After the Stock Market Plunge on the 5th Last Month, Focused Net Buying of Samsung Electronics and SK Hynix

Significant Losses for Encell, ABL Bio, and M83 in the KOSDAQ Market

In the domestic stock market, individual investors have recorded cumulative net purchases over the past month. After the KOSPI plunged nearly 9% on the 5th of last month, individuals began buying at lower prices. However, amid ongoing concerns about a global economic recession, individuals are wearing a frown over 'negative' returns.

According to the financial investment industry on the 10th, from the 6th of last month for one month, individuals recorded net purchases of 2.74 trillion KRW and 1.27 trillion KRW in the KOSPI and KOSDAQ markets, respectively. During the same period, foreigners and institutional investors showed net selling dominance of 2.83 trillion KRW and 290 billion KRW, respectively, in the KOSPI market.

On the 5th, the KOSPI and KOSDAQ indices fell by -8.77% and -11.3%, respectively. Starting from the next day, the 6th of last month, individuals continued 'buy' orders, seeing it as an opportunity to purchase blue-chip stocks at low prices.

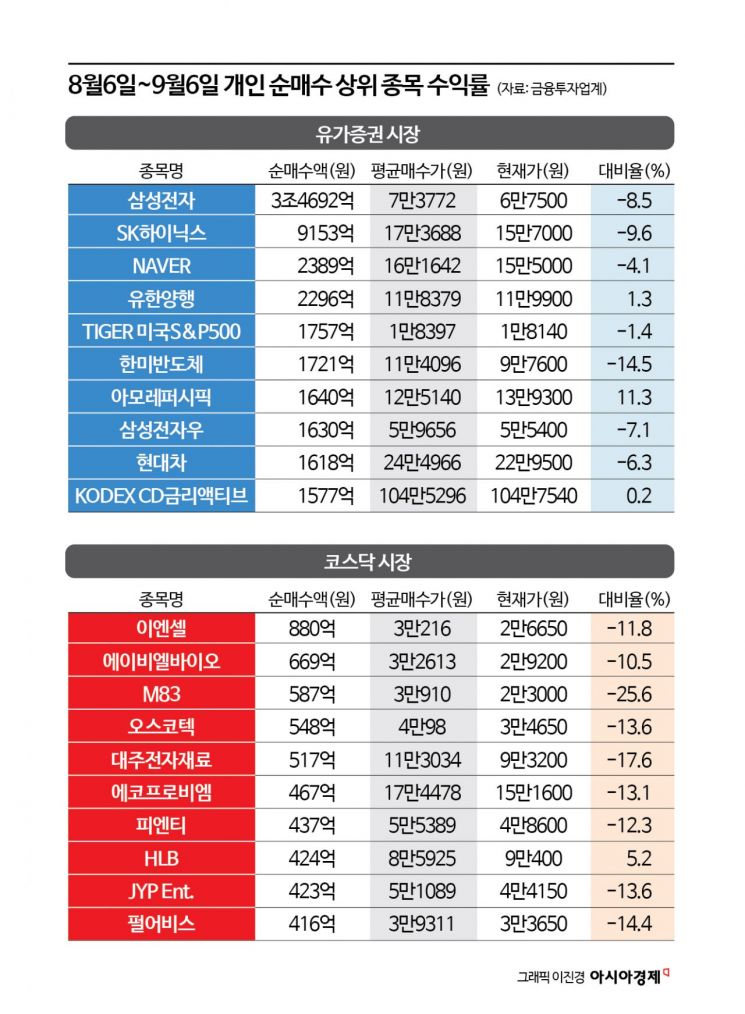

Individuals focused on buying Samsung Electronics shares in the KOSPI market. Over the past month, they accumulated Samsung Electronics stocks worth 3.47 trillion KRW. The average purchase price for individuals was 73,800 KRW, about 9% higher than the current price of 67,500 KRW. As foreigners and institutions recorded net sales of 2.18 trillion KRW and 1.5 trillion KRW respectively, Samsung Electronics’ stock price continued to decline. This selling trend appears to continue amid forecasts that the third-quarter earnings will fall short of market expectations. Seongyeon Seo, a researcher at DB Financial Investment, explained, "Samsung Electronics is estimated to achieve an operating profit of 11.1 trillion KRW in Q3," adding, "which is 19% below market expectations."

Individuals also purchased SK Hynix shares worth 920 billion KRW. They expected a rebound due to the excessive short-term drop, but SK Hynix’s stock price has struggled to recover. SK Hynix’s price fell to 151,600 KRW on the 5th of last month, then recovered to 202,500 KRW by the 20th. However, along with the decline in Nvidia’s stock price in the New York market, SK Hynix’s price dropped below 160,000 KRW. The average purchase price for individuals is 173,700 KRW, recording a loss rate close to -10%.

Among the top 10 individual net purchase stocks in the KOSPI market, few are showing positive returns compared to the market. The KOSPI fell 2.5% over the past month. Stocks like Yuhan Corporation and Amorepacific currently have prices exceeding the average purchase price of individuals.

The hardship of individuals continues in the KOSDAQ market as well. They focused on buying stocks such as Encell and ABL Bio but are recording losses exceeding -10%. Individuals who invested in M83, which was listed on the KOSDAQ market on the 22nd of last month, recorded an evaluation loss rate of -25.6%. This was affected by the large price fluctuations on the first day of listing. M83 was listed at a public offering price of 16,000 KRW, rose to 54,800 KRW on the first day, and closed at 22,300 KRW. Considering the average net purchase price of individuals is 30,910 KRW, it appears many individuals bought on the first day of listing and failed to cut losses. There were not many days when M83 traded above 30,000 KRW, including the first day of listing and the 2nd of this month.

Osscutec, Daewoo Electronics Materials, and EcoPro BM are also called 'ant graves.' Many individuals who bought these stocks are currently recording losses. For individuals’ low-price buying to succeed, a full-fledged rebound trend must continue, but market experts predict that volatility will persist for the time being.

Youngwon Lee, a researcher at Heungkuk Securities, said, "Stock prices fell sharply in early August and again in the first week of September," adding, "The market that plunged with concerns about a U.S. recession in early August is undergoing repeated adjustments for similar reasons before fully recovering."

Seungjin Shin, head of the investment information team at Samsung Securities, explained, "Since mid-July, when global stock market adjustments and U.S. recession concerns intensified, domestic stock market trading volume and foreign investor demand have decreased," adding, "With global economic uncertainty compounded by shallow demand, volatility in the domestic stock market is expanding further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)