that many domestic and foreign institutional investors and individual investors find participating in the tender offer more advantageous in terms of tax benefits.

According to Korea Zinc on the 12th, most individual investors with financial income below 20 million KRW can achieve higher after-tax returns by responding to Korea Zinc's tender offer for treasury shares. When participating in the tender offer, dividend income tax is imposed, whereas participating in MBK Partners' tender offer incurs capital gains tax. However, due to the difference in tender offer prices, Korea Zinc's purchase price is more favorable.

For individual investors with financial income below 20 million KRW, it is more advantageous to participate in Korea Zinc's tender offer if the average purchase price per share is 482,000 KRW or higher, or if they hold 6 or more shares regardless of the purchase price. Conversely, MBK Partners' tender offer is favorable only when the average purchase price per share is below 482,000 KRW and the number of shares held is less than 6.

Most individual investors with financial income exceeding 20 million KRW also gain higher after-tax returns by participating in Korea Zinc's tender offer. For an individual investor holding 200 shares of Korea Zinc stock with a marginal comprehensive income tax rate of 44%, it is more advantageous to respond to Korea Zinc's tender offer if the average purchase price is 410,000 KRW or higher.

Korea Zinc stated that the increase in the tender offer price for treasury shares is beneficial not only for individual investors but also for institutional investors. Domestic institutional investors are subject to the same corporate tax rate on both dividend income and capital gains, so Korea Zinc's tender offer is more profitable depending on the price difference. Foreign institutional investors can also benefit from tax credit adjustments in their home countries due to double taxation relief, making participation in the tender offer generally advantageous.

A Korea Zinc official said, "The increase in the tender offer price for treasury shares provides favorable conditions for both individual and institutional investors," adding, "Korea Zinc's tender offer is more advantageous in terms of taxes and price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)