Short-term Weakness in Tech Stocks During Holidays

Positive for Market in Mid to Long Term

Key to Stabilizing at 2650~2660 Range

Was it because it was a fully anticipated event?

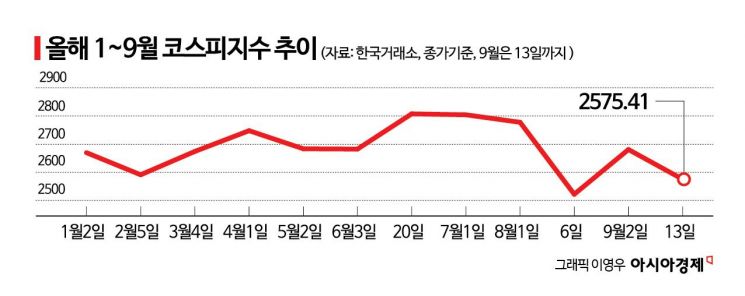

Despite the news of the U.S. big cut (0.5% interest rate cut), on the 19th, the KOSPI showed a lukewarm response, fluctuating around the 2570 level. Due to the impact of a target price downgrade report issued by Morgan Stanley the previous day, SK Hynix fell more than 7%, and concerns over earnings grew mainly among large semiconductor stocks, leading to increased selling pressure primarily from foreign investors. Experts forecast that the big cut will create a favorable environment for the market in the mid to long term, but they advise monitoring the possibility of a U.S. economic recession and watching the direction of the KOSPI.

As of 9:41 a.m. on the 19th, the KOSPI recorded 2567.86, down 8.27 points (0.31%) from the previous trading day. The KOSPI started higher on expectations from the U.S. interest rate cut but extended its losses, falling to the 2560 level. At the same time, the KOSDAQ index rose 5.32 points (0.73%) to 738.53. This is interpreted as a result of declines in Samsung Electronics and SK Hynix, which have a large market capitalization weight in the domestic stock market. In particular, SK Hynix fell more than 7%, breaking below the 150,000 KRW level.

The market did not take the interest rate cut decision, the first in 4 years and 6 months, as positive news because of concerns that the Fed’s big cut decision might be due to an economic recession. Also, the fact that the big cut was an event fully anticipated by the market is another reason for the domestic stock market’s weakness.

Lee Kyung-min, a researcher at Daishin Securities, said, "Since entering the interest rate cut cycle, the key issue will be whether the current economic situation moves toward a recession or a soft landing." He added, "At this point, the possibility of a soft landing is considered high, but given the distrust in the economy and the fear of recession, time is needed to verify the U.S. economy." He further predicted, "As the U.S. economy’s soft landing becomes visible through economic indicators in October and November, global stock markets and risky assets will resume their upward trend."

However, experts expect this big cut to have a positive effect on the domestic stock market in the mid to long term. Han Ji-young, a researcher at Kiwoom Securities, analyzed, "The weaker the dollar shows, the more it can reduce the risk of capital outflows from emerging markets, which is expected to create a favorable environment across emerging market stock markets, including Korea."

Kim Byung-yeon, a researcher at NH Investment & Securities, said, "During the holiday period, some large U.S. tech stocks such as Apple and Nvidia experienced profit-taking selling, leading to weak stock prices, so it is necessary to keep in mind the possibility that domestic tech stocks may continue a short-term weak trend." However, he added, "Since concerns about a U.S. economic recession are easing, the downward trend in stock prices is unlikely to continue."

There was also a forecast that the KOSPI would attempt a rebound. Researcher Lee Kyung-min said, "After the long Chuseok holiday, attempts to rebound in the KOSPI will continue." He added, "The key is whether it can break through and settle above the 2650 to 2660 level. If successful, a box range fluctuation is possible, but if it reverses downward due to resistance, there is also the possibility of securing support below the September low of 2490."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.