Q2 Overseas Direct Investment Trends

Negative Flow Continues Since the Beginning of the Year

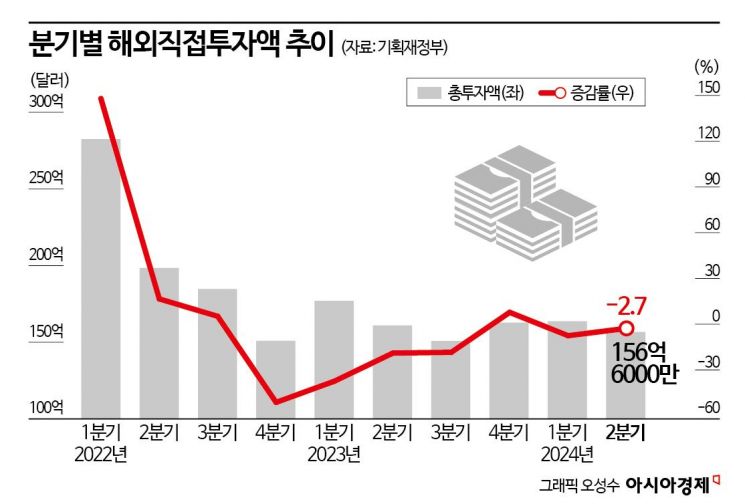

Overseas direct investment (ODI) in the second quarter recorded $15.66 billion, down 2.7% from the same period last year. After experiencing a negative trend since the fourth quarter of 2022, it seemed to rebound in the fourth quarter of last year but showed negative growth for two consecutive quarters this year. This decline is attributed to weakened investment sentiment due to uncertainties in global economic recovery and prolonged high interest rates.

According to the "2024 Q2 Overseas Direct Investment Trends" released by the Ministry of Economy and Finance on the 13th, the total ODI amount in the second quarter was $15.66 billion, a 2.7% decrease compared to the same quarter last year. Net investment, which subtracts recovery amounts such as equity sales and liquidation from the total investment, also fell 6.1% year-on-year to $12.33 billion.

The downturn in ODI began in the fourth quarter of 2022. In that quarter, total investment was $15.1 billion, down 51.2% from the same period the previous year. Subsequently, the first (-37.3%), second (-18.9%), and third (-18.4%) quarters of last year each showed double-digit declines. Although there was a brief rebound in the fourth quarter (7.8%), the negative trend resumed from the first quarter of this year (-7.5%).

For the second quarter, although the decline narrowed compared to the first quarter, total investment remained in the $15 billion range. The Ministry of Economy and Finance evaluated, "Due to uncertainties in global economic recovery, prolonged high interest rates, and global conflicts, overall investment sentiment remains subdued, resulting in a slow recovery."

By industry, the largest investment amounts were in financial and insurance services ($5.33 billion), manufacturing ($3.61 billion), mining ($1.6 billion), and information and communication ($1.32 billion). While financial and insurance services and manufacturing decreased by 17.4% and 10.5% respectively compared to the same period last year, mining and information and communication increased by 42.9% and 41.9% respectively.

By region, North America ($7 billion), Asia ($3.3 billion), and Europe ($2.1 billion) accounted for the largest shares, but investment amounts decreased by 8.5%, 6.1%, and 11.5% respectively compared to the same period last year. Conversely, Latin America ($2.07 billion), Oceania ($350 million), Africa ($100 million), and the Middle East ($40 million) saw increases in investment.

The Ministry of Economy and Finance explained, "Innovative industry investments such as robotics, mobility, and secondary batteries continue mainly in the North American region," and "Mining shows an increase in investment compared to the same period last year due to rising demand for a wide range of resources."

By country, the United States ($5.96 billion), Cayman Islands ($1.11 billion), and Canada ($1.04 billion) were the top investment destinations. However, investment amounts in all these countries decreased compared to the same period last year.

The Ministry of Economy and Finance stated, "Amid rising geopolitical and geoeconomic risks in the international community, we plan to strengthen communication and cooperation with major investment destination countries in various ways to ensure that Korean companies operating overseas can conduct their business activities stably."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.