Securities Industry Positive on Q3 Earnings Outlook

Stable Profits Expected from Strengthened E-commerce Memberships

"AI Business Expansion Could Boost Momentum... Still Need to Monitor"

NAVER's stock price is rebounding. Securities analysts say that NAVER is holding the bottom thanks to stable profits from its core business, and if it proves its competitiveness in artificial intelligence (AI), it can recover its corporate value.

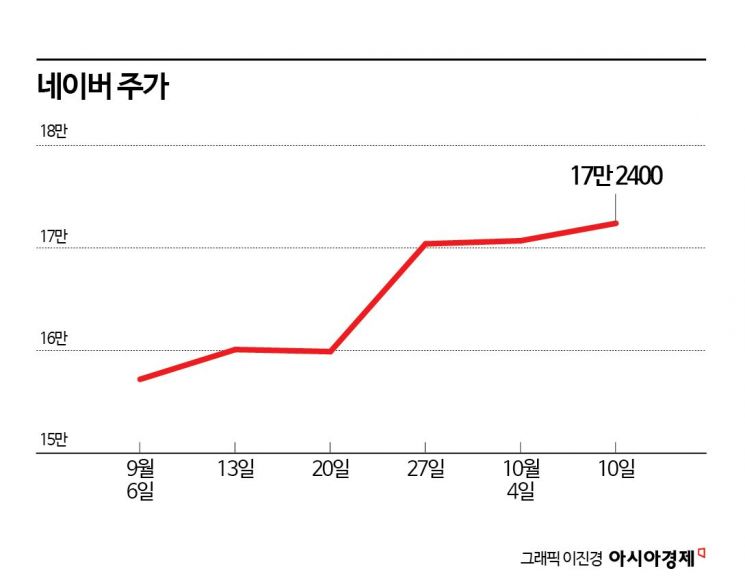

According to the Korea Exchange on the 11th, NAVER recorded 172,400 won at the previous day's closing price, up 14.10% from the low of 151,100 won in August. Although NAVER has fallen 23.04% since the beginning of the year due to concerns about the slowdown in the advertising industry and a lack of innovation to secure growth outside its core business, it has recently been attempting a turnaround.

Securities firms diagnosed that the possibility of a stock price decline is low due to NAVER's clear improvement in profit margins. In particular, it is analyzed that NAVER will gradually gain an advantage despite the slowdown in the growth rate of the domestic e-commerce industry. Dongwoo Kim, a researcher at Kyobo Securities, said, "Thanks to solutions based on low fees and vast purchase data, as well as promotion effects based on membership, the number of sellers and transaction volume in Smart Store will increase," adding, "Next year, with the launch of a dedicated space for Smart Store that enables active marketing and strengthening of Plus Membership through partnerships such as Netflix, it will be possible to increase commission rates and sales growth."

Jieun Lee, a researcher at Daishin Securities, also said, "In the third-quarter earnings, the overall commerce commission rate is expected to slightly increase due to the rise in the brand store billing consent rate, so earnings will grow compared to the previous quarter," and added, "Currently, the commission rate is estimated to be below 2%, which is a low burden, so resistance to additional commission rate increases due to new benefits provided in e-commerce membership will be limited."

Meanwhile, as the acquisition of data necessary for advancing AI services emerges as an important variable in the interests between global big tech companies and local platforms, there is also anticipation that NAVER could cooperate with big tech. Jingu Kim, a researcher at Kiwoom Securities, mentioned the reality, saying, "Global big tech companies aiming for Artificial General Intelligence (AGI) are aggressive, but value creation based on prediction and inference beyond simply enhancing productivity is not yet concrete," and added, "Therefore, securing personalized data will become a key issue, and big tech companies are likely to cooperate with local platforms." He further stated, "Ultimately, local platforms that first partner with global big tech will have an advantage in securing business opportunities," and evaluated, "NAVER is positive as it possesses its own AI and related services while having room for cooperation with big tech."

However, there are criticisms that it is still insufficient to respond with aggressive buying by assigning excessive multiples to the AI business relative to investment performance. Hajung Kim, a researcher at Daol Investment & Securities, said, "There is a lack of B2B performance commensurate with the scale of investment related to AI," adding, "It is positive that the Middle East business is being developed centered on Saudi Arabia, but it is still in the early stages to expect meaningful sales. There are no other clear large-scale orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)