Focus on Financial Soundness Crisis of Korea Zinc

Chairman Choi Yunbeom's Unilateral Investment Decisions Questioned

Confidence in No Tender Offer Failure... Institutional Investor Analysis Completed

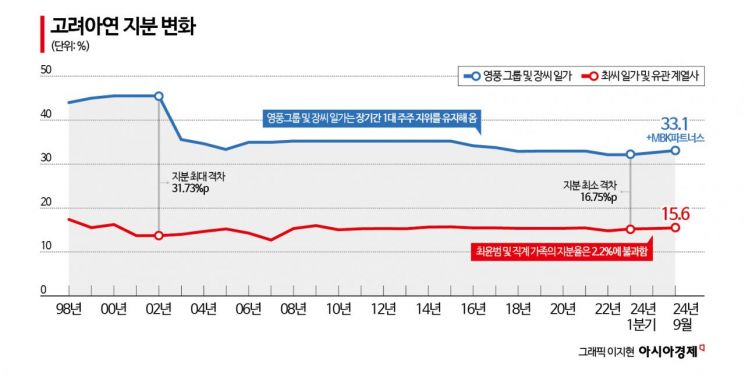

MBK Partners, conducting a public tender offer for Korea Zinc together with the largest shareholder Youngpoong, explained the background of the tender offer and 'precisely targeted' suspicions related to Chairman Choi Yoon-beom, including the unilateral investment decision-making process that caused Korea Zinc's financial soundness crisis. MBK judged the possibility of failure to be low, given that it has already secured 33.1% of shares from the largest shareholder and is currently conducting a public tender offer for an additional 7% or more. They focused on persuading profit realization using objective indicators such as the fact that about 98% of other shareholders are institutional investors and their average acquisition price is in the 450,000 KRW range.

Where Did Korea Zinc's 3.1 Trillion KRW Cash Disappear?

Kim Kwang-il, Vice Chairman of MBK Partners, said at a press conference on the Korea Zinc public tender offer held at Lotte Hotel in Jung-gu, Seoul on the 19th, "Korea Zinc's debt is rapidly increasing while profitability is deteriorating, raising concerns about financial soundness," adding, "If the approximately 12 trillion KRW investment in new businesses, which is increasingly dependent on borrowing due to reckless investments, is fully reliant on debt, the debt burden will intensify."

MBK pointed out the grounds for concerns about Korea Zinc's financial soundness in detail. Vice Chairman Kim said, "The company earns about 800 billion KRW in cash annually, and excluding that, adding the 2.5 trillion KRW net cash originally held in 2019 plus 1.3 trillion KRW from real estate funds and partial disposal of treasury stock, there should be 3.8 trillion KRW," adding, "Currently, only 700 billion KRW remains, so 3.1 trillion KRW has gone somewhere (invested), but profitability has rather worsened." He added, "Simply put, cash was spent like water," and "Considering the planned investment scale, by the end of this year, the company will shift to a net debt position for the first time since its founding."

Korea Zinc's debt scale increased 35 times from 41 billion KRW in 2019, when Chairman Choi took office as CEO, to 1.411 trillion KRW in the first half of this year. Considering that the debt scale was between 30 billion and 50 billion KRW annually from 2015 to 2019, this is a very sharp increase. The increase rate in debt scale since Chairman Choi took office in 2022 is notable. Compared to 2021, Korea Zinc's debt scale increased by 135% in 2022, surpassing 1 trillion KRW, and compared to 9.26 trillion KRW last year, the debt scale increased by 52% in the first half of this year.

