Stock Price Soars 200% This Year

Business Opportunities Expand with US Biosecurity Act Enforcement

Competition to Attract Small and Medium CDMOs Intensifies

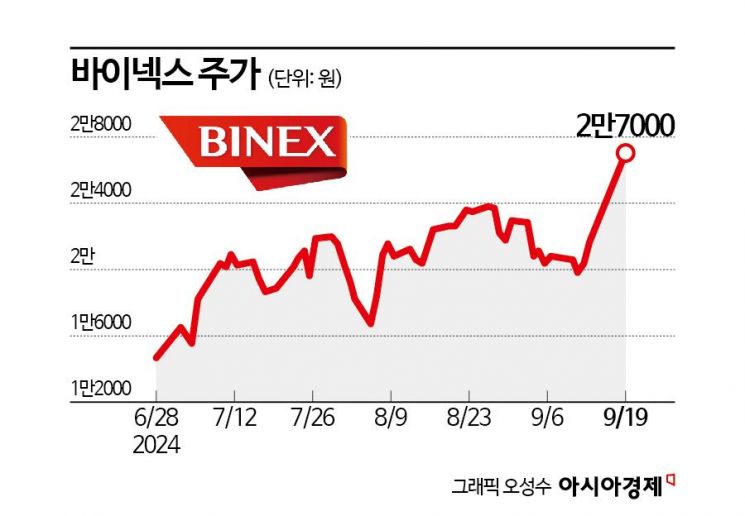

Binex hit an all-time high amid expectations for the implementation of the U.S. government's Biosecurity Act.

According to the financial investment industry on the 20th, Binex's stock price has risen 202% this year. Considering that the KOSDAQ index fell 15% during the same period, the market-relative return reaches 217 percentage points (P). Since the beginning of this month, foreign and domestic institutional investors have been rushing to buy Binex shares. Foreigners and institutions recorded net purchases of 17.7 billion KRW and 13.7 billion KRW, respectively.

Binex's main businesses are the production and sales of chemical pharmaceuticals and contract manufacturing of biopharmaceuticals. It possesses pharmaceutical production facilities that comply with the U.S. Food and Drug Administration (FDA) required "current Good Manufacturing Practice (cGMP)" and the European Medicines Agency (EMA) standards. Biopharmaceuticals are produced at the Songdo and Osong plants. Biopharmaceuticals are classified into two forms: active pharmaceutical ingredients (APIs) and finished dosage forms. APIs are produced at the Songdo and Osong plants, while finished dosage forms are produced at the Songdo plant.

Lee Sangheon, a researcher at iM Securities, explained, "In January this year, the U.S. House and Senate jointly proposed the Biosecurity Act to protect Americans' personal health and genetic information from concerning companies in the advanced bioindustry sector." He added, "The Biosecurity Act is a bill that prohibits the U.S. government from contracting with or providing subsidies to biotechnology companies from countries of concern such as China and companies that do business with them."

The Biosecurity Act will be finalized after passing the U.S. Senate plenary session and presidential signature stage in the second half of this year. Pharmaceutical companies currently trading with Chinese companies such as WuXi Biologics, a global biopharmaceutical contract development and manufacturing organization (CDMO), BGI Group, Complete Genomics, MGI, and WuXi AppTec are striving to prepare alternatives. The related industry is paying attention to contract manufacturing organizations (CMOs) capable of clinical, sample, and regional commercial production.

Binex's bio division is also expected to secure new orders. Binex's order backlog was maintained in the 60 billion KRW range, with 61.9 billion KRW at the end of 2021 and 66.7 billion KRW at the end of 2022. However, it decreased to 28.4 billion KRW at the end of last year and then increased to 36.2 billion KRW at the end of the first half of this year. This explains the recent sluggish sales.

Jo Jeonghyun, a researcher at Hana Securities, said, "Binex has secured cell line development experience through its core client Celltrion's biosimilar products." He added, "Considering the U.S. and European regulatory approval schedules for biosimilar items, full-scale mass production sales can be expected from next year." He emphasized, "Binex's Songdo plant completed FDA inspection in June and EMA inspection in September. Upon approval, it will be recognized as a small- to medium-sized CDMO company equipped with both cGMP and EU GMP-grade facilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)