Global Supply Chain Changes... Becoming a 'Source of Risk'

"Strengthen R&D Collaborations... Expand Service Industry Exports"

To prepare for future changes in the global supply chain, it has been suggested that industrial strategies such as strengthening international research and development (R&D) cooperation bodies and expanding service exports are necessary.

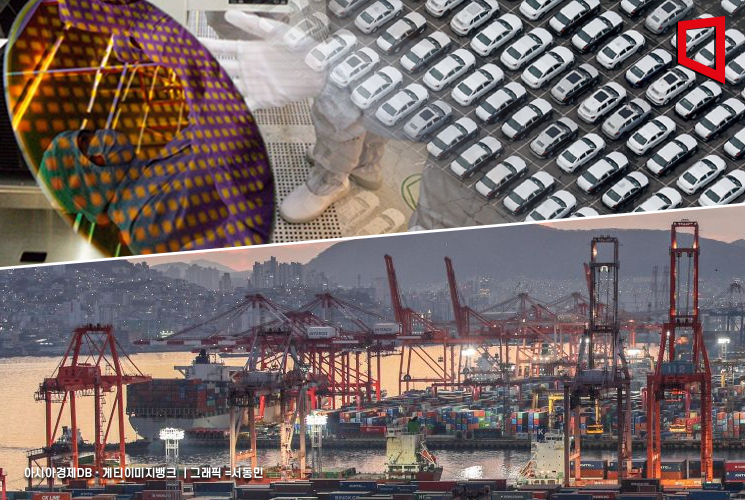

According to the 'BOK Issue Note: Structural Changes in Our Economy and Policy Responses Viewed through the Global Supply Chain' released by the Bank of Korea on the 27th, perceptions of the global supply chain have recently shifted from being a driving force of economic growth to a 'source of risk.' Recently, trade between geopolitically close countries has increased, and geopolitical bloc formation and regionalization are progressing, such as advanced countries strengthening their domestic core manufacturing bases.

The report states that the current economic structure of South Korea is characterized by ▲a production structure concentrated in manufacturing, ▲a high dependence on exports, ▲slow growth in service exports despite high potential, and ▲a need for stability in raw material imports centered on some new industries.

Compared to major advanced countries, South Korea has a relatively high proportion of manufacturing. In 2020, the share of manufacturing in South Korea's gross domestic product (GDP) was 27%, nearly double the OECD average of 14%. Considering that manufacturing accounts for around 30% in manufacturing powerhouses like Germany and Japan, it is clear that South Korea's production structure is skewed toward manufacturing.

Moreover, half of the total output of manufacturing is 'direct and indirect exports' consumed overseas or used as intermediate goods in overseas production. When the ratio of direct and indirect exports in total output is defined as 'export exposure,' South Korea's manufacturing export exposure exceeds 40%. China has a higher manufacturing share than South Korea and accounts for one-third of global manufacturing production, but due to its large domestic market, its manufacturing export exposure is only 19%. This indicates that South Korea's economy is more vulnerable to supply chain disruptions than China. By industry, export exposure in electronics, chemicals, and petroleum refining exceeds 50%. By destination, the share of direct and indirect exports to China rose significantly through the 2000s and remained high but has declined since 2019. The share of direct and indirect exports to the United States has rapidly increased since the pandemic.

Meanwhile, compared to the global expansion of service trade, South Korea's service exports have been somewhat sluggish. Since 2010, South Korea's service export growth rate has averaged 4.6% annually, lagging behind the global growth rate of 6.0%. The share of services in exports is also around 16%, lower than the global average of 25%. However, during the same period, the value added by services in manufacturing exports increased from 14.6% in 2010 to 17.4% in 2020.

The risk associated with imports of key minerals has increased. South Korea's intermediate goods import exposure has gradually declined since 2011 due to higher self-sufficiency in intermediate goods, but it remains high compared to Japan, China, and Germany. Recently, imports of key minerals in new industries such as secondary batteries have increased, and import exposure is expected to rise again.

Global Supply Chain Changes Likely to Affect 'Export-Oriented Intermediate Goods Production Structure'

Future changes in the global supply chain are expected to mainly impact the production structure of export-oriented intermediate goods. If direct and indirect exports of intermediate goods are defined as 'export-linked production' connected to the global supply chain, South Korea's export-linked production grew significantly in the 2000s but has gradually slowed in the 2010s. Export-linked production has decreased by an average of 1.4% of GDP annually since 2014, largely attributed to the 'China factor.'

Changes in the global production structure centered on China are increasingly negatively affecting South Korea's major export industries. Excluding China, the flow of export-linked production shows that the largest export industries in the 1990s, textiles and apparel, have shrunk since the 2000s, and major export industries such as steel and primary metals, petroleum refining, chemicals, and automobiles peaked in the early to mid-2010s before reversing trends. Export-linked production to China in steel, primary metals, chemicals, and automobiles began to slow from the mid-2000s.

South Korea participates in the upstream, relatively high value-added segment of the semiconductor and IT manufacturing supply chain alongside the United States and Japan. In 2020, South Korea's share of global IT industry value added was 8%, third after China and the United States. However, since around 2018, changes in the production structure of IT manufacturing in South Korea and China have become a downward factor for South Korea's exports to China and an upward factor for China's exports to South Korea. This suggests that China may have strengthened its role in supplying intermediate goods to South Korea through technological changes, unlike in the past.

By industry, the automobile sector has maintained a high level of export-linked production within the global supply chain over the past decade, securing a competitive edge. However, its position may be threatened by the transition to electric vehicles. South Korea shows competitiveness in batteries, a key component of electric vehicles, but the supply chain for related minerals and materials is vulnerable, and competition with China is fierce. The input structure of electric vehicle manufacturing is more import-dependent than internal combustion engine vehicles, and achievements in the high value-added vehicle operating system (OS) sector are not yet clear.

If the future supply chain is reorganized, the importance of intermediate goods services will increase, and the servitization of manufacturing will accelerate, while the pace of globalization will be greatly influenced by the development of geopolitical conflicts and responses to climate change.

Lee Arang, head of the macro analysis team at the Bank of Korea's Research Department and author of the report, stated, "South Korea's industrial strategy should focus on maintaining technological superiority in advanced manufacturing and strengthening the stability of import supply chains through international strategic cooperation." She added, "The strategy to expand service exports should proceed on two tracks: manufacturing embedded services and digital services, and the transition to ESG (environmental, social, and governance) supply chains should also be accelerated."

She continued, "To enable Korean companies to strategically respond to changes in the global supply chain, policy authorities should actively participate in international R&D cooperation bodies such as the U.S. NSTC to secure a technological lead in the semiconductor industry, and in the battery and electric vehicle industries, preemptively manage import country risks according to ESG standards." She also emphasized, "In a situation where the boundaries between manufacturing and services, and between domestic and export markets are blurring, it is necessary to significantly reduce regulations based on industry classifications."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.