KIRI to Hold Seminar on 'Challenges for Innovating Insurance Industry Sales Channels' on the 10th

"Need to Amend the Financial Consumer Protection Act to Align with Separation of Sales and Underwriting"

"System Improvements Needed to Change Commission-Dependent Sales Methods"

There has been a call to further strengthen the responsibility of corporate insurance agencies (GA) due to the deepening separation of manufacturing and sales channels in insurance companies. It was also suggested that policy measures should be established to enable sellers to recommend suitable products to consumers without being influenced by incentives.

Professor An Su-hyun of Hankuk University of Foreign Studies Law School stated at the seminar "Challenges for Innovation in Insurance Industry Sales Channels" held at the Korea Insurance Research Institute on the 10th, "The current insurance sales responsibility system was designed based on an integrated manufacturing and sales environment and exclusive agency principle, so it needs to be reviewed to respond to recent changes where separation of manufacturing and sales is intensifying."

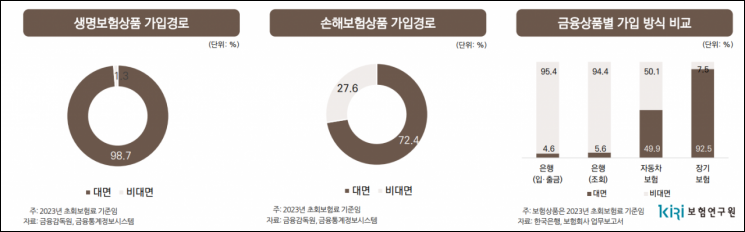

Insurance sales channels are becoming increasingly diverse, including insurance company employees, agents, GAs, brokers, and platforms. Recruitment methods also vary, such as telemarketing (TM), cyber marketing (CM), online bancassurance, and artificial intelligence (AI).

In the past, the sales method centered on exclusive agents of insurance companies, but recently, the proportion of sales through non-exclusive channels like GAs has been increasing. Over the past decade, exclusive agents have decreased by an average of 3.7% annually, while GA agents have increased by 4.8%. As of the end of last year, there were 606,353 insurance agents, of which GA agents accounted for 43.4% (263,321 agents). Insurance companies are establishing GAs as subsidiaries or independent GAs separate from insurance companies are emerging rapidly. In this structure, the outsourcing of insurance product sales, i.e., the separation of manufacturing and sales, is accelerating.

Previously, if an insurance contract holder purchased insurance through a GA and suffered losses due to incomplete sales, only the insurance company was held responsible. GA was only secondarily examined for employer liability or illegal acts. After the amendment of the Financial Consumer Protection Act, GAs also became directly responsible to financial consumers. However, holding insurance companies responsible, which manufacture products but do not engage in sales, has not changed. Professor An said, "In the past, the recruitment consignment between insurance companies and GAs involved a supervisory employer relationship, but now functional and organizational separation is deepening," adding, "It is difficult to expect both parties to exercise due care if insurance companies bear primary responsibility for GAs' incomplete sales, so the sales responsibility regulations under the Financial Consumer Protection Act need to be reorganized."

There was also a suggestion to improve sales channel business practices that heavily rely on commissions. Kim Dong-gyeom, a research fellow at the Korea Insurance Research Institute, said, "Insurance products recommended by sellers based on recruitment commissions may conflict with consumers' understanding," and added, "Commission-related policy tools such as disclosure systems, insurance product sales responsibility systems, and recovery regulations should be selectively operated considering their acceptability, stability, and effectiveness."

It was also argued that since insurance still relies more on face-to-face channels than non-face-to-face, the expertise of face-to-face channels should be enhanced. Research fellow Kim explained, "As financial products are diverse and complex, consumers want reliable information from sellers with expertise," and emphasized, "Rather than focusing on increasing new sales personnel, policies should strengthen the competitiveness of face-to-face channels by securing seller expertise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.