Lawsuit and Defamation Battle, Financial Supervisory Service Issues Rare Verbal Warning Amid Heated Dispute

Choi Yoon-beom, Chairman of Korea Zinc, Fights to Block MBK's Entry into the Board

MBK's 'Winning Strategy' at Risk as Failed Tender Offer Could Damage Asia's Largest PEF Reputation

The management rights dispute over Korea Zinc has intensified to the point where the Financial Supervisory Service (FSS) issued a verbal warning. Both Korea Zinc and the Yeongpung-MBK Partners alliance are staking everything on securing management control. Choi Yoon-beom, chairman of Korea Zinc, who is plagued by allegations of breach of trust, must absolutely block the Yeongpung-MBK alliance from entering the board of directors. The private equity fund (PEF) MBK must win the management rights dispute with the conglomerate that has stirred the entire country to maintain its reputation as Asia's largest PEF. MBK had launched a large-scale tender offer for Korea & Company at the end of last year but was thwarted, so consecutive failures could be fatal to its reputation. With the addition of 'financial battles,' 'litigation battles,' and 'defamation battles,' the Korea Zinc management rights dispute has become a 'chicken game' where neither side can back down.

FSS Issues 'Verbal Warning' Amid Escalating Management Rights Dispute

According to the financial investment industry on the 30th, Lee Bok-hyun, governor of the Financial Supervisory Service, instructed at a closed vice-governor meeting on the 27th to actively monitor to ensure no illegal activities occur during the tender offer process. Governor Lee said, "Healthy competition for management rights arising from mergers and acquisitions (M&A) such as tender offers should be left to market autonomy, but the ongoing tender offers for listed companies appear to involve overheated competition among related parties," adding, "Excessive competition may cause market instability and undermine trust in the capital market, so it needs to be closely watched." This judgment was made because baseless rumors and gossip related to the Korea Zinc tender offer could cause investors to make wrong judgments or misunderstandings. The FSS plans to conduct market surveillance to detect any unfair trading or market disorder. The reason the Korea Zinc management rights dispute has intensified to the point of a verbal warning from the FSS is that neither side can afford to take a step back.

Chairman Choi Yoon-beom and White Knights Face Tightening Legal Risks

Chairman Choi Yoon-beom’s side at Korea Zinc is putting all efforts into blocking the Yeongpung-MBK side, which is attempting to enter the board by demanding disclosure of the company’s investment decision-making process and related documents. Domestic conglomerates such as Hanwha Energy and global PEFs like Kohlberg Kravis Roberts (KKR) are mentioned as potential white knights for Chairman Choi’s counter tender offer, but the market is concerned about various legal and ethical issues. The plan for Korea Zinc to lend funds to domestic conglomerates like the Hanwha Group to assist Chairman Choi’s counter tender offer could raise issues such as board approval, credit extension, and circular shareholding. Lending funds to a specific shareholder without board approval during a management rights dispute could be considered an abuse of management rights and may constitute breach of trust. There is also the possibility of violating the Commercial Act. According to the Commercial Act, listed companies must not extend credit to major shareholders or their special related parties. Credit extension, which prohibits lending money or providing financial support to specific shareholders, can lead to criminal liability.

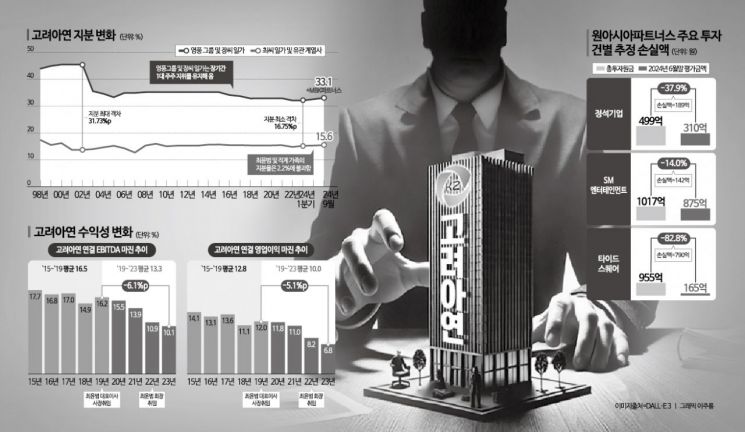

The prohibition on circular shareholding could also be problematic. Korea Zinc already holds a 7.25% stake in the Hanwha Group. If an affiliate within the Hanwha Group acquires additional shares of Korea Zinc through a special purpose company, issues of mutual shareholding could arise. Global investors such as SoftBank, Bain Capital, and KKR also face difficulties passing internal investment review committees. The biggest obstacle is that acquiring shares at an already elevated price due to the management rights dispute may result in an unclear exit strategy as the stock price reverts after the dispute ends. Additionally, with various controversies such as allegations of breach of trust against Chairman Choi, global PEFs are hesitant to step forward. For PEFs that must consider the views of global pension funds when raising capital, legitimacy has become as important as profitability. Allegations against Chairman Choi have been publicly raised, including breach of trust related to private equity fund investments managed by One Asia Partners, breach of fiduciary duty related to investments in Ignio Holdings, and preferential treatment in business dealings.

MBK’s Unprecedented 'Fierce Offensive'... Failure in Tender Offer Could Deal Fatal Blow to Asia’s Largest Fund Reputation

MBK is also putting its life on the line in this battle. Currently, it is closely watching the price and timing of Chairman Choi’s counter tender offer. Even as Asia’s largest fund, MBK’s financial burden is not light. By raising the Korea Zinc tender offer price from 660,000 KRW to 750,000 KRW per share, the required funds increased from 2 trillion KRW to 2.2721 trillion KRW. Of the 2.2721 trillion KRW, 1.8 trillion KRW (1.5 trillion KRW from NH Investment & Securities and 300 billion KRW from Yeongpung) was borrowed at an interest rate of 5.7%, maturing in June next year. Interest alone will amount to about 76.6 billion KRW over the 9 months until maturity. The market expects MBK’s internal rate of return (IRR) guaranteed to fund investors (LPs) to be in the mid-teens percentage range. There is also a possibility that the tender offer price will be raised once more. This is why there are views in the business and securities sectors that even if MBK wins the Korea Zinc management rights, its profitability could be hit. Nevertheless, MBK must succeed in this tender offer.

MBK participated in the Korea & Company management rights dispute between brothers in December last year, aiming to secure shares through a tender offer but failed. Especially if MBK fails again in this Korea Zinc tender offer, which is attracting attention both domestically and internationally, it will leave an irreparable mark on MBK’s strategy and reputation. MBK is known to have prepared for this tender offer over a long period. Kim Kwang-il, MBK vice chairman, once expressed confidence, saying, "We succeeded in gathering about 8% of shares in the past Korea & Company tender offer. This time, we are gathering about 7% together with the largest shareholder, so I believe success is quite possible."

Meanwhile, Yeongpung and MBK plan to secure management rights by tendering for 6.98% to 14.61% of Korea Zinc shares by the 4th of next month. During this process, the tender offer price was raised from 660,000 KRW to 750,000 KRW per share. In response, Chairman Choi’s side at Korea Zinc has been contacting various financial investors (FI) and strategic investors (SI) to implement a counter tender offer strategy and is expected to announce a counter tender offer before the market opens on the 2nd or 4th of next month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)