After US Presidential Debate Ends

Clean Energy Sector Soars in New York Stock Market with Sunrun and First Solar

Electric Vehicle Stocks Also Rise Together

But Tesla Gains Only 0.87%

Harris's November Election Win Probability Rises from 53% to 55%

[Image source=Yonhap News]

[Image source=Yonhap News]

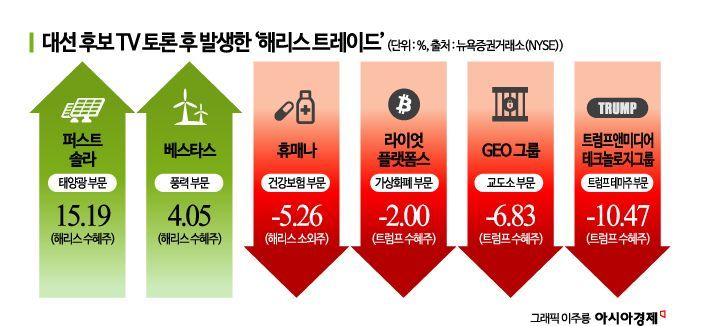

After the first presidential candidate TV debate on the 10th (local time) between U.S. Democratic presidential candidate Vice President Kamala Harris and Republican presidential candidate former President Donald Trump, a ‘Harris trade’ occurred in the financial markets. Unlike when the previous Democratic candidate, President Joe Biden, debated Trump on TV in June, this time the market gave Vice President Harris a higher score than former President Trump. The green energy sectors benefiting from Harris, such as electric vehicles, solar power, and wind power, experienced a rare upward trend.

‘Harris Trade’ Emerges Simultaneously After TV Debate

What caught attention in the New York Stock Exchange on the 11th, immediately after the presidential TV debate, was the clean energy sector. Solar companies Sunrun and First Solar saw their stock prices rise by 11.34% and 15.19%, respectively. Wind power company Vestas’ stock price increased by 4.05%. Since Vice President Harris emphasized that “as Vice President, $1 trillion was invested in clean energy over the past four years,” it is expected that this policy direction will continue if she is elected president.

The electric vehicle sector also rose. Small and medium electric vehicle companies Rivian and Lucid Dream increased by 5.29% and 12.75%, respectively. The largest U.S. electric vehicle company Tesla’s (0.87%) growth rate was slower, which analysts attribute to investors being cautious about buying due to Tesla CEO Elon Musk’s “close relationship” with former President Trump.

Representative Harris-ignored stocks such as health insurance companies Humana (-5.26%) and CVS Healthcare (-1.46%) declined. In the TV debate the day before, Vice President Harris strongly supported public health insurance programs like the so-called “Obamacare,” emphasizing that such programs complement private insurers who block people with pre-existing conditions from enrolling. Former President Trump announced that if re-elected, he would create an alternative private health insurance plan instead of Obamacare.

According to the U.S. political betting site ‘PredictIt,’ the probability of Vice President Harris winning this election rose from 53% to 55% immediately after the debate, while former President Trump’s probability dropped from 52% to 47% during the same period. In a post-debate poll conducted by polling firm YouGov with over 3,300 respondents, 43% believed Vice President Harris had a clearer plan, while only 32% thought so of former President Trump.

Decline in Trump Beneficiary Stocks

Stocks in sectors that had attracted attention for deregulation under former President Trump’s re-election scenario faced downward pressure. As Bitcoin, the largest cryptocurrency by market capitalization, weakened, stocks of Riot Platforms (a mining company) and Coinbase (an exchange) fell by 2% and 0.79%, respectively. Former President Trump had stated that he would dismiss Gary Gensler, chairman of the Securities and Exchange Commission (SEC) known as the “cryptocurrency grim reaper,” on his first day in office.

After showing weakness following the TV debate, former President Trump’s hardline stance on illegal immigration led to declines in stocks of private prison companies GEO Group and CoreCivic by 6.83% and 2.66%, respectively.

‘Trump Media & Technology Group,’ the parent company of former President Trump’s social networking service (SNS) Truth Social, plummeted 10.47%. The conservative-leaning video platform Rumble, also considered a Trump-themed stock, fell 4.07%.

Market Outlook After the Election

Experts have also offered market outlooks for the period following the November election based on the policies observed from the presidential candidates’ TV debate. Steve Chiavaron, senior portfolio manager at asset management firm Federated Hermes, observed, “If Vice President Harris is elected, the federal budget deficit is relatively less emphasized, which could support Treasury bond prices while also helping to boost the stock prices of large growth and technology companies.”

Regarding the scenario of former President Trump being elected, he analyzed, “Policies such as tax cuts and tariffs under America First could raise the stock prices of small-cap and cyclical stocks,” but also noted, “This could negatively impact bonds.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)