PF Non-Performing Loans 'OEM Fund' Establishment and Operation Exposed

The Financial Supervisory Service (FSS) has uncovered so-called 'tricky sales' occurring during the cleanup of non-performing real estate project financing (PF) sites managed by the savings bank industry. The FSS plans to respond strictly to illegal and unfair practices and conduct additional inspections of similar cases.

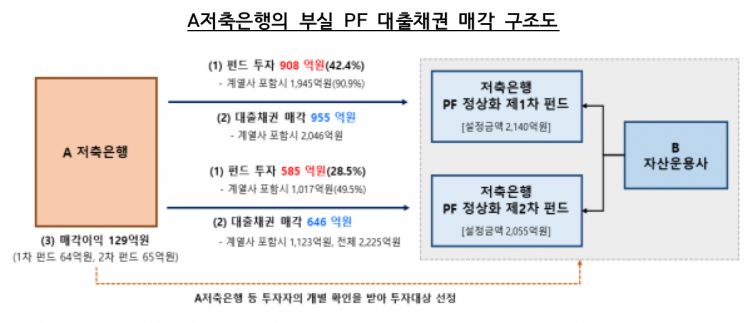

According to the FSS on the 9th, a special inspection of Savings Bank A and Asset Management Company B revealed irregularities in the sale of PF loan receivables. Savings Bank A invested 90.8 billion KRW in the first fund of Asset Management Company B in June, and including its affiliates, the total investment amounted to 194.5 billion KRW, accounting for 90.9% of the fund's total capital. Subsequently, the non-performing loan principal (108.1 billion KRW) was sold at 95.5 billion KRW after applying a 11.7% discount rate. This price was higher than the book value (loan principal minus allowance for loan losses), resulting in Savings Bank A recognizing a sales profit of 6.4 billion KRW. Including affiliates, the sales profit increased to 15.1 billion KRW.

Two months later, last month, Savings Bank A again sold non-performing sites to Asset Management Company B's fund. At that time, Savings Bank A had invested 58.5 billion KRW (including affiliates 101.7 billion KRW, 49.5%), and four other savings banks also participated in the investment. Subsequently, the non-performing loan was sold at 64.6 billion KRW after applying a 9.7% discount rate to the principal of 71.5 billion KRW, and a sales profit of 6.5 billion KRW (including affiliates 7.9 billion KRW) was recognized. Among the other four savings banks, three recognized sales profits ranging from 0.5 billion to 2.5 billion KRW, indicating that the savings bank industry set excessively high prices during the cleanup of non-performing loans, according to the FSS.

The FSS also pointed out that the investment ratio of each savings bank in the fund exactly matched the ratio of PF loan receivables sold. Excluding senior external investors, Savings Bank A's investment in the first fund was 90.8 billion KRW, accounting for 46.7%, and the non-performing loans sold to the fund amounted to 95.5 billion KRW, also 46.7%. In the second fund, both investment and sales proportions were 33.3% (58.5 billion KRW and 64.6 billion KRW, respectively).

Accordingly, the FSS criticized Savings Bank A for selling PF non-performing loans to the fund it invested in and recognizing sales profits, thereby deferring losses. Although PF loan receivables were replaced by fund beneficiary certificates upon sale, the effect was essentially the same as holding the PF loan receivables. Savings Bank A improperly overstated net income by reversing 12.9 billion KRW of allowance for loan losses through sales profits and was also criticized for evaluating the delinquency rate approximately 2.6 percentage points better than actual.

The FSS also pointed out that Asset Management Company B set up and operated an illegal 'Original Equipment Manufacturer (OEM) fund' under the Capital Markets Act. The company finalized the PF loan receivables to be invested by individually confirming with the savings banks investing in the fund and purchased non-performing loans at high prices by using appraisal values from up to four years prior at the time of loan origination without conducting separate due diligence. An OEM fund refers to a fund created by an asset management company at the request of financial institutions or fund distributors.

The FSS plans to instruct Savings Bank A to recognize impairment losses on securities for the reversal of allowance for loan losses and remove the illusionary effects on delinquency and non-performing loan ratios caused by the tricky sales. It also stated that it will take strict measures according to relevant laws and procedures against illegal and unfair acts such as Asset Management Company B's operation of the OEM fund. Furthermore, the FSS will continue market surveillance to prevent financial companies from deferring the cleanup of non-performing loans using OEM funds and will actively respond to normalize PF by conducting additional inspections if necessary.

Previously, concerns were raised in the savings bank industry that the real estate PF normalization fund might be misused as a temporary parking tool for savings banks rather than for the purpose of cleaning up non-performing loans. This was because some savings banks that contributed to the fund sold non-performing loans they held in proportion to their investment amounts. An FSS official said, "As concerns about the possibility of deferring losses through the formation of private equity funds (PEFs) during the recent cleanup of PF non-performing loans by savings banks continued to be raised, we conducted a special inspection of Savings Bank A, which had many non-performing loan sales, and Asset Management Company B, the related fund operator."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)