Ministry of SMEs and Startups Announces 'Advanced Venture Investment Market Leap Plan'

Aiming to Become One of the Global Top 4 Venture Investment Powers

Attracting 1 Trillion Won in Global Investment and Expanding Domestic and Foreign Investors

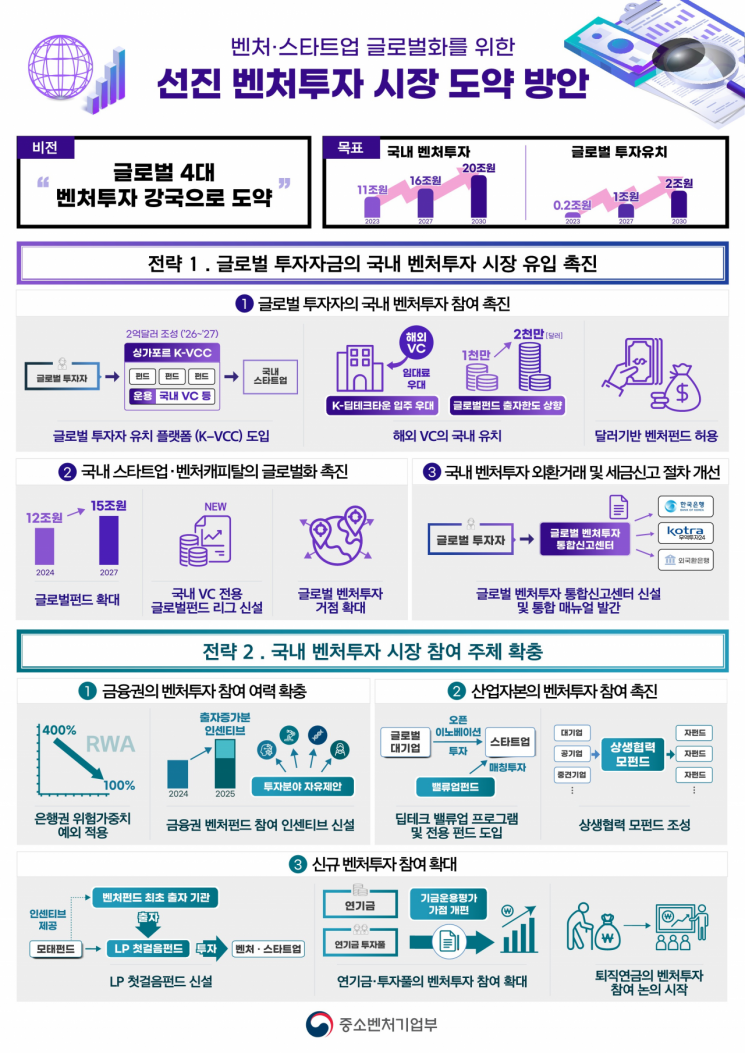

The government plans to grow the domestic venture investment market to a scale of 16 trillion won by 2027, aiming to develop it into one of the world's top four venture investment powerhouses. To achieve this, it intends to ease regulations to attract private investment.

On the 2nd, the Ministry of SMEs and Startups announced the 'Advanced Venture Investment Market Leap Plan' at the Economic Ministers' Meeting, which includes these details. This plan concretizes the vision of the 'Startup Korea Comprehensive Measures' announced in August last year.

Through this plan, the Ministry aims to grow the domestic venture investment market to a record high of 16 trillion won by 2027 and significantly expand the scale of global investment attraction from 200 billion won in 2023 to about 1 trillion won by 2027.

Oh Young-joo, Minister of SMEs and Startups, is giving a welcome speech at the 'Venture Capital Industry Meeting' held at the Gwanghwamun Building in Jongno-gu, Seoul on the 30th. (Photo by Ministry of SMEs and Startups)

Oh Young-joo, Minister of SMEs and Startups, is giving a welcome speech at the 'Venture Capital Industry Meeting' held at the Gwanghwamun Building in Jongno-gu, Seoul on the 30th. (Photo by Ministry of SMEs and Startups)

Promoting the Inflow of Global Investment Funds into the Domestic Venture Investment Market

First, to promote the inflow of global investment funds into the domestic venture investment market, a global investment attraction mother fund (K-VCC) will be established in Singapore. VCC is a convertible fund system authorized by the Monetary Authority of Singapore, allowing independent fund management within it.

K-VCC will serve as a platform to support domestic venture capital firms in establishing global funds at low costs and attracting global investments. The plan is to raise a fund of 200 million USD in Singapore by 2027 and consider additional establishments in global financial hubs such as the Middle East and Delaware, USA.

By raising an additional 1 trillion won annually in global funds, the total will expand to 15 trillion won by 2027. Incentives will also be strengthened to attract world-class venture capital firms to Korea. A 'Global Venture Investment Integrated Reporting Center' will be opened for foreign investors to enhance convenience in foreign exchange transactions during the investment process, and a joint manual by related ministries will be produced to help easily understand administrative procedures involved in domestic venture investments.

Expanding Venture Investment Participants through Incentives such as Regulatory Relaxation

The plan is to lead private participation to expand the domestic venture market size. To this end, regulatory relaxation will be implemented.

Specifically, to enable banks to take bolder venture investments, special risk-weighted exceptions will be applied to policy-purpose venture funds that meet certain conditions, and incentives for expanding financial sector participation in venture funds will be newly introduced. These incentives include preferential loss coverage when increasing contributions to venture investment associations and expanded awards for excellent institutions.

