Household and Corporate Both Rise

Significant Reduction in Non-Performing Loan Resolution Scale

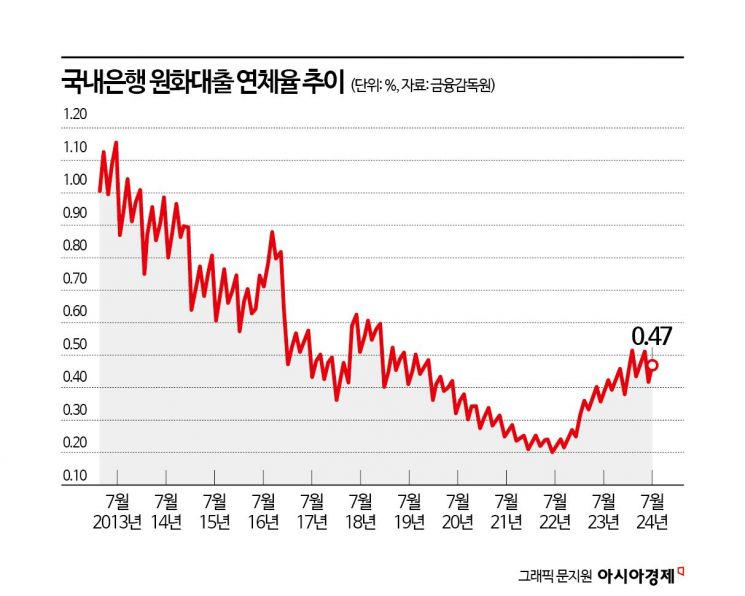

The bank loan delinquency rate, which had slightly declined in June, turned upward again in July. Both household and corporate loan delinquency rates increased.

According to the Financial Supervisory Service on the 20th, as of the end of July, the delinquency rate on won-denominated loans at domestic banks was 0.47%, up 0.05 percentage points from the previous month (0.42%). The delinquency rate at domestic banks had fallen in June for the first time in three months but has now returned to an upward trend.

The amount of new delinquencies in July was 2.7 trillion won, an increase of 400 billion won compared to the previous month (2.3 trillion won). On the other hand, the amount of delinquent loans resolved during the same period was 1.5 trillion won, a sharp decrease of 2.9 trillion won, more than half compared to the previous month (4.4 trillion won).

Specifically, the corporate loan delinquency rate rose 0.07 percentage points to 0.53% from 0.46% in the previous month. During the same period, the delinquency rate for large corporations increased by 0.01 percentage points to 0.05%, and the delinquency rate for small and medium-sized enterprises (SMEs) rose 0.09 percentage points to 0.67%. The delinquency rate for small and medium-sized corporate loans was 0.71%, up 0.13 percentage points from 0.58% the previous month, and the delinquency rate for individual business loans increased 0.04 percentage points to 0.61% from 0.57%.

The household loan delinquency rate also rose 0.02 percentage points to 0.38% from 0.36% in the previous month. During the same period, the delinquency rate on mortgage loans increased 0.01 percentage points to 0.25%, while the delinquency rate on other household loans such as unsecured loans rose 0.05 percentage points to 0.76%.

Generally, delinquency rates tend to rise during the quarter and fall at the end of the quarter, as banks expand the resolution of delinquent loans through sales and disposals at quarter-end. Compared to June, which was the end of the second quarter, the beginning of the third quarter in July experienced a base effect.

An official from the Financial Supervisory Service evaluated, "Although delinquency rates are rising mainly among vulnerable borrowers such as SMEs, they are still low compared to the long-term average before COVID-19." However, they added, "Since the new delinquency rate has remained at a higher level than usual since the second half of last year, it is necessary to prepare for the possibility that the delinquency rate may continue to rise."

The Financial Supervisory Service plans to encourage banks to strengthen asset soundness management through provisions for loan losses and resolution of delinquent loans, while supporting debt burden relief for borrowers by activating self-debt restructuring for vulnerable borrowers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)