Bio Venture & VC "No Residents, Clinical Trials at a Standstill"

Domestic Q3 Clinical Trials Down 22% YoY

# A bio startup company founded by a university technology holding company in Seoul at the end of last year has recently been repeatedly postponing the start date of its clinical trials. A company official said, "Even if the professor remains in the lab, it is difficult to proceed as the residents have left due to the strike," adding, "Still, the situation is better than places that have already started and then stopped clinical trials. Even if the trials are halted, money continues to be paid to the Contract Research Organization (CRO) and Clinical Research Coordinator (CRC)."

As the conflict between the medical community and the government over the residents' collective strike prolongs, the domestic medical and bio startup and related venture capital (VC) industries have also been affected. Since the research and development (R&D) and investment foundations could be shaken, the bio industry is urging a swift resolution to the conflict.

On June 17, when professors at Seoul National University Hospital began an indefinite strike demanding the resolution of the resident doctors' crisis, patients and their families were looking at the medical staff at Seoul National University Hospital in Jongno-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On June 17, when professors at Seoul National University Hospital began an indefinite strike demanding the resolution of the resident doctors' crisis, patients and their families were looking at the medical staff at Seoul National University Hospital in Jongno-gu, Seoul. Photo by Jinhyung Kang aymsdream@

"Residents Leave, Remaining Doctors Face Burnout... Now Professors Join the Struggle"

Earlier, the government announced in February its plan to increase medical school admissions by 2,000 students, and residents submitted resignation letters and left the medical field. They maintain a firm stance demanding the complete cancellation of next year's medical school expansion, continuing a strong confrontation with the government.

This has led to damages for bio ventures requesting clinical trials and investment VCs. Typically, new drug and medical device development takes place in university hospitals, but due to the large-scale medical vacuum, clinical processes have been consecutively halted or delayed. A VC representative who has been focusing investments in the bio sector around the COVID-19 period told Asia Economy on the 4th, "Large hospitals find it difficult to conduct clinical trials without residents," adding, "At the beginning of the conflict, remaining medical school professors complained of burnout, slowing down clinical trials, but now even those professors have joined the struggle."

Registering patients eligible for trials is also difficult. Especially for injectables, clinical trials can only be conducted on hospitalized or surgical patients, but amid the medical crisis, some have requested extensions for clinical re-evaluation periods due to insufficient patient numbers. Once the clinical trial track starts and participants enter, the structure makes it impossible to stop cost expenditures. Even if there is no overall progress, fixed costs continue to be paid to CROs and CRCs contracted to manage patient care and other tasks.

"Domestic Clinical Trials Decrease, R&D Funds Flow Overseas... Conflict Must Be Resolved Quickly"

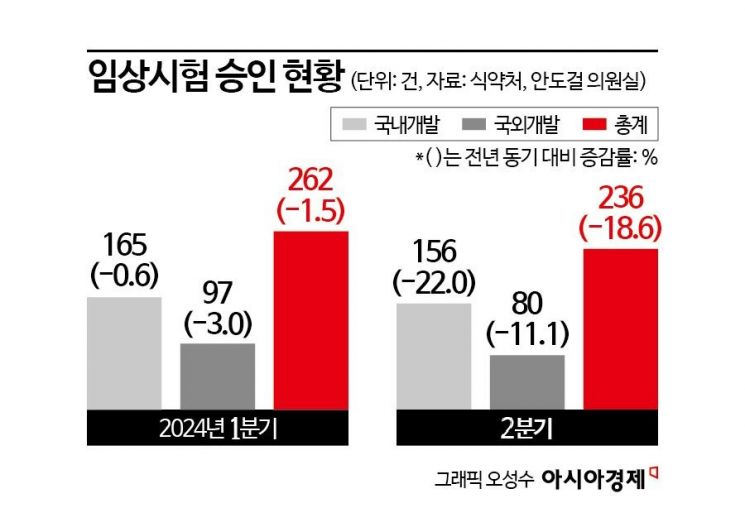

The decrease in clinical trials in the bio and medical industries due to the prolonged medical-government conflict has been confirmed by statistics. On the 30th of last month, Ando-geol, a member of the Democratic Party of Korea, pointed out, "According to an analysis of data from the Ministry of Food and Drug Safety, the number of clinical trial approvals was 262 in the first quarter, 236 in the second quarter, and 223 in the third quarter, shrinking for three consecutive quarters." This contrasts with the third quarter of last year, which recorded 250 cases, a 23.8% increase compared to the same period in 2022.

As the number and proportion of domestically developed clinical trials decrease, concerns have been raised about R&D funds flowing overseas. In particular, domestic clinical trial approvals in the second quarter were 156, down 22% from the same period last year. During the COVID-19 outbreak in 2021, 69% (924 cases) of all clinical trials were conducted domestically, but this year, the domestic share was only 63% (454 cases) up to the third quarter.

R&D delays are also obstacles to the rebound of the bio industry, which has experienced a downturn due to high interest rates. Recently, with the U.S. Federal Reserve's big rate cut (a 0.50 percentage point reduction), global capital markets have increased expectations that the growth stock bio industry will enter a recovery phase. According to the Korea VC Association, domestic new VC investments in bio and medical sectors in the first half of this year reached 420.8 billion KRW, a 14.8% increase compared to the same period last year. By industry, new investment proportions ranked second (15.7%) after ICT services (32.1%).

Representative Ando said, "As the medical-government conflict prolongs, research professors are being dispatched to emergency rooms, shaking the R&D foundation," and added, "To maintain the competitiveness of the bio industry, the conflict must be urgently resolved." A VC industry insider also said, "Each emerging bio company receives investments ranging from hundreds of millions to several tens of billions of KRW. The longer hospital stabilization is delayed, the longer it takes to achieve results, and the performance of startups and investment companies, whose invested money leaks meaninglessly, worsens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)