Next Year's Government Budget of 207.8 Billion Won Invested

Income Guarantee for Price Drops Not Caused by Disasters

Strengthening Self-Responsibility to Prevent Moral Hazard

Increase in Basic Direct Payment Rates for Rice and Field Crops

Income Stability Support for Retiring Elderly Farmers

The government will launch the 'Agricultural Income Stabilization Insurance' next year, which compensates farmers if their income falls below a certain level. This is to guarantee income reduction caused by the decline in agricultural product prices. Going forward, the government plans to expand the insurance coverage items and regions while diversifying insurance products to strengthen protection to the level of advanced countries such as the United States and Japan. Additionally, the government will reform the public payment system by raising the basic direct payment unit price to establish a basic income safety net for farmers.

The Ministry of Agriculture, Food and Rural Affairs announced the 'Korean-style Agricultural Income and Management Safety Net Establishment Plan' at the Min-Dang-Jeong consultation meeting held on the 27th.

Rice harvesting taking place in a paddy field in Buk-myeon, Inje-gun, Gangwon-do. [Image source=Yonhap News]

Rice harvesting taking place in a paddy field in Buk-myeon, Inje-gun, Gangwon-do. [Image source=Yonhap News]

This plan is the result of a total of 21 discussions after the government formed a public-private-academic consultative body with the agricultural sector and academia in June. It includes expanding policy insurance to manage management risks such as natural disasters and agricultural product price declines, and expanding and reforming the public payment system to provide a basic income safety net for farmers. It also includes a plan to fundamentally mitigate price volatility by proactively managing supply and demand through public-private cooperation.

Kim Jong-gu, Director of Agricultural Innovation Policy at the Ministry of Agriculture, Food and Rural Affairs, said, "Agricultural product price fluctuations continue, and risks are increasing due to recent abnormal climate conditions. If this situation worsens, the sustainability of agriculture cannot be guaranteed, and the stable supply of agricultural products will also become unstable." He added, "While agricultural management entities are becoming corporatized and scaled up, agricultural structural polarization is progressing, such as the aging of rural areas and the increase of small-scale farms."

Gradual Expansion of Agricultural Income Stabilization Insurance... Strengthening Farmers' Self-Responsibility

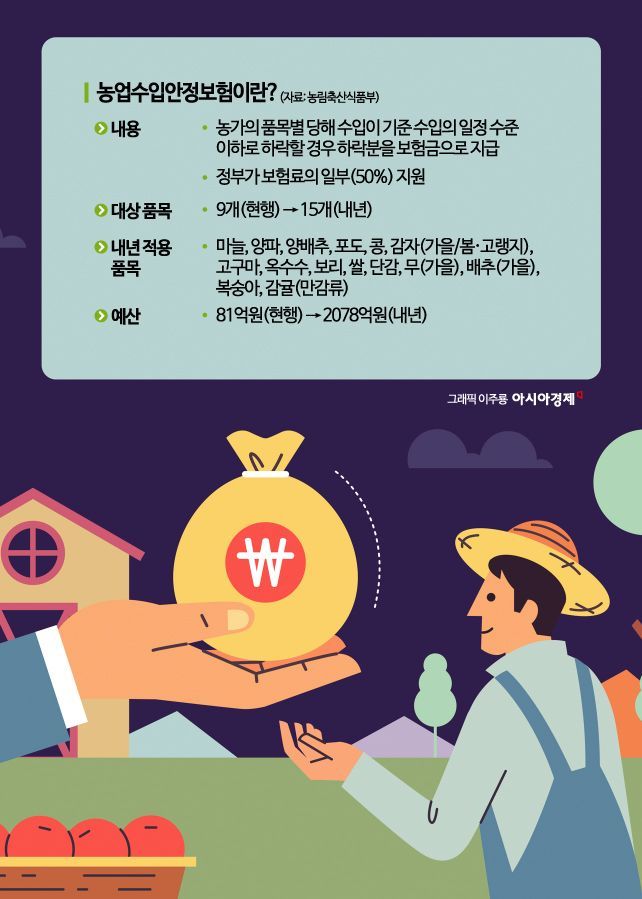

The government decided to convert the item-specific Agricultural Income Stabilization Insurance into a nationwide full-scale project from next year to compensate for income reductions caused by agricultural product price declines. The target items will also be expanded from 9 this year to 15 next year. New items such as rice, persimmons, radish (autumn), and cabbage (autumn) will be converted into full-scale projects after pilot projects. For livestock products, the government will decide on introduction after studying overseas cases and product design feasibility.

Agricultural Income Stabilization Insurance is an insurance product that pays insurance money for the decline if a farm's income for each item falls below a certain level of the standard income. The income for each item is calculated by multiplying the standard price by the farm's harvest volume. The government supports part of the insurance premium (50%) at this time. There are three types of insurance: ▲ Past Income Type (calculates income based on the average price as the standard price) ▲ Expected Income Type (calculates income by estimating the standard price reflecting part of the price increase during harvest season on the average price) ▲ Actual Income Type (guarantees actual income based on the actual price received by each farm).

To prevent moral hazard and adverse selection, farmers' self-responsibility will be strengthened. A verification system for harvest volume by farm will be established to prevent farmers from intentionally reducing harvest volume or neglecting cultivation. Farms with high cumulative loss rates will be required to subscribe to lower coverage products. Also, to prevent overproduction of items covered by Agricultural Income Stabilization Insurance, farmers receiving insurance premium support will be required to pay mandatory mutual aid funds and fulfill supply and demand management obligations such as cultivation reporting.

Considering the increasing risk of natural disasters due to climate change, the disaster response system will also be strengthened. Disaster recovery costs will be increased by an average of 23% considering actual transaction prices, and agricultural machinery and facilities will be added to the support targets. The government explained that coverage for natural disaster-related pests and diseases will increase in the future.

The government will significantly increase the related budget from 8.1 billion won this year to 207.8 billion won next year for this project. In the long term, the government plans to gradually expand the insurance target items and regions considering field demand. The number of items is expected to increase to 30.

Increase in Basic Direct Payment and Strengthening of Optional Direct Payment Support

The government will raise the basic direct payment unit price, which has been fixed since the introduction of the public payment system in 2020, next year to reduce the gap between paddy fields and dry fields in non-promotion areas. For paddy fields, the unit price will increase from a maximum of 1.78 million KRW/ha to 1.87 million KRW/ha, and for dry fields, from 1.34 million KRW/ha to 1.5 million KRW/ha. The support area and payment unit price for strategic crop direct payments will also be increased. Through this, the government plans to establish a basic income safety net for farmers. In this process, the budget related to agricultural direct payments will be expanded from 31 trillion KRW this year to 50 trillion KRW next year. The optional direct payment support system, which compensates for environmental and ecological conservation activities, will also be reformed.

To respond to the aging agricultural workforce and promote generational transition, the government will support young farmers' initial livelihood stabilization and income stability for elderly farmers wishing to retire. Support for young farmers' settlement in farming will also continue. The Agricultural Land Transfer Retirement Direct Payment (which pays direct payments to retiring elderly farmers on the condition of selling farmland and transfers secured farmland to young farmers) will extend the subscription age and payment period. The accuracy of the supply and demand prediction system by item will also be improved by utilizing drones and satellite imaging and expanding the measured items.

The government expects that the full-scale introduction of Agricultural Income Stabilization Insurance and the expansion of the public payment system will enable income protection at the level of advanced countries such as the United States and Japan. It also expects to enhance the response capacity to natural disasters increasing due to climate change and mitigate agricultural product price volatility through proactive supply and demand management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)