‘Global Entertainment & Media Industry Outlook 2024~2028’ Report

"Wave of Business Model Reinvention... Must Seize Powerful Opportunities Offered by AI"

The global advertising market is expected to surpass $1 trillion (approximately 1,337 trillion KRW) by 2026, driven by the rapid growth of the internet sector. Advertising revenue is projected to account for more than half (55%) of the total increase in revenue across the entire Entertainment & Media (E&M) industry over the next five years, leading the largest growth.

Samil PwC, part of the global accounting and consulting group PwC, released the 'Global Entertainment & Media Outlook 2023?2027' report on the 27th, containing this analysis. Now in its 25th year, the report analyzes and forecasts the E&M industry across 53 regions and 13 sectors worldwide.

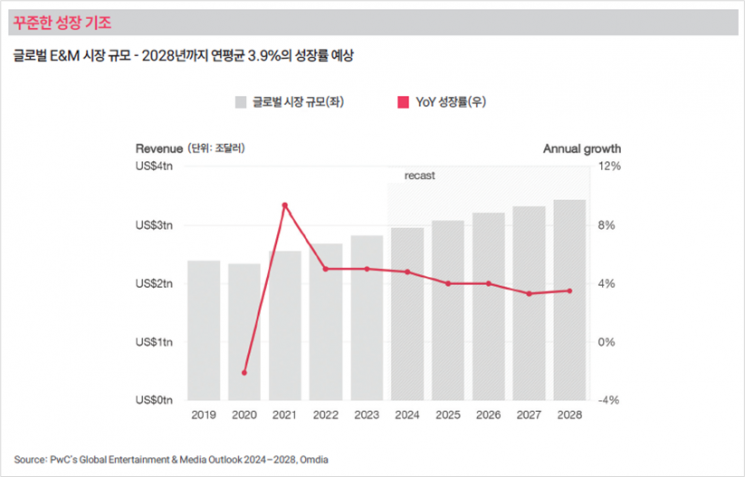

According to the report, despite economic challenges, technological changes, and intense competition within regions and industries, the global E&M industry recorded revenue of $2.8 trillion (approximately 3,697 trillion KRW) last year, a 5% increase from the previous year. This figure surpasses the overall economic growth rate of 3.2% compiled by the International Monetary Fund (IMF). The market size is expected to grow at an average annual rate of 3.9% over the next five years, reaching $3.4 trillion (approximately 4,489 trillion KRW) by 2028.

The advertising industry was identified as the fastest-growing sector within E&M. The report stated, “There is the greatest growth opportunity in advertising, where companies pay to expand consumer exposure across all E&M business areas such as mobile phones, gaming, mobility, and e-commerce,” and emphasized, “Going forward, all participants in the industry ecosystem must be able to effectively create value through advertising.”

Approaches to the changing advertising business include ▲ refining advertising models through data monetization ▲ closer connections between discovery of needed products/services and consumption ▲ considering the impact of global privacy regulations on growth.

The report assessed that the streaming industry, which has attracted significant attention in recent years, is facing challenging conditions due to intensified competition. Streaming companies are introducing ad-supported services to generate new revenue streams beyond traditional subscription models and investing in live broadcast content such as live sports (including large-scale events like the Summer Olympics). As a result, the share of advertising revenue in global streaming sales is expected to rise from 20% last year to about 28% by 2028.

Gaming remains one of the fastest-growing E&M sectors globally, with particularly strong growth in the Asia-Pacific region. Revenue is expected to exceed $300 billion (approximately 396 trillion KRW) by 2028. Live music is being revitalized by global tours, and in-person events such as global blockbuster movies are expected to return to pre-COVID-19 levels.

Warner Bolhouse, PwC’s Global Entertainment and Media Industry Leader, said, “Uncertainties caused by changes in consumer preferences, digital innovation, and emerging technologies such as generative artificial intelligence (AI) are driving a wave of business model reinvention,” and advised, “To maintain their share within the growing E&M business, companies must restructure how they create value, leverage advertising growth potential, and harness the powerful opportunities AI offers.”

Meanwhile, the United States remains the largest consumer spending and advertising market globally, accounting for more than one-third of global spending last year. However, the average annual growth rate is expected to be faster in markets such as China (7.1%), India (8.3%), Indonesia (8.5%), and Nigeria (10.1%) compared to the U.S. (4.3% through 2028). South Korea is projected to rank 9th worldwide with a total of $42.3 billion (approximately 56 trillion KRW) by 2028, but its expected average annual growth rate during this period is only 3.1%.

Han Jong-yeop, Media Industry Leader (Partner) at Samil PwC, stated, “The forecast that six of the top 10 countries by 2028 (India, China, the UK, Canada, the U.S., and France) will have higher growth rates than South Korea raises concerns about the future growth rate of Korea’s E&M industry. This is due to low growth in internet advertising and the gaming market,” and added, “To overcome Korea’s growth slowdown, existing business models must be reinvented.”

He further noted, “It is necessary to find ways to create greater value based on new technologies such as generative AI, and by experimenting and iterating new solutions and processes to provide new experiences to service users, the growth potential of the E&M business will improve.” More detailed information about the report is available on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.