Sharp Decline in Business Sentiment Among Large and Mid-sized Companies

Only Cosmetics and Medical Precision Sectors Show Recovery

Semiconductor, Auto, and Steel Industry Outlook 'Gloomy'

62% of Companies Say "Difficult to Achieve Targets"

The domestic manufacturing sector is freezing up amid signs of economic slowdown in major countries such as the United States and China. Manufacturing companies expect the perceived business conditions in key industries like semiconductors and automobiles to decline further in the fourth quarter of this year.

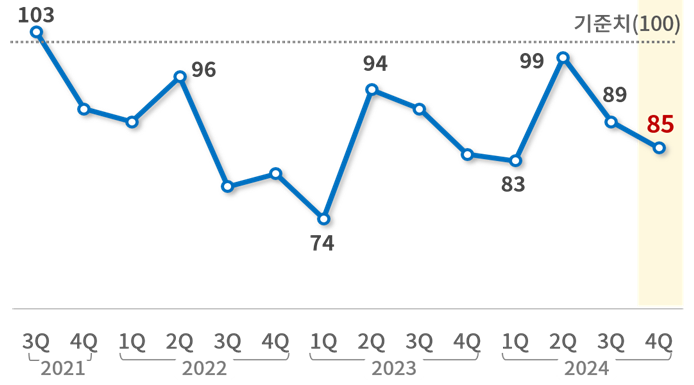

The Korea Chamber of Commerce and Industry announced on the 29th the results of the '2024 Q4 Manufacturing Business Survey Index (BSI)' conducted on 2,252 manufacturing companies. The Q4 BSI stood at 85, down 4 points from the previous quarter (89). This marks the second consecutive quarter below the baseline of 100, indicating that the domestic manufacturing economy continues to face difficulties. A BSI above 100 signifies economic improvement, while below 100 indicates deterioration.

Trend of the Korea Chamber of Commerce and Industry Manufacturing Business Survey Index (BSI) [Image source=Korea Chamber of Commerce and Industry]

Trend of the Korea Chamber of Commerce and Industry Manufacturing Business Survey Index (BSI) [Image source=Korea Chamber of Commerce and Industry]

By company size, large enterprises (86) and mid-sized companies (84) saw declines of 12 points and 13 points respectively, which were larger than the 2-point drop experienced by small and medium-sized enterprises (85).

The sharp decline in perceived business conditions among large and mid-sized companies caused both domestic demand and exports to fall significantly below the baseline.

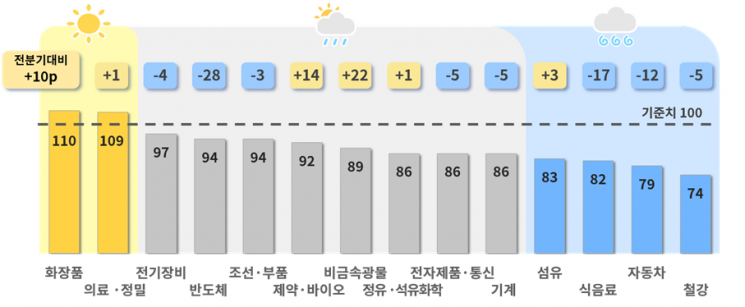

Only Cosmetics and Medical Precision Show 'Clear Skies'... Non-metallic Minerals and Petrochemicals 'Cloudy', Automobiles and Steel 'Rainy'

By industry, only cosmetics (110) and medical precision (109) exceeded the baseline of 100, showing signs of recovery. Despite weak demand in China, the cosmetics sector is expected to see improved business conditions due to increased exports to the United States and Europe.

The medical precision sector is expected to perform positively, reflecting optimism about increased order contracts and sales.

The semiconductor (94) and electrical equipment (97) sectors have returned to a downward trend. The semiconductor industry outlook is bleak due to concerns over declining mobile and PC demand, compounded by falling prices of general-purpose DRAM.

The steel sector (74) recorded the lowest outlook as the construction industry, its upstream sector, remains in a prolonged slump.

The automobile sector (79) is also expected to be hit by weakening electric vehicle demand and a decrease in production volume in August. The food and beverage sector (82) faces a gloomy outlook due to the burden of product price increases caused by high interest rates and rising raw material costs.

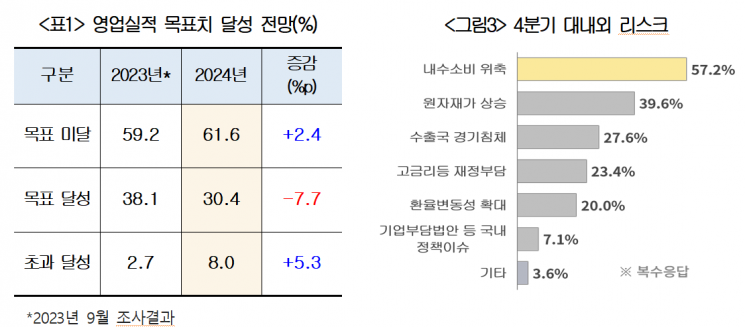

62% of Manufacturing Companies Say "Difficult to Achieve This Year's Targets"

61.6% of companies responded that they will not achieve the operating performance targets set at the beginning of this year, up from 59.2% at the same time last year. Among them, 42.0% expected to miss the target slightly (within 10%), while 19.6% anticipated missing it significantly (over 10%). Companies expecting to meet their targets accounted for 30.4%, down 7.7 percentage points from last year.

Companies cited 'domestic consumption contraction (57.2%)' and 'rising raw material prices (39.6%)' as the biggest risks affecting Q4 performance. This was followed by concerns over 'economic downturn in export countries (27.6%)', 'financial burdens such as high interest rates (23.4%)', and 'increased exchange rate volatility (20.0%)'.

Kim Hyun-soo, head of the Economic Policy Team at the Korea Chamber of Commerce and Industry, said, "As major countries like the U.S. are considering interest rate cuts to address recession concerns, it is time for South Korea to actively consider a shift in monetary policy to stimulate domestic demand and promote investment." He added, "Expansion of tax credits for advanced strategic industries and fiscal support for infrastructure investment are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)