In September, the growth of household loans, centered on mortgage loans, has been slowing down, but there are concerns that loan demand may increase again ahead of the autumn moving season. Additionally, with the decline in the COFIX rate, commercial banks are also lowering mortgage loan interest rates, drawing attention to the future growth trend of household loans, especially mortgage loans.

According to commercial banks on the 25th, the outstanding balance of household loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) was 728.0869 trillion won (as of September 19), an increase of 2.7227 trillion won compared to the end of August (725.3642 trillion won). Among these, mortgage loans increased by 2.6551 trillion won this month. If this trend continues, the increase in household loans this month is expected to be about 4 trillion won, which is only 45% of the total increase in August (8.9115 trillion won).

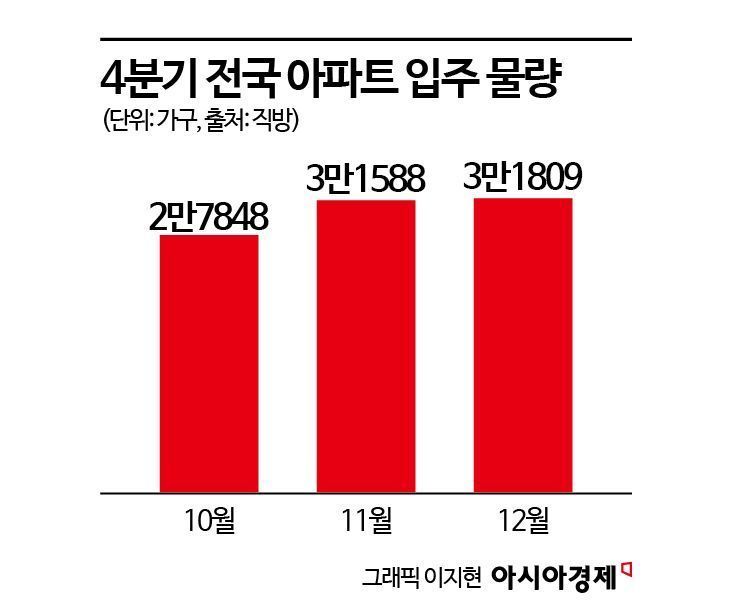

However, it is premature to be complacent. Since the recent slowdown is partly due to the Chuseok holiday and the temporary effect of the second-stage stress Debt Service Ratio (DSR), mortgage loans may increase again ahead of the full-scale autumn moving season. According to Zigbang, the nationwide apartment move-in volume in October is estimated at 27,848 households, about 5,000 more than in September. This represents an increase of approximately 24% compared to 22,499 households in September. Notably, nearly 10,000 of the October move-ins are concentrated in Seoul and Gyeonggi Province. In November and December, more than 30,000 households are scheduled to move in each month, with the 'Olympic Park Foreon,' comprising 12,032 households, starting move-ins in November. Furthermore, the renewal period of the Housing Lease Protection Act enacted in 2020 has arrived, which may also influence increased housing demand.

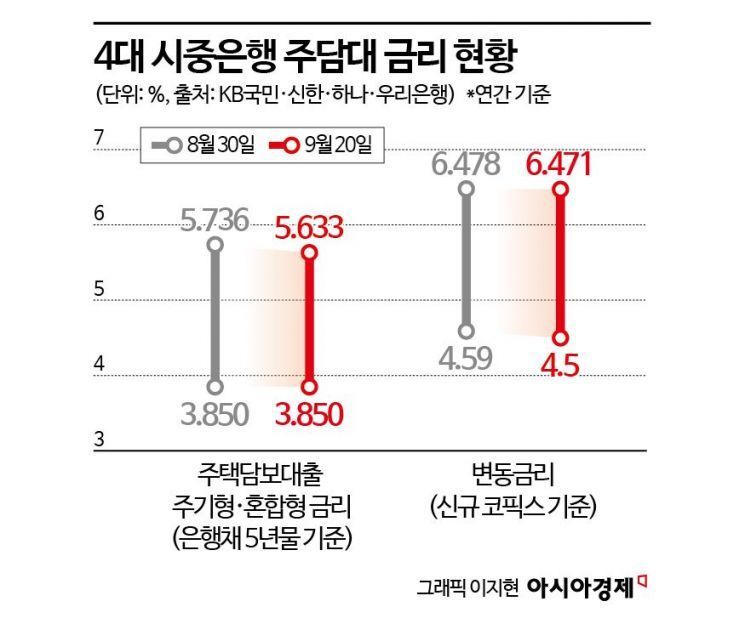

The decline in the COFIX rate, prompting commercial banks to lower mortgage loan interest rates, is another concern. The COFIX rate dropped by 0.06 percentage points from 3.42% to 3.36% (based on new contracts, announced on the 19th). Accordingly, commercial banks have slightly reduced mortgage loan interest rates. KB Kookmin Bank announced on the 20th that it would lower the upper and lower limits of the COFIX-linked new mortgage loan variable interest rates from 4.56-5.96% to 4.50-5.90%, a 0.06 percentage point reduction. The 5-year fixed interest rate ranges from 3.85% to 5.25%. The fixed rates at the five major banks range from 3.60% to 6.00%, with all but Woori Bank having lower bounds in the 3% range. The variable rates at the five major banks range from 4.50% to 6.47%, also reflecting decreases of 0.09% and 0.007% at the upper and lower bounds, respectively, compared to before.

The upcoming Monetary Policy Committee meeting of the Bank of Korea next month is also a point of interest. The possibility of the Bank of Korea lowering its base rate has increased following the U.S. interest rate cuts. Considering that interest rate decisions are based on housing prices and household debt levels in September, if the rate cut decision is made due to the somewhat slowed household debt growth caused by the September holiday effect and the second-stage stress DSR, it could further fuel household debt growth.

Although tightened regulatory measures make it unlikely that lower loan interest rates will lead to a surge in loan demand, it is still too early to be complacent, leaving concerns about the increase in household loans.

A representative from a commercial bank said, "Due to the government's strengthened household debt management policy, it is difficult for market interest rates to drop sharply in a short period," but added, "However, with the U.S. signaling additional rate cuts and the Bank of Korea's base rate decisions inevitably reflecting these factors, loan demand could be stimulated. We are considering ways to manage the increase in household loans while reflecting interest rate cuts."

Kim Jae-woo, a researcher at Samsung Securities, analyzed, "In the upcoming interest rate cut cycle, the decline in loan interest rates could also lead to increased loan demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)