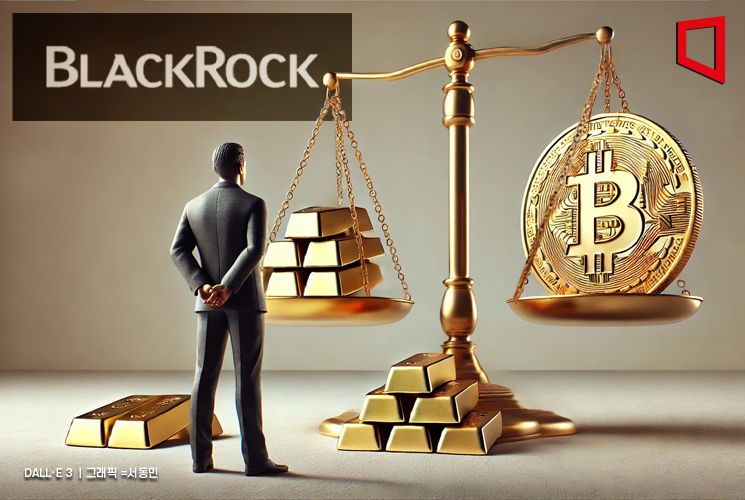

The world's largest asset management firm, BlackRock, claimed that Bitcoin, the number one cryptocurrency by market capitalization, can serve as a risk-hedging asset similar to gold. Since the approval of Bitcoin spot exchange-traded funds (ETFs) by U.S. securities regulators this year, BlackRock has become a major player in the cryptocurrency market and has been expressing continued optimism.

On the 24th (local time), Robby Michnick, Head of Digital Assets at BlackRock, said in an interview with Bloomberg TV that despite Bitcoin recently showing a high correlation with U.S. stocks, “calling it a risk asset is likely a misnomer,” and added, “rather, (Bitcoin) should be seen as an asset for risk aversion.”

Generally, in financial markets, assets like gold are classified as preferred by investors when uncertainty increases. In this context, Michnick said, “Gold also shows a similar pattern (to Bitcoin).”

Michnick also viewed Bitcoin as a potential global currency alternative. He said, “There is no country or government controlling Bitcoin,” and “Bitcoin is scarce and decentralized.”

Regarding Ethereum, the second largest cryptocurrency by market capitalization, he took a cautious stance, saying, “Many clients still see it as unclear.”

BlackRock’s CEO Larry Fink also evaluated Bitcoin as having value as a means to counteract currency depreciation in an interview with U.S. economic media CNBC last July.

BlackRock, which had a skeptical stance on cryptocurrencies years ago, is now regarded as a leading manager of Bitcoin and Ethereum spot ETFs this year.

BlackRock manages the Bitcoin spot ETF ‘IBIT’ and the Ethereum spot ETF ‘ETHA.’

Bitcoin and Ethereum have risen by 49% and 15%, respectively, this year, supported by institutional investor inflows following the approval of spot ETFs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.