KOSDAQ, Weak Earlier This Year, Shows Strength Against KOSPI Recently

KOSDAQ Rises Nearly 7% Over Last 6 Consecutive Days

Foreign Investors Sell 6 Trillion Won in KOSPI This Month but Maintain Buying in KOSDAQ

Sentiment Reverses on Growth Stock Optimism Amid Interest Rate Cuts

There is growing interest in whether the KOSDAQ can continue its recent strong performance and recover from its previous slump. The KOSDAQ has risen for six consecutive days recently, significantly outperforming the KOSPI. The turnaround in the KOSDAQ’s sentiment can be attributed to expectations for growth stocks following the U.S. interest rate cut, the strength of healthcare stocks emerging as leaders amid weakness in semiconductors, among other factors. In particular, the securities industry forecasts that if the financial investment income tax (금투세) is deferred, it would have a positive impact on the KOSDAQ, which has many individual investors.

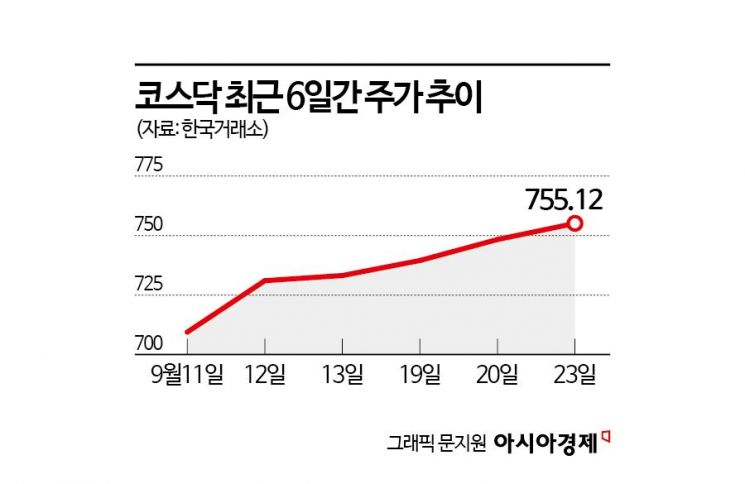

According to the Korea Exchange on the 24th, the KOSDAQ has maintained a six-day consecutive upward trend from the 11th to the previous day. The stock price, which was around the 700 level, has recovered to the 750 level. The increase rate during this period reached 6.93%, more than double the KOSPI’s rise of 3.11% over the same period. Although the KOSPI also rose for five consecutive days recently, its increase rate lagged behind that of the KOSDAQ.

Foreign investors widened the gap in the rise rates between the KOSDAQ and the KOSPI. This month, foreign investors sold more than 6.7 trillion won in the KOSPI market but maintained buying momentum in the KOSDAQ market with a net purchase of 74.7 billion won.

The stock most purchased by foreign investors this month was also from the KOSDAQ. Foreign investors have net bought 330.7 billion won worth of Alteogen, the KOSDAQ’s leading stock, making it the most acquired stock. Additionally, they net purchased 66.3 billion won of EcoPro BM.

The KOSDAQ had shown a weaker performance compared to the KOSPI since the beginning of this year. This was because corporate value-up programs and the benefits from the strength of AI semiconductors, which acted as momentum for stock price increases this year, were concentrated in large KOSPI stocks, leaving the KOSDAQ sidelined. Furthermore, uncertainty over U.S. interest rates in the first half of the year adversely affected the KOSDAQ, which has a high proportion of growth stocks.

However, recent U.S. interest rate cuts have raised expectations for growth stocks, leading to a turnaround in the KOSDAQ’s sentiment. Earlier, the U.S. Federal Reserve (Fed) implemented a 'big cut' by lowering the benchmark interest rate by 0.5 percentage points at the September Federal Open Market Committee (FOMC) meeting held on the 17th and 18th (local time). This is the first Fed rate cut in about four and a half years since March 2020. KB Securities researcher Hainhwan said, "Although there is still debate about whether the Fed’s rate cut signals a recession, the clear fact is that rate cuts are beginning in earnest. From a style strategy perspective, which emphasizes focusing on growth stocks during rate cuts, this logic can be connected to the domestic market by suggesting that more attention should be paid to the KOSDAQ than the KOSPI."

Shinhan Investment Corp. researcher Lee Byunghwa also analyzed, "Historically, rate cuts have been accompanied by economic downturns and low growth, during which leading stocks shifted to sectors showing growth exceeding the interest rate. AI hardware, which was a leading stock until the first half of this year, experienced a sharp correction as rate cuts became more likely amid economic weakness. As rate cuts breathe new life into various growth stocks, there is a continuous movement to seek opportunities in growth stocks that have been lacking in demand." He added, "There is potential for excess returns in various small and mid-cap growth stock sectors, including healthcare."

The strength of healthcare stocks, which have shown relatively robust performance amid semiconductor weakness and have emerged as leaders, is supporting the KOSDAQ’s upward trend. Leading KOSDAQ stocks by market capitalization, such as Alteogen and Rigacembio, have recently surged significantly, driving the KOSDAQ’s strength. Alteogen rose 9.72% this month, and Rigacembio increased by 8.49%. Shin Seungjin, head of investment information at Samsung Securities, explained, "The recent strong performance of biotech companies is due to, first, the U.S.-China trade conflict expanding into the biotech sector, which is expected to relatively benefit domestic biotech firms, and second, expectations of interest rate cuts. The pharmaceutical and biotech sectors benefit from a low-interest-rate environment because capital raising for new drug development is easier. The Fed’s decision to cut rates in September is expected to lead to a positive stock trend in the biotech sector during the upcoming rate cut cycle." He continued, "Additionally, more biotech companies are being revalued due to technology exports to global big pharma. Recent consecutive technology export announcements by domestic biotech firms have attracted attention from investors thirsty for growth stocks."

Furthermore, if the financial investment income tax (금투세) currently being discussed in political circles is deferred, it is expected to have a positive impact on the KOSDAQ. Researcher Ha said, "The reason the KOSDAQ has been particularly sluggish this year is likely due to the Fed’s rate cuts being delayed more than expected and concerns over the introduction of the financial investment income tax. While it is necessary to continuously monitor the progress or deferral of the tax, the time to reach a conclusion in either direction is approaching. If the tax is deferred, the KOSDAQ will undoubtedly be the most noteworthy beneficiary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.