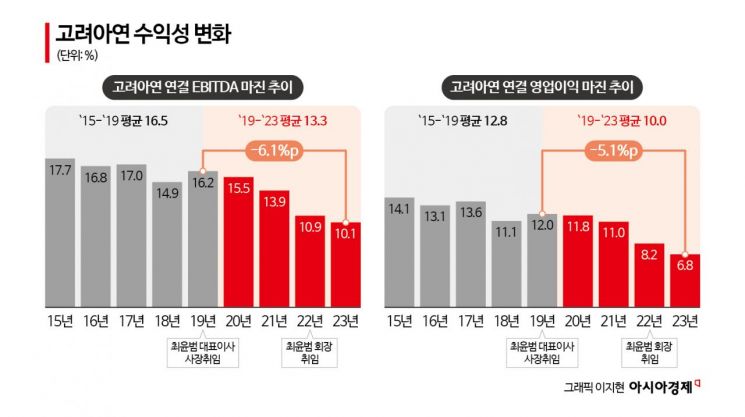

Korea Zinc's consolidated operating profit margin was 12% in 2019 but decreased by 5.2 percentage points to 6.8% in 2023. The average consolidated operating profit margin from 2015 to 2019 was 12.8%, but from 2019 to 2023, it dropped to 10%. Due to the deteriorated financial soundness of Korea Zinc, its net cash has been continuously decreasing, and it is expected to shift to a net debt situation by the end of this year.

Korea Zinc's net cash was 2.5 trillion KRW in 2019 but is expected to turn into net debt of minus 44 billion KRW by the end of this year. Net cash refers to the amount obtained by subtracting restricted cash and borrowings from total cash and cash equivalents, short-term financial institution deposits, and short-term investment assets. MBK said, "It is a point of concern for the market that a company like Korea Zinc, which belongs to an industry sensitive to international oil and raw material price fluctuations, has been pushed into a net debt situation within just a few years from a large net cash position."

560 Billion KRW Investment in a New PEF Involved in SM Stock Manipulation; Chairman Choi and PEF CEO Were Middle School Classmates

MBK Partners pointed to reckless investments as one of the reasons behind Korea Zinc's deteriorated financial soundness. They analyzed that unverified profitability investments or investments unrelated to the core business have continued under Chairman Choi's leadership, and the board of directors, which should have put a brake on this, did not function. This means that major corporate decisions are effectively controlled by Chairman Choi's will.

Specific examples cited include Ignio, a company in complete capital erosion invested at 200 times its sales; One Asia Partners, a private equity fund (PEF) whose CEO was indicted for SM Entertainment stock manipulation; and travel product platform company Tidesquare.

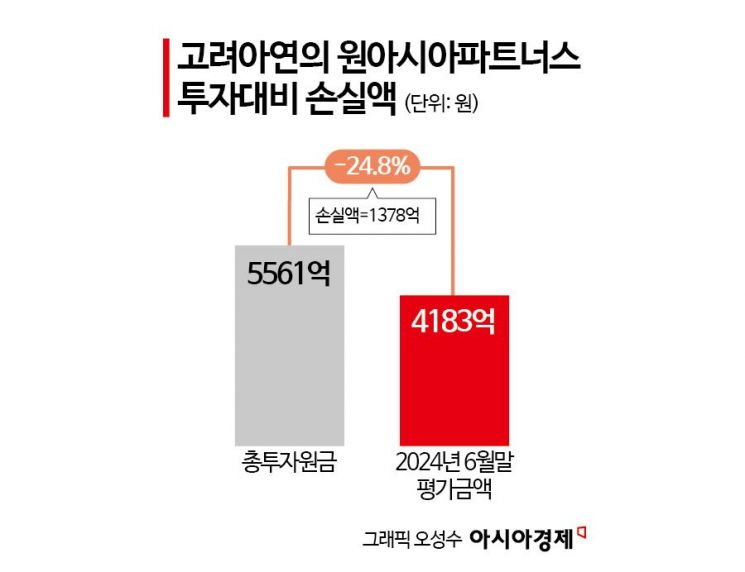

Vice Chairman Kim said that there was court testimony that Ji-mo, CEO of One Asia Partners, who was recently released on bail after being detained and tried, was a middle school classmate of Chairman Choi, raising suspicions between Chairman Choi and One Asia Partners. One Asia Partners was established after Chairman Choi took office in 2019, and Korea Zinc invested 99% in One Asia's Havana No.1 Fund, which was used for stock manipulation.

