Domestic Market 5-Year Average Annual Growth of 7.6%

Zero Carbonated Drinks Lead Market Growth

Zero Cola Achieves 87.3% High Growth Over 5 Years

Zero carbonated beverages are leading the growth of the domestic carbonated drink market by captivating consumers' tastes with improved flavor and quality.

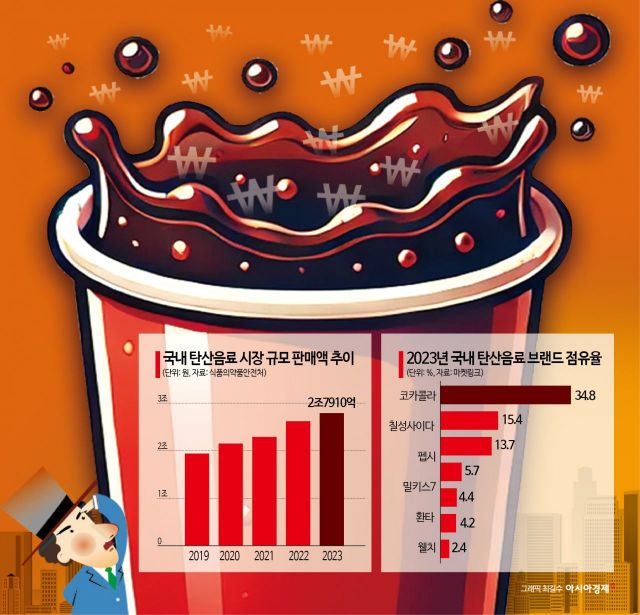

According to the Ministry of Food and Drug Safety on the 20th, the sales of the domestic carbonated beverage market last year amounted to 2.791 trillion KRW, marking a 6.3% increase from 2.626 trillion KRW the previous year. The domestic carbonated beverage market, which was around 1.94 trillion KRW in 2019, surpassed the 2 trillion KRW mark in 2020 and has steadily expanded with a compound annual growth rate (CAGR) of 7.6% up to last year.

The item driving the growth of the domestic carbonated beverage market is the rapidly expanding zero carbonated beverages. As the 'Healthy Pleasure' culture, which pursues health in an enjoyable way, has become mainstream, the number of consumers seeking zero beverages has increased. Domestic beverage manufacturers are leading market growth by improving the taste and quality of existing zero carbonated beverages or continuously launching various new products to meet this consumer demand. Zero beverages are drinks with no calories and no sugar content. According to the Ministry of Food and Drug Safety, beverages with less than 4 kcal per 100 ml can be labeled as calorie-free (zero). If the sugar content is less than 0.5 g per 100 ml, they can be labeled as sugar-free (zero sugar).

In fact, consumers are rapidly switching from regular carbonated beverages to zero carbonated beverages. Looking at the substitution trend within cola and cider over the past five years from 2019 to last year, zero cola has shown a steep growth with a CAGR of 87.3%. Meanwhile, regular cola shrank by -2.4%. During the same period, zero cider also showed a high growth rate of 27.5%, although it did not reach the level of zero cola.

This trend is also clearly reflected in brand market shares. Based on retail sales last year, the domestic carbonated beverage market was led by 'Coca-Cola,' which accounted for 34.8% of the total market, followed by 'Chilsung Cider (15.4%),' 'Pepsi (13.7%),' and 'Milkis (5.7%).' However, in terms of market share compared to the same period last year, Milkis and Jinro Tonic Water showed remarkable growth rates of 40.8% and 95.0%, respectively. Milkis successfully launched the 'Milkis Zero' product in February last year, and thanks to the popularity of the zero product, interest expanded to the overall Milkis brand, resulting in additional sales growth even for the original product.

Recently, with advancements in technology using alternative sweeteners to create sweetness, zero carbonated beverages have been re-evaluated by consumers as drinks that capture both calories and taste. Zero carbonated beverages, which have low sugar content and thus less impact on health while allowing consumers to enjoy sweetness, are increasingly recognized as a better choice compared to regular carbonated or high-fructose beverages. Since foods typically consumed with carbonated drinks tend to be high in calories, drinking zero carbonated beverages can also be seen as a way to find psychological comfort.

As consumer interest and demand for zero carbonated beverages expand, not only are existing products being released in zero versions, but brands that had discontinued sales in the past are also being reintroduced with the zero label. Lotte Chilsung Beverage re-released 'Chilsung Cider Zero' in January 2021, which was originally launched in 2011 and discontinued in 2015. Toms, launched in 1978 and discontinued in the 2000s, was reborn as a zero product in April 2022. This month, Coca-Cola also introduced a zero-calorie version of Ambasa, which was first launched in Korea in 1984.

Although the number of health-conscious consumers has increased since the COVID-19 pandemic, carbonated beverage companies are taking this as an opportunity to explore various changes. An industry insider said, “As demand for carbonated beverages that are healthy and have added functionality increases, the growth of the low-sugar and sugar-free carbonated beverage market is noteworthy,” adding, “Functional carbonated beverages with added vitamins and probiotics are also expected to grow in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.