The 'Deep Tech Value-Up Program' to promote open innovation by large corporations will be fully operated, and a 'Value-Up Fund' will be newly established, where the mother fund matches investments when large corporations invest in startups during the process. Eight large corporations, including Samsung Electronics and Hyundai Motor Company, will participate in this program.

To support venture investment participation using win-win cooperation funds from large corporations and public enterprises, a 'Win-Win Cooperation Mother Fund' managed by Korea Venture Investment Corp will be established. Additionally, deregulation on external fundraising and overseas investment for corporate venture capital will continue to be pursued.

A new 'LP First Step Fund' will be created for institutional investors such as pension funds with no prior experience in venture investment association contributions. The mother fund will provide exceptional incentives such as preferential loss coverage and put options to expand new participants in the venture investment market.

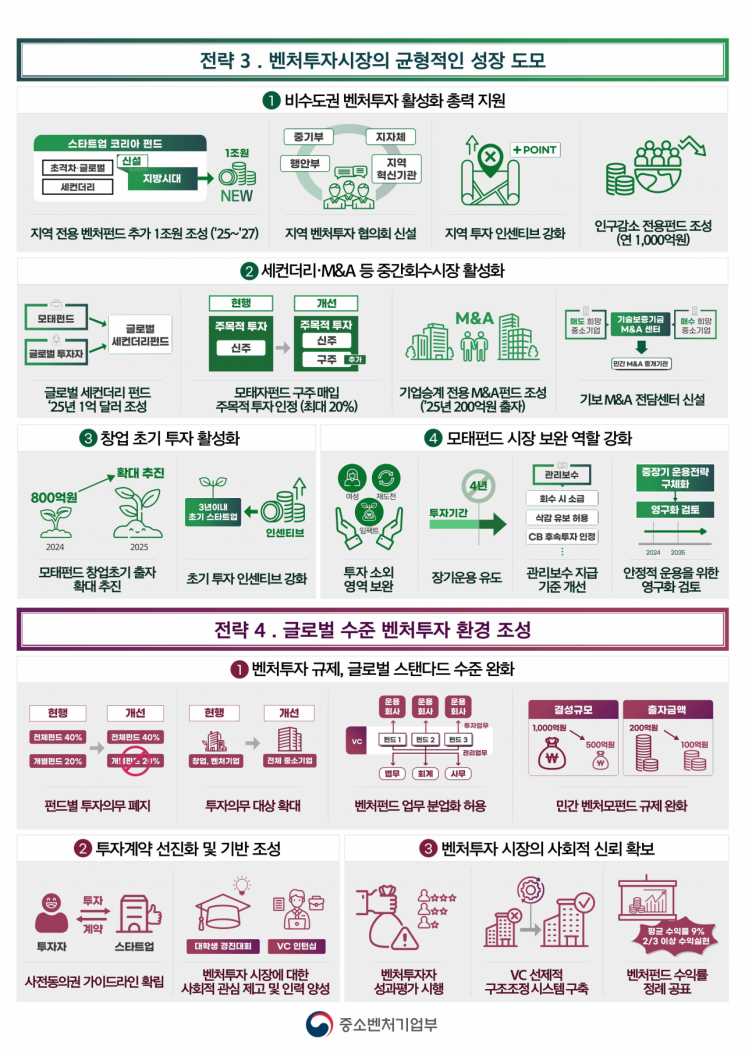

An Additional 1 Trillion Won Dedicated Venture Fund for Non-Capital Regions

To promote balanced growth of the venture investment market, an additional 1 trillion won dedicated venture fund for non-capital regions will be raised by 2027. Through incentives such as preferential loss coverage, the plan is to lead participation in regional venture investments by regional key companies and local banks.

The government will establish a 'Regional Venture Investment Council' among the Ministry of SMEs and Startups, the Ministry of the Interior and Safety, and local governments, and will fully support the revitalization of regional venture investments by strengthening regional investment incentives across the mother fund's sub-funds.

To stably supply investment funds to early-stage startups, the mother fund's early-stage sector contributions will be expanded, and the scope of company-building investments?where startup planners support the entire cycle from incubation to investment through subsidiary establishment?will be broadened.

A global secondary fund of 100 million USD will be raised by 2025, and regulations on mergers and acquisitions (M&A) and secondary sectors will be significantly relaxed. Secondary funds refer to funds that purchase difficult-to-sell company stocks held by institutional investors such as private equity funds and venture capital at discounted prices. Additionally, the intermediate recovery market will be reinforced by establishing a 'Corporate Succession M&A Fund.'

Creating a Global-Level Venture Investment Environment

Finally, regulations related to the investment autonomy of venture investment companies will be significantly relaxed to meet global standards. The division of investment and management tasks, common in advanced venture investment markets, will also be allowed to enhance fund management expertise.

The plan includes revising the standard investment contract to balance the rights of investors and startups by adjusting investors' prior consent rights, spreading contract systems that comply with global standards. At the same time, programs such as university student venture investment competitions and venture capital internships will be promoted to attract talented individuals.

Minister Oh Young-joo stated, "The rise of startups as the main players in global innovation competition is a trend already recognized and noted worldwide. This also signals fierce competition among countries over startup ecosystems in the future." He added, "The government will create a world-class dynamic venture investment ecosystem so that our startups can confidently secure competitive advantages against global companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)