He said, "Korea Zinc's annual labor cost for all employees is 380 billion KRW, but they invested 560 billion KRW in One Asia Partners without ever obtaining board approval," adding, "It is presumed to have been processed by Chairman Choi's personal approval." He cited as evidence that internal reporting on Korea Zinc's funding related to One Asia Partners' acquisition of SM Entertainment shares was made on February 14, 2023, and just one day later, on February 15, a huge amount of 101.7 billion KRW was effectively solely invested in the Havana No.1 Fund.

Vice Chairman Kim said, "It is not right for a person with a 2.2% stake (Chairman Choi) to think of himself as the owner and believe he can decide on this property," adding, "After the public tender offer, we will enter the board, review the suspicions, and then decide our position."

He emphasized, "Except for Chairman Choi, the other employees have made tremendous efforts and possess enormous know-how to become a world-class number one company," adding, "We believe we must all go together. There will be no restructuring regarding employment, and we will strive to promote employment."

According to Korea Zinc's disclosure data, among 38 investment cases since 2019, 30 companies have recorded cumulative net losses from 2021 to the first half of 2024. The cumulative net loss amount of these companies reaches 529.7 billion KRW.

Judgment That Chairman Choi's Counter Tender Offer Is Practically 'Impossible'... Calculations and Analysis Completed on Institutional Investors' Ratios and Average Acquisition Prices

Regarding the public tender offer, MBK has already completed calculations and focused on objective persuasion targeting institutional investors. Korea Zinc's shareholding structure consists of Youngpoong Group and the Jang family with 33.1%, Chairman Choi Yoon-beom and his immediate family with 2.2%, the broader Choi family with 13.4%, Korea Zinc treasury stock with 2.4%, and other shareholders with 48.8%. Among other shareholders, 97.7% are classified as institutional investors and other corporations. Excluding strategic alliance shares such as Hanwha Group (7.8%), Hyundai Motor (5.0%), LG Chem (1.9%), and Trilipigura (1.5%), about 31.8% remains. Additionally, there are the National Pension Service (7.8%) and individual shareholders (domestic 2.2%, foreign 0.1%). Vice Chairman Kim said, "Even if strategic alliances say they won't sell shares, the remaining shares amount to about 35%, and we are conducting a public tender offer for at least 7% of these, which is a sufficiently feasible volume," adding, "There are almost no individual investors, and 97.7% are long-term institutional investors. According to our findings, the average acquisition price of institutions is below 450,000 KRW. If they realize profits at half or a quarter of the 660,000 KRW we offer and reinvest, that would be fine."

Regarding the possibility of Chairman Choi's counter tender offer, MBK analyzed that while it is not theoretically impossible, the likelihood of realization is very low. Vice Chairman Kim said, "In the SM Entertainment case, those who participated in the tender offer were all sued and are on trial," adding, "Without a legitimate business reason, one should not engage in a tender offer." He said, "To conduct a counter tender offer, the price and volume must be ahead of ours. We are conducting a tender offer worth up to 2 trillion KRW, so it's a probability game," adding, "The volume must be larger than our 15.9%, and the price must be higher than 660,000 KRW. It's a game involving trillion KRW-level funds." He added, "Looking at past stock prices hovering around 500,000 KRW, as you saw with financial soundness, the stock price will likely revert after the tender offer ends, so how will they bear losses of several hundred billion KRW from a counter tender offer, and whether there will be a board to support such a tender offer is questionable." Furthermore, he said, "Our tender offer is not starting from 0% shares but that the largest shareholder intends to secure an additional 7%, so it is very difficult to secure shares exceeding the largest shareholder's stake through a counter tender offer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.