Listed on KOSDAQ in July last year through a technology special case

Raised 18.1 billion KRW via IPO and issued CB in January this year

Concerns grow over frequent fundraising

SensorView, which was listed on the KOSDAQ market last July, is issuing new shares again to raise funds. As the sales growth rate has slowed down more than initially expected at the time of listing, resulting in continued profitability deterioration, concerns are emerging over frequent fundraising.

According to the Financial Supervisory Service's electronic disclosure system on the 8th, SensorView will issue 14.89 million new shares by allocating 0.565 new shares per existing share. The planned issue price for the new shares is 2,015 KRW, aiming to raise a total of 30 billion KRW. The final issue price will be confirmed on December 4.

SensorView is a materials, parts, and equipment (MPE) company developing cables, connectors, and antennas in the millimeter wave (mmWave) band. It is the only domestic company possessing wired and wireless ultra-high-speed radio frequency (RF) connection solutions. The RF connection solution technology is utilized in various fields ranging from defense, aerospace, and space industries to next-generation mobile communication base stations as well as semiconductor measurement industries. The company has secured 5G-related clients such as Qualcomm, Meta, T-Mobile, and Ericsson. Recently, it has been supplying high-frequency RF measurement and test cable assemblies to Microsoft and SGS, the world's largest testing and certification organization.

SensorView plans to use the funds raised from shareholders to develop next-generation antenna system modules and semiconductor testing equipment. It will also invest in expanding factories related to the defense industry and semiconductor equipment.

The company explained that it is newly pursuing a state-of-the-art active electronically scanned array (AESA) radar business. To enter the AESA radar market, it is developing next-generation antenna system modules that include semiconductor transmit-receive modules (TRM), control modules, and power modules. AESA-based products are attracting attention in radar, communication, and satellite fields because they enable active electronically scanned beam steering compared to conventional mechanical or single transmit-receive modules. SensorView is also developing wafer probe cards and sockets necessary for semiconductor testing.

To expand production capacity in the civilian communication sector and secure production lines in defense, aerospace, and semiconductor testing sectors, a new headquarters building is being constructed in Yubang-dong, Yongin-si, Gyeonggi-do. The capital increase funds will be used for the construction costs of the new building and the establishment of mass production lines after construction.

Although fundraising is inevitable for growth, shareholders are expressing concerns about frequent capital raises. When SensorView was listed on the KOSDAQ market on July 19 last year, it raised 18.1 billion KRW. In January this year, it issued convertible bonds (CB) worth 10 billion KRW. It also raised 1.5 billion KRW by issuing bonds with warrants (BW).

SensorView has also used the raised funds differently from the original plan. Of the funds raised through the initial public offering (IPO), 11.7 billion KRW was planned to be used for facility investment, but only 2.7 billion KRW was actually used. Although 5.4 billion KRW was allocated for operating expenses, 14.4 billion KRW was actually spent. There were higher-than-expected expenditures on research and development. The company explained that this was due to an increase in development projects related to the defense industry and semiconductor business.

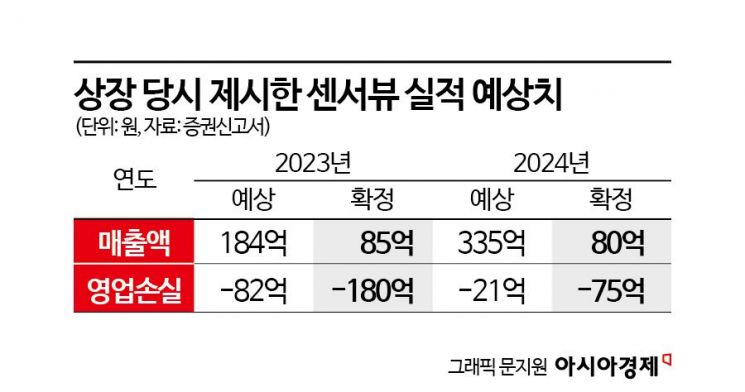

The achievement rate of the sales targets presented at the time of the IPO is also low. The securities registration statement for the public offering presented performance estimates from 2023 to 2025. The sales target for 2023 was 18.4 billion KRW, but last year's sales reached only 8.5 billion KRW, less than half of the target. The sales target for this year was 33.5 billion KRW, but the cumulative sales for the first half amounted to only 8 billion KRW. The company explained that the gap in sales occurred because the millimeter wave market growth was slower than expected and investments from clients decreased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)