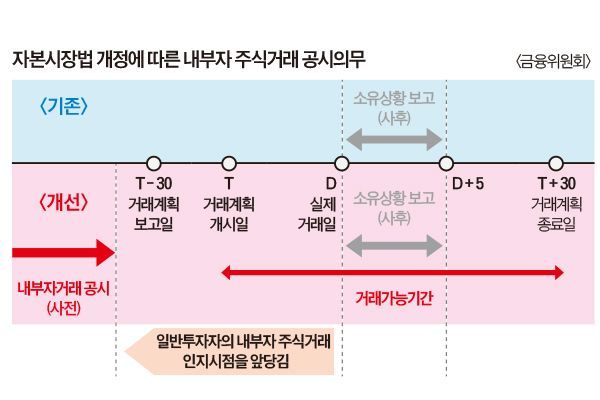

The Financial Services Commission (Chairman Kim Byung-hwan) has introduced a pre-disclosure system for insider trading to prevent a so-called "second KakaoPay eat-and-run incident," in which former KakaoPay CEO Ryu Young-jin and other executives made hundreds of billions of won in capital gains by selling stock options after the company’s listing, and to protect minority shareholders from suffering losses.

However, the financial investment industry has raised criticism that this excessively restricts individuals' freedom to dispose of their stocks, potentially infringing on property rights.

An industry insider said, "Except for institutional cases, insider stock trading by individuals is also a matter of personal wealth, so there is an aspect of property rights infringement."

Choi Joon-sun, Honorary Professor at Sungkyunkwan University Law School, pointed out, "Ultimately, the pre-disclosure system for insider trading acts as a kind of 'disposal prohibition law' that restricts major shareholders from disposing of their stocks," adding, "Rights such as profit rights or disposal rights related to property in the form of stocks are significantly restricted, which constitutes an infringement of property rights guaranteed by the Constitution."

In addition to property rights restrictions, there are opinions that it violates the constitutional principle of prohibition of excessiveness.

Professor Choi emphasized, "Sanctions under the Capital Markets Act are imposed when insider trading using undisclosed information, which is unfair trading, is confirmed," and added, "Stock trading itself cannot be illegal." He also said, "If major shareholders trade stocks without disclosure, imposing criminal penalties or fines solely for non-disclosure logically means considering non-disclosure itself as 'unfair trading.'"

While some predict that the stock market may somewhat contract due to the pre-disclosure system for insider trading, the government, aware of industry concerns, has taken the position that it is necessary to observe whether the market will actually shrink by setting exceptions within a reasonable scope.

The system exempts reporting obligations if both of the following two conditions are met: △ less than 1% of the total issued shares and △ less than 5 billion won. It also excludes transactions due to unavoidable reasons such as △ inheritance, △ stock dividends, △ stock transfers, and △ mergers and acquisitions from the pre-disclosure obligation. Furthermore, financial investors (FIs), including pension funds, were excluded from the pre-disclosure obligation due to the low likelihood of using undisclosed information.

A former chief judge turned lawyer, who requested anonymity, said, "From the perspective of selling stocks, there are unavoidable cases, so there may be grounds to see it as an infringement of property rights, but it is difficult to consider it unconstitutional," and added, "I believe the pre-disclosure system for insider trading in listed companies is a social demand for major shareholders to trade with more responsibility and caution."

Kim Ji-hyun, Legal Times Reporter

※This article is based on content supplied by Law Times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.