Minimizing Use of Foreign Exchange Stabilization Fund

Likely to Utilize Alternatives Such as Reduction of Local Grants

The scale of this year's tax revenue shortfall is expected to be around 30 trillion won. The Ministry of Economy and Finance will announce the specific estimated shortfall within this week and disclose measures to cover it. Since the shortfall is certain, the government has decided to reduce the amount of grants and local allocation taxes sent to local governments and use funds with surplus resources to cover the tax revenue shortfall.

According to related ministries on the 23rd, the Tax Policy Bureau of the Ministry of Economy and Finance is in the final stages of revising the tax revenue forecast for this year. The Ministry plans to announce the detailed results of the tax revenue revision and countermeasures after the 25th. Initially, the Ministry intended to announce the revised forecast right after the Chuseok holiday, but the announcement was delayed due to prolonged deliberations on countermeasures. A Ministry official stated, “As the announcement schedule has been delayed, we are reviewing the daily (revenue) performance with the National Tax Service more closely.”

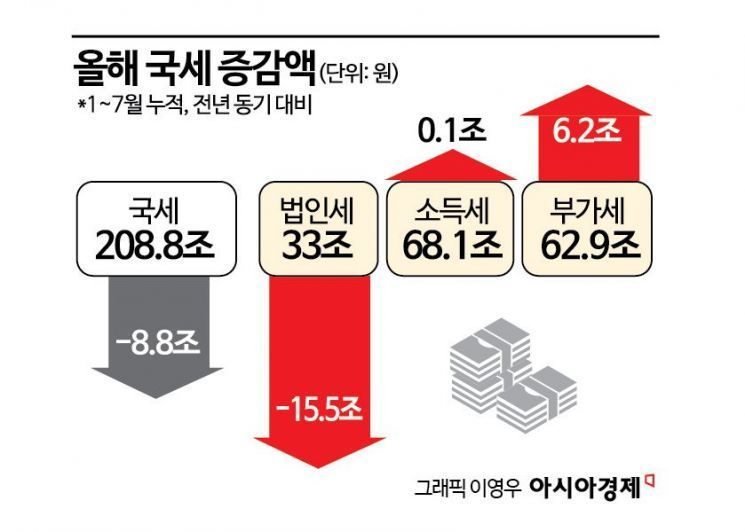

Internally, the Ministry of Economy and Finance predicts a shortfall of around 30 trillion won. At the beginning of this month, during a comprehensive inquiry at the National Assembly Budget and Accounts Committee, Deputy Prime Minister and Minister of Economy and Finance Choi Sang-mok responded “Yes” to the question, “Is a 32 trillion won tax revenue shortfall expected if things continue as they are?” This assumption is based on the premise that the remaining tax revenue to be collected will be the same as last year. However, considering the economy is recovering compared to last year and the possibility of improved tax revenue performance such as the August corporate tax interim payment, the shortfall is unlikely to reach 32 trillion won. The government had initially projected national tax revenue of 367.3 trillion won this year, but as of July, national tax revenue was 208.8 trillion won, down 8.8 trillion won compared to the same period last year. This decline is largely due to a significant decrease in corporate tax revenue (-15.5 trillion won) compared to the previous year.

The Ministry will also present funding measures to cover the shortfall when announcing the revised tax revenue forecast. Unlike last year, the option of preparing a supplementary budget is not being considered; instead, the use of surplus funds from existing funds is being reviewed. Additionally, since the shortfall in national tax revenue is certain, the originally budgeted amounts for local allocation tax and local education finance grants, which were predicted based on the initial revenue budget, will also be reduced.

As a result, criticism has arisen mainly from the political sphere that the government is shifting the burden of the tax revenue shortfall onto local governments. In response, the Ministry of Economy and Finance explained that the amount initially allocated to local governments will not decrease. The government automatically allocates about 40% of domestic taxes to local allocation tax (19.24%) and local education finance grants (20.79%), which are initially calculated based on the revenue budget. Considering the final national tax revenue may be lower or higher than expected, the government adjusts these allocations through a settlement process based on the final tax revenue in February of the following year.

A Ministry official explained, “Currently, it is certain that tax revenue will not meet the revenue budget, so the government is preemptively allocating less to local governments and education offices, which will be settled again in February next year,” adding, “This does not mean that the share local governments and education offices should receive is reduced or that the government is withholding special funds.” However, the National Assembly Legislative Research Office pointed out in its analysis report on this year’s national audit issues that “If the ordinary local allocation tax for the current year must be reduced due to unavoidable reasons, mechanisms should be established to allow local governments to predict and respond accordingly.”

Unlike last year, the Foreign Exchange Equalization Fund (WEEF) is unlikely to be utilized this year. A Ministry official said, “We are trying to use as little or none of the WEEF as possible,” adding, “However, it is still in the final coordination stage.” Initially, the Ministry had strongly considered using the WEEF as it did last year, but due to criticism from the National Assembly and others, it is reportedly deliberating ways to minimize its use. Last year, when the government announced a revised tax revenue forecast showing a 59 trillion won decrease, it proposed using the WEEF.

Furthermore, the Ministry of Economy and Finance is expected to partially disclose institutional improvement plans to reduce errors in tax revenue forecasting. The Tax Policy Bureau has been working on enhancing forecasting models by incorporating recommendations from the International Monetary Fund (IMF) to reduce recurring forecasting errors. For next year’s revenue budget forecast, an improved method is expected to be introduced that separately estimates corporate tax revenue for listed and unlisted companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)