Dropped to '50,000 Electronics' after 1 year and 6 months

Foreigners net sold for 22 consecutive days... Sold over 10 trillion won

Brokerages lower earnings forecasts one after another due to poor performance

Q4 outlook also 'cloudy'

Samsung Electronics has finally dropped to the '50,000 won level.' After briefly falling into the 50,000 won range earlier this month during intraday trading, it had barely held above the 60,000 won mark at closing prices, but ultimately the closing price also fell below 60,000 won. The relentless selling pressure from foreign investors dragged Samsung Electronics down to the 50,000 won level. Foreign investors have sold Samsung Electronics for 22 consecutive days recently, with net sales amounting to 10 trillion won during this period. Given the poor third-quarter earnings and bleak outlook, a rebound is also expected to be difficult.

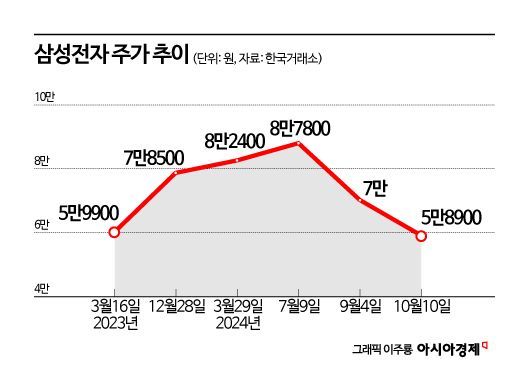

According to the Korea Exchange on the 11th, Samsung Electronics closed at 58,900 won, down 2.32% from the previous day. This is a 52-week low. It is the first time in one year and six months since March 16 last year (59,900 won) that Samsung Electronics has fallen into the 50,000 won range based on closing prices.

Since Samsung Electronics’ stock price peaked at 87,800 won in July, it has continued to decline due to a combination of a global stock market plunge, concerns over poor earnings, and lagging competitiveness in high-bandwidth memory (HBM). This month, even the 60,000 won level was breached.

With investor sentiment weakened to the extreme, the third-quarter earnings falling short of market expectations further dampened sentiment, causing the closing price to break below 60,000 won. Earlier on the 8th, Samsung Electronics announced that its consolidated sales for the third quarter of this year were tentatively estimated at 79 trillion won, with an operating profit of 9.1 trillion won. This fell short of market expectations; the third-quarter earnings consensus for Samsung Electronics compiled by financial information provider FnGuide (the average of securities firms’ forecasts) was sales of 80.9003 trillion won and operating profit of 10.7717 trillion won.

As concerns over poor earnings materialized, foreign investors’ selling pressure has also continued. Foreign investors have net sold Samsung Electronics for 22 consecutive days since the 3rd of last month. The net sales during this period amounted to 10.3066 trillion won. If foreign investors continue net selling for a few more days, it will set a new record for the longest consecutive net selling period. The longest consecutive net selling period by foreign investors for Samsung Electronics was 25 days (net sales of 4.4217 trillion won) from March 25 to April 28, 2022. Due to sustained net selling, the foreign ownership ratio of Samsung Electronics has dropped from the mid-56% range to the mid-53% range.

The problem is that a rebound is unlikely to be easy. Securities firms have successively lowered Samsung Electronics’ target price following the announcement of the third-quarter preliminary earnings. KB Securities lowered the target price from 95,000 won to 80,000 won. It lowered the target price again within a month. Dongwon Kim, head of research at KB Securities, explained, "The target price downgrade is due to expected short-term slowdown in the general memory cycle caused by weak demand for sets such as smartphones and PCs, and increased supply volume due to expanded memory production capacity in China." He added, "Accordingly, we revised down Samsung Electronics’ operating profit for 2024 and 2025 by 5% and 16%, respectively, to 36 trillion won and 48 trillion won."

Hyundai Motor Securities lowered its target price from 104,000 won to 86,000 won, DB Financial Investment lowered it from 100,000 won to 90,000 won, and NH Investment & Securities lowered it from 92,000 won to 90,000 won. iM Securities slightly lowered its target price from 77,000 won to 76,000 won, and Eugene Investment & Securities also lowered it from 91,000 won to 82,000 won. Seungwoo Lee, a researcher at Eugene Investment & Securities, said, "The stock price has plunged more than 30% in a short period since the peak in July. The stock price already reflects a significant portion of the poor earnings, and the price-to-book ratio (PBR) has fallen to 1.1 times by the end of 2024 and 1.0 times by the end of 2025, reaching historically low levels, so I do not think it is necessary to lower the investment opinion now." However, he added, "Due to earnings that are worse than expected and a slower-than-anticipated improvement process, adjusting the target price seems necessary."

Following a round of target price cuts by securities firms last month, the renewed lowering of target prices this month reflects the bleak outlook for future earnings.

Geunchang Noh, head of research at Hyundai Motor Securities, said, "It is negative that Samsung Electronics recorded excessively poor earnings compared to competitors like Micron, which have already announced third-quarter results," and predicted, "In the fourth quarter, which traditionally sees inventory adjustments and increased marketing costs related to finished products, Samsung Electronics’ earnings will continue to lag behind competitors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.