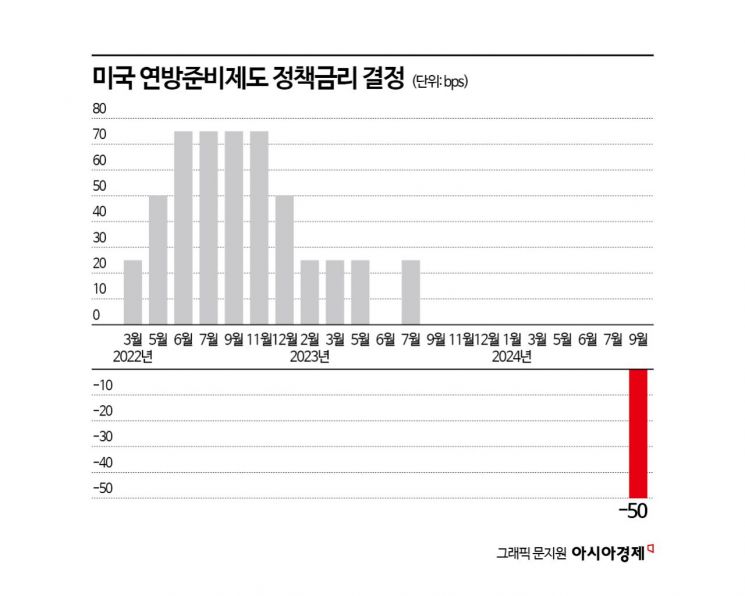

50bp Cut After 4.5 Years... Shift from Tightening to Easing

'Post-Recession Response vs. Preventive Measures' Conflict

"Stock Prices Diverge on Entering Rate Cut Cycle Depending on Actual Recession"

As the U.S. Federal Reserve (Fed) implemented a 'big cut' (a 0.5 percentage point reduction in the benchmark interest rate), concerns about an economic recession have reignited in the market. Analysts in the securities industry suggest that whether an actual recession occurs in the future will determine stock returns.

According to the Korea Exchange on the 20th, the KOSPI closed at 2,580.80, up 0.21% from the previous trading day. During the session, it showed volatility, retreating to the 2,550 level, and ended mixed as foreigners sold more than 1 trillion won. Despite the Fed's first 'big cut' in four and a half years, the market did not perceive it as a positive factor.

Rather, the market continued to worry about a recession. This is based on the judgment that historically, Fed rate cuts have often acted as a reactive measure to recessions, causing sharp declines in the stock market. Lee In-gu, a researcher at Mirae Asset Securities, said, "In the past, a 50bp (1bp = 0.01 percentage point) rate cut generally signaled a prelude to a recession," adding, "It is necessary to monitor additional economic indicators going forward."

Some argue that this rate cut could act as a 'proactive measure' like in 1998 and be positive for the stock market. Han Ji-young, a researcher at Kiwoom Securities, noted, "It is important to pay attention to the fact that at the September Federal Open Market Committee (FOMC), Chairman Jerome Powell emphasized that the current policy is not a lagging response to the real economy but a preemptive rate cut." She added, "Although most leading economic indicators are slowing, they are not deteriorating as sharply as during past recessions." She further stated, "There is a high probability that this Fed rate cut is a preemptive response. This will have effects such as preventing economic slowdown and calming stock market anxiety."

Ultimately, investors should focus on whether an actual recession will occur, given that the Fed has tended to make lagging judgments about the economy. Ha Jae-seok, a researcher at NH Investment & Securities, explained, "Since the 1980s, stock returns have generally been poor during rate cut phases accompanied by recessions. Conversely, rate cuts not accompanied by recessions have been favorable for stock prices."

Ha also advised, "In cases of rapid rate cuts accompanied by recessions, the volatility of risk assets like stocks increases. Moreover, until new policy momentum emerges after the U.S. presidential election, the potential for stock price gains is limited," recommending, "Maintaining a neutral weighting in stocks would be effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.