9.44 Million Elderly Aged 65 and Over Last Year... 18.2% of Total Population

Expected to Surpass 10 Million Next Year, Entering Super-Aged Society

With the entry into a super-aged society and the increase in single-person households, the need for elderly individuals to prepare for their own long-term care in old age is growing. Many consumers are looking for insurance products to reduce the burden of dementia management costs and long-term care expenses. Dementia care insurance and insurance for those with pre-existing conditions can become significant assets in preparing for the impending old age.

According to Statistics Korea on the 16th, as of last year, the population aged 65 and over was 9.44 million, accounting for 18.2% of the total population. Next year, it is expected to exceed 10 million, entering a super-aged society where the elderly population accounts for more than 20%. As of last year, the domestic aging index was 165.4, and the old-age dependency ratio was 25.8, sharply increasing by 77.8% and 47.4%, respectively, compared to 93 and 17.5 in 2015. The aging index is the ratio of the elderly population to 100 youths (ages 0-14). The old-age dependency ratio is the ratio of the elderly population to 100 working-age people (ages 15-64).

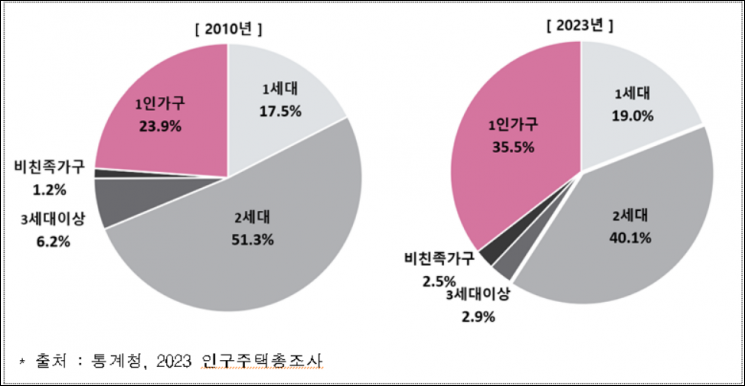

The composition of family generations is also changing. The proportion of single-person households surged from 23.9% in 2010 to 35.5% last year, while the proportion of households with two or more generations decreased from 57.5% in 2010 to 43% last year.

Due to rapid aging and changes in family composition, the demand for national-level old-age welfare is steadily increasing. According to the National Health Insurance Service, the number of recognized long-term care insurance beneficiaries for the elderly was about 1.1 million last year, with a ratio of 11.1% compared to the population aged 65 and over, a significant increase from 5.8% in 2012.

Rapid aging is also increasing the incidence of fatal diseases such as cancer. In 2021, the total number of cancer patients was 2.43 million, with 1.19 million aged 65 and over, meaning one in seven elderly people had cancer. It is estimated that the probability of developing cancer by the expected lifespan (83.6 years) is 38.1%.

However, recent advances in medical technology and increased health screening rates have continuously improved cancer survival rates. As of 2021, the 5-year relative survival rate for cancer patients diagnosed in the recent five years (2017?2021) was 72.1%, an increase of 6.6 percentage points compared to about 10 years ago (65.5% for 2006?2010). Compared to about 20 years ago (45.2% for 1996?2000), it increased by 26.9 percentage points. Nevertheless, patients still face burdens from continuous regular check-ups and additional surgery costs due to recurrence and metastasis.

Dementia is also a disease that is hard to avoid in old age. According to statistics from the Central Dementia Center of the National Medical Center, among 9.46 million elderly people aged 65 and over last year, about 984,000 (10.4%) were dementia patients. It is expected to exceed 1.42 million (10.9%) by 2030 and 3.15 million (16.6%) by 2050. The annual management cost per dementia patient increased by 19.9%, from 18.51 million KRW in 2010 to about 22.2 million KRW in 2022. Since the average monthly income of elderly couple households is lower than that of general households, the relative economic burden is expected to be even greater.

To prepare for this situation, life insurance companies currently offer various dementia and long-term care insurance products as well as insurance for those with pre-existing conditions. The features of these products include coverage by dementia stage, support for care and living expenses, reduction of premium burdens, operation of dementia prevention and care programs, and various special riders.

Coverage by dementia stage and support for care and living expenses provide broad coverage from mild dementia, which has a high incidence rate, to severe dementia. They also support care and living expenses caused by diseases such as dementia and accidents. Premium burden reduction products offer services such as waiving premium payments upon diagnosis of severe dementia or lowering consumer premium burdens through low-surrender-value refund-type products. Dementia prevention and care programs provide dementia care services differentiated before and after dementia onset or offer dementia prevention services through partnerships with digital therapeutics developers. Additionally, some products refund the main contract premiums already paid upon diagnosis of specific diseases or severe dementia, strengthen coverage related to long-term care, and expand coverage through special riders for severe Alzheimer's, Parkinson's disease, and others.

An official from the Life Insurance Association said, "Dementia care insurance and insurance for those with pre-existing conditions can be effective means to prepare for a super-aged society," adding, "It is important for consumers to compare and select products suitable for their circumstances to reduce the economic burden in old age."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)