KPMG, ‘2024 KPMG ESG Due Diligence Survey Report’

59% “Willing to Pay Premium for Companies with High ESG Maturity”

45% “Have Considered Halting M&A Due to ESG Issues”

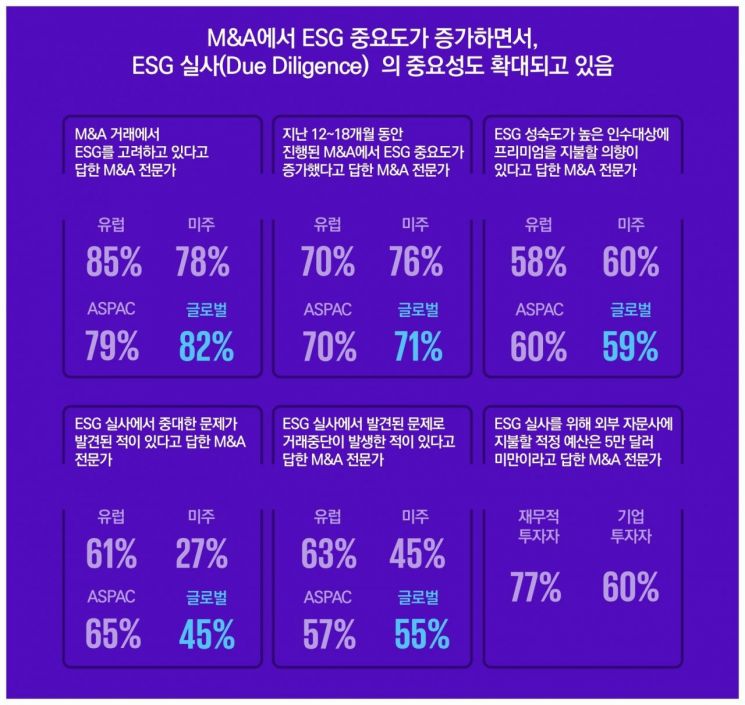

Eight out of ten global mergers and acquisitions (M&A) experts responded that they consider ESG (Environmental, Social, and Governance) factors during M&A transactions.

On the 11th, according to the ‘2024 KPMG ESG Due Diligence Survey’ published by the global accounting and consulting firm KPMG, 82% of global M&A experts said they consider ESG in transactions. Among the respondents, 58% judged that identifying sustainability-related risks and opportunities of acquisition targets at the early stages of transactions through ESG due diligence has financial value.

Fifty-nine percent of global M&A experts expressed willingness to pay a premium for acquisition targets with high ESG maturity. Forty-five percent said they have discovered significant issues during ESG due diligence that led them to consider halting an M&A transaction. Sixty-one percent of financial investors stated that they acquire companies with potential for ESG innovation even if their current ESG performance is low.

Global M&A experts identified ‘selecting meaningful and manageable ESG factors (49%)’, ‘difficulty in quantifying potential ESG factors (48%)’, and ‘lack of accurate data and policies (45%)’ as major challenges encountered during the ESG due diligence process.

Accordingly, 57% of respondents said they are willing to outsource ESG due diligence to external advisory firms. The largest proportion answered that the appropriate budget per project is less than $50,000 (approximately 67.23 million KRW). Although ESG due diligence significantly impacts the M&A process, the related budget is still considered insufficient. Sixty-one percent of Asia-Pacific (ASPAC) respondents preferred accounting firms as external advisors for ESG due diligence.

The report also presented four ‘Best Practices’ for creating ESG value. First, ESG issues should be considered when making investment decisions. For example, when investing in the construction of a new gas pipeline, not only the forecasted increase in natural gas demand but also ESG issues such as the contribution of natural gas to carbon emissions and potential leakage risks should be evaluated together.

A comprehensive standard for ESG performance is also necessary. ESG due diligence should be conducted as a standard practice before M&A transactions to ensure the reliability of quantitative ESG data of acquisition targets. Improvement measures should be taken based on ESG due diligence reports. ESG-related risks and opportunities should be identified at all stages of the M&A transaction, and improvement actions should be implemented based on the due diligence results.

Furthermore, government funding capabilities such as tax benefits and subsidies should be actively utilized. It is necessary to leverage government incentive programs for ESG value creation, such as the European Union (EU) Green Deal and the United States Inflation Reduction Act (IRA).

Jinman Kim, Vice President of the Financial Advisory Division at Samjong KPMG, said, “Going forward, domestic companies should recognize the importance of ESG due diligence and use it to explore ways to create corporate value.”

This survey involved 617 M&A experts from 35 countries participating online, and the report also included in-depth interviews with 50 investment experts. The regions consisted of Europe (42%), the Americas (39%), and Asia-Pacific (19%). The types of companies were listed companies (34%) and unlisted companies (61%). The types of investors were financial investors (44%), corporate investors (39%), and others (17%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.