The temporary shareholders' meeting of Hanmi Science, which will be a turning point in the management rights dispute of Hanmi Pharmaceutical Group, is set to take place.

At the site of the 51st regular shareholders' meeting of Hanmi Science held last March at Syntex in Hwaseong-si, Gyeonggi Province. Photo by Jinhyung Kang aymsdream@

At the site of the 51st regular shareholders' meeting of Hanmi Science held last March at Syntex in Hwaseong-si, Gyeonggi Province. Photo by Jinhyung Kang aymsdream@

Hanmi Science held an extraordinary board meeting on the morning of the 27th at its headquarters in Songpa-gu, Seoul, and decided to convene a temporary shareholders' meeting. A company official stated, "The agenda items for convening the temporary shareholders' meeting and appointing new directors were approved." Detailed procedures, date, location, and agenda contents will be disclosed through future announcements. Present at the board meeting were Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group, registered directors Lim Jong-hoon, CEO of Hanmi Science, and Kwon Kyu-chan, CEO of DXVX. Lim Jong-yoon, an inside director of Hanmi Science, attended remotely.

Hanmi Pharmaceutical Group has been embroiled in a management rights dispute for nine months involving the owner family and the largest individual shareholder, Shin Dong-guk, Chairman of Hanyang Precision. At the regular shareholders' meeting in March, the brothers Lim Jong-yoon and Jong-hoon took control of management rights. However, the so-called 'three-party alliance'?consisting of Chairwoman Song and Group Vice Chairman Lim Joo-hyun, mother and daughter from the owner family, along with Chairman Shin?has been demanding the convening of a temporary shareholders' meeting to reclaim management rights.

Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group, and Lim Joo-hyun, Vice Chairman of Hanmi Pharmaceutical Group (from left)

Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group, and Lim Joo-hyun, Vice Chairman of Hanmi Pharmaceutical Group (from left)

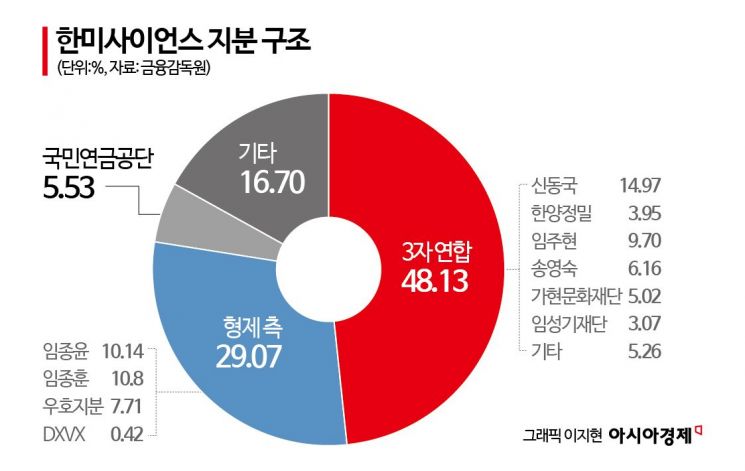

By forming the three-party alliance, they became the largest shareholder group holding 48.13% of shares but have yet to regain control of the group’s management. To overturn the current holding company board structure, which they consider inferior at 5 to 4, they proposed amending the existing articles of incorporation that limit the maximum number of board members to 10, increasing it to 'up to 11 members.' They also submitted a shareholder proposal for Chairman Shin (non-executive director) and Vice Chairman Lim (inside director) to join the board directly. Since the shareholder proposal for the shareholders' meeting was confirmed at this board meeting, the brothers' side is also expected to soon decide and disclose their director candidates.

The three-party alliance, as the company did not proceed with convening the temporary shareholders' meeting, filed a petition with the Suwon District Court on the 4th to permit the convening of the temporary shareholders' meeting. However, since the agenda was discussed and the meeting convening was decided at this board meeting, the court's judgment is likely to be deferred.

The future direction of the management rights dispute remains uncertain. This shareholders' meeting is a bold move by the three-party alliance, which holds nearly a majority stake but believes reclaiming management rights under the current articles of incorporation is difficult, to change the very rules of the game. However, amending the articles of incorporation requires a special resolution at the shareholders' meeting under the Commercial Act, needing approval from 66.7% of the voting rights present. Currently, Hanmi Science’s shareholding structure is 48.13% for the alliance and 29.07% for the brothers, making it difficult to be confident of either the alliance’s victory or the brothers’ blockade.

Therefore, the voting intentions of the National Pension Service, which holds 5.53% of shares, and other minority shareholders are expected to determine the outcome. Industry insiders predict that the National Pension Service will side with the three-party alliance, as it opposed all director appointment proposals recommended by the brothers at Hanmi Science’s shareholders' meeting in March and also opposed all director candidates from the brothers except CEO Lim Jong-hoon at Hanmi Pharmaceutical’s shareholders' meeting after the brothers gained the upper hand. Minority shareholders, who supported the brothers at the March shareholders' meeting, are now reportedly leaning toward supporting Vice Chairman Lim Joo-hyun.

The approval of the company's proposed reduced dividend at this board meeting is also seen as a strategy to sway minority shareholders on the brothers' side. A reduced dividend is a dividend paid by reducing the company’s capital reserve; unlike regular dividends, corporate shareholders do not include it in their profits, and individual shareholders do not include it in dividend income, so the 15.4% dividend income tax is not imposed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)