July Sales Soar Year-on-Year

Number of Stores Increased from 166 Last Year to 298 This Year

Amid a deepening slump in the dining-out market due to the recent economic downturn and high inflation, the yogurt ice cream franchise 'Yoajeong (The Standard of Yogurt Ice Cream)' is enjoying a boom on its own, rapidly increasing the number of stores and sales volume.

According to purchase big data from market research firm Macromill Embrain on the 10th, Yoajeong's purchase amount in July recorded a growth rate of 1569.9% compared to the previous month (June). Yoajeong began its growth momentum in February this year, when its sales increased by 272.4% from the previous month to 1.12 billion KRW, and has continued a sharp upward trend throughout the year.

Yoajeong is a delivery-specialized ice cream franchise established by Trillians in 2020. The first store was launched in Seongsu-dong in 2021 as a delivery-only store, and from 2022, offline stores called 'Cafe Yoajeong' have also opened in Seoul’s Seongsu-dong, Ewha, Euljiro, and Mangwon areas.

Model Joo Woo-jae is trying Yoajeong in the content and recommending a 'perfect combination' recipe. [Image source=YouTube channel 'Oneul-ui Joo Woo-jae' capture]

Model Joo Woo-jae is trying Yoajeong in the content and recommending a 'perfect combination' recipe. [Image source=YouTube channel 'Oneul-ui Joo Woo-jae' capture]

Yoajeong’s recent popularity is attributed mainly to its customizable topping options that reflect individual preferences and influencer marketing spread through social networking services (SNS). In fact, recipes such as ‘Yoajeong Pick’ and ‘Yoajeong Honey Combination’ have been shared widely on SNS, making certifying ‘My Own Yoajeong’ a kind of play culture. Riding on this recent popularity, convenience store GS25 also collaborated with Yoajeong to launch the 'Yoajeong Honey Yogurt Choco Ball Parfait,' which has received a hot response.

On the other hand, the momentum of Tanghulu, which was popular mainly among the 10-20 age group, has significantly declined. The representative Tanghulu franchise brand ‘Wangga Tanghulu’ showed a steep increase from early last year, recording sales of 16.37 billion KRW in the second half of the year. However, this year it has shown a sharp decline, with purchase amounts shrinking to 410 million KRW in July. When converted to average monthly sales, this is about an 85% decrease compared to the previous year.

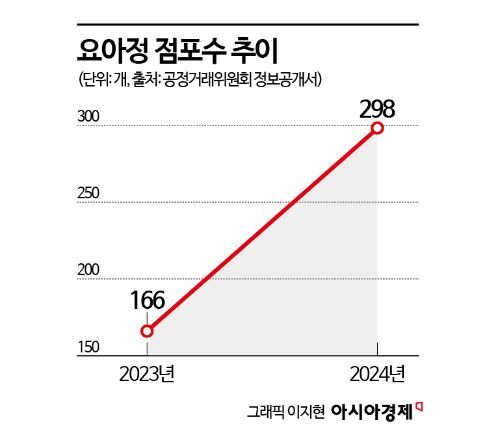

