Exchange of Friendly Shares for Management Control Defense vs Treasury Stock Cancellation for Shareholder Returns

Yeongpung and MBK Side Pressures with Active Shareholder Return Policy Announcing Full Cancellation

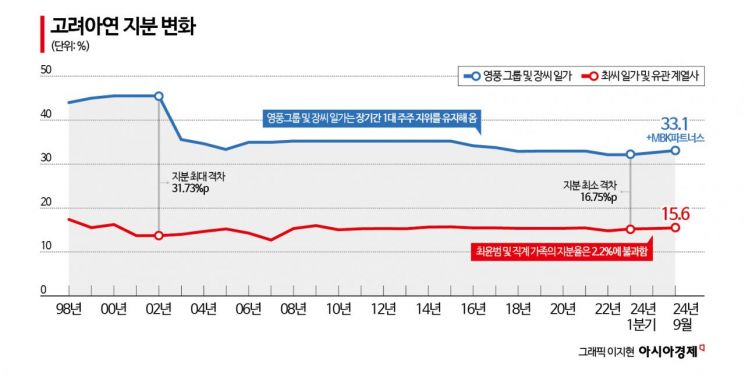

Chairman Choi Yoon-beom of Korea Zinc is drawing attention from the capital market and business circles regarding whether he will use treasury shares to defend his management rights. Using treasury shares for purposes other than cancellation to enhance shareholder value contradicts the government's recent value-up policy. However, in reality, Chairman Choi needs to gather even a small additional stake to defend his management rights against Youngpoong and MBK Partners, who are attempting to enter the board by raising allegations of breach of trust.

Will Chairman Choi Yoon-beom Cast the 'Magic of Treasury Shares'?

According to the financial investment industry on the 20th, Korea Zinc purchased treasury shares worth 255.8 billion KRW after the shareholders' meeting in March. This corresponds to 2.4% of the company's shares. However, unlike before, the purpose of canceling the treasury shares has not been clearly stated, raising suspicions that the purchase is intended for defending management rights.

The Youngpoong and MBK Partners side stated, "In the past, Korea Zinc disclosed the purpose of treasury share purchases as 'cancellation,' but since March this year, the purpose has been vaguely explained as employee stock options, enhancing shareholder value, and other uses besides cancellation," adding, "This is the basis for suspecting that the treasury share purchase is for Chairman Choi's defense of management rights."

Treasury shares do not have voting rights, but they can be exchanged with friendly companies' shares. If other companies such as Hyundai Motor and Hanwha assist, friendly stakes can be secured through treasury share exchanges, and voting rights can be revived.

A financial investment industry official said, "If Chairman Choi transfers treasury shares to friendly forces as a card he can use, voting rights come back to life," adding, "He has done so before." Previously, Korea Zinc exchanged treasury shares with large corporations such as Hyundai Motor, Hanwha, and LG. This is why the market's attention is focused on Chairman Choi's decision regarding the cancellation of treasury shares. Currently, Korea Zinc holds 2.4% of treasury shares, and after the scheduled treasury stock repurchase, this will rise to around 4-5%. A financial investment industry official evaluated, "A shareholder holding 2.2% of shares is trying to strengthen their control with company funds, which goes against the interests of all shareholders and the government's policy."

Youngpoong and MBK Announce 'Complete Cancellation' of Purchased Treasury Shares

While Chairman Choi has not clearly stated his position on the treasury share policy, Youngpoong and MBK, who are conducting a public tender offer for Korea Zinc, have sought to win shareholders' favor by proposing an active shareholder return policy.

Youngpoong and MBK recently stated, "After the public tender offer aimed at strengthening the largest shareholder's management rights is completed, we will restore the damaged shareholder value and implement an active shareholder return policy for all shareholders."

The core of the shareholder return policy announced by Youngpoong and MBK Partners is the 'complete cancellation' of the purchased treasury shares. Youngpoong and MBK said, "It is in line with enhancing shareholder value to cancel all 2.4% of treasury shares and to cancel all treasury shares to be acquired in the future with the remaining amount (about 290 billion KRW) from the fourth treasury share repurchase," adding, "We will actively communicate with the board of directors to this end."

They also plan to strengthen the dividend policy. Korea Zinc's average dividend per share over the past three years was 18,333 KRW, and the average over the past five years was 16,800 KRW. Youngpoong and MBK Partners plan to maintain or strengthen the current dividend payout ratio and ultimately communicate with the board to expand the dividend per share to the 25,000 KRW range.

Youngpoong and MBK said, "Our position on treasury shares is firm. It is right to cancel all treasury shares, not only those already purchased but also those to be purchased, for the purpose of shareholder returns," adding, "To dispel suspicions that Chairman Choi is using treasury shares to defend management rights, he must clearly state his position on treasury shares worth about 550 billion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.