LH's 'Land Contract Cancellation Status by Year Over the Last 5 Years' Shows

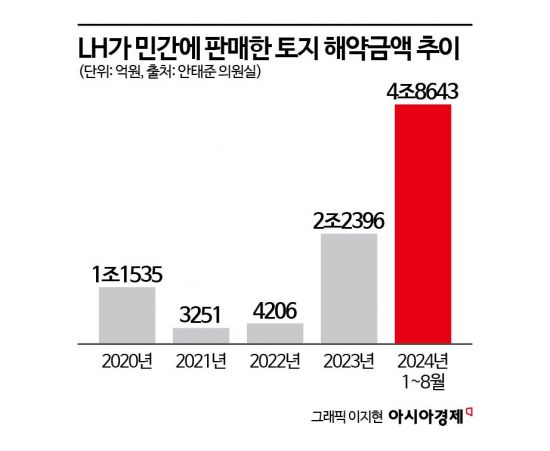

4.8643 Trillion KRW Contract Cancellations from January to August This Year

15 Times Increase Compared to 2021

Office of Ahn Taejun, Democratic Party of Korea

"May Reach 6 Trillion KRW This Year... Supply Disruptions Require Countermeasures"

From January to August this year, the amount of land sold by Korea Land and Housing Corporation (LH) to private real estate developers and subsequently canceled reached a staggering 5 trillion won. Except for some areas in Seoul, the real estate market continues to slump, construction costs have surged, and construction companies' financing capacity has been depleted. As a result, LH's supply policies are expected to face significant disruptions.

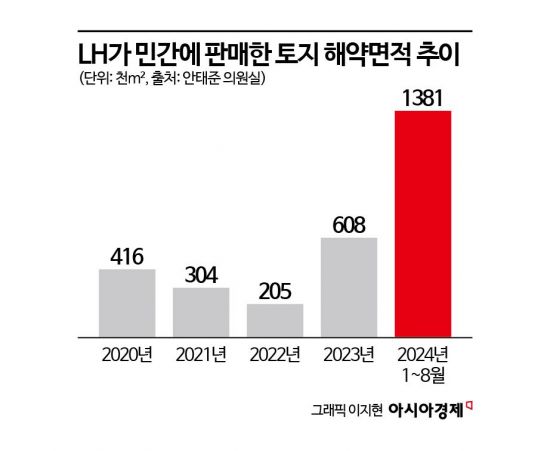

According to the 'Annual Land Cancellation Status for the Past 5 Years' received by Rep. Ahn Tae-joon of the National Assembly's Land, Infrastructure and Transport Committee from LH on the 27th, the total area of land contracts invalidated from January to August was 1,381,000㎡. In terms of value, this amounts to approximately 4.8643 trillion won.

Compared to the cancellation status in 2021, when the real estate market was strong (a total of 304,000㎡ and 325.1 billion won), the area increased 4.5 times and the amount surged 15 times. Even compared to last year, when the market began to cool down (a total of 608,000㎡ and 2.2396 trillion won), both area and amount more than doubled, indicating that this year's situation has worsened.

The canceled land includes all types such as public housing sites for apartment construction, single-family residential sites for commercial buildings or villas, commercial sites for mixed-use complexes, officetels, shopping malls, and industrial sites for factories and logistics centers.

Private Developers Who Bought Land at High Prices Abandon Projects

Land cancellations were particularly concentrated in Gyeonggi Province and Incheon. As of January to August this year, Gyeonggi Province (641,000㎡, 3.2866 trillion won) and Incheon (306,000㎡, 834.5 billion won) together account for about 70% of the total canceled area and 85% of the total amount.

An official from a major construction company said, "Even in the metropolitan area, sales proceed smoothly only in prime locations like downtown Seoul. Expanding to Gyeonggi Province, there is a widespread perception that 'building now would actually cause losses,'" adding, "Land plots that could be immediately developed and have transportation benefits such as the Metropolitan Area Express Railway (GTX) are being returned to LH."

Private developers purchased land contracts from LH at high prices during the real estate boom between 2021 and 2022 but are now returning the land. This is seen in areas such as Paju Unjeong, Yeongjongdo, and parts of Dongtan, which are part of the 2nd New Town development. The mixed-use complex sites planned for these areas were sold at the highest bid prices ever at the time. Due to overheated competition, the land was sold at prices several times higher than LH's set supply price.

Subsequently, rising construction costs and interest burdens, along with the real estate market downturn, have undermined project viability. Since last year, the number of private developers canceling contracts at a loss of about 10% of the supply amount as deposits has surged.

Disruptions to LH Supply Plans, Decline in Land Plot Completeness

As LH's major revenue source from land sales faces setbacks, the supply volume of housing and facilities is decreasing, and LH's financial soundness is turning red.

Ham Young-jin, head of the Real Estate Research Lab at Woori Bank, expressed concern, saying, "LH has to resell the canceled land, but since the project financing (PF) market has not yet recovered, it is difficult to expect aggressive land purchases by private developers. This could lead to increased financial burdens for LH."

He also mentioned, "From the housing supply perspective, the delay in public housing sales timing could cause an imbalance in housing supply and demand. Additionally, if commercial land contracts are canceled, it will be difficult to improve living conditions around apartments where residents have already moved in, leading to a decline in the completeness of land development districts."

Rep. Ahn emphasized, "The amount of land cancellations by LH this year could reach 6 trillion won by the end of the year. Since it is certain that LH's planned housing and infrastructure supply plans have been disrupted, countermeasures must be established."

Meanwhile, the amount of overdue payments that LH failed to collect after selling land to private parties has also surged. According to the 'Land Sale Payment Overdue Status' received by Rep. Ahn's office from LH, as of the end of August, the overdue amount was 6.2475 trillion won, about three times higher than 2.0689 trillion won in December 2021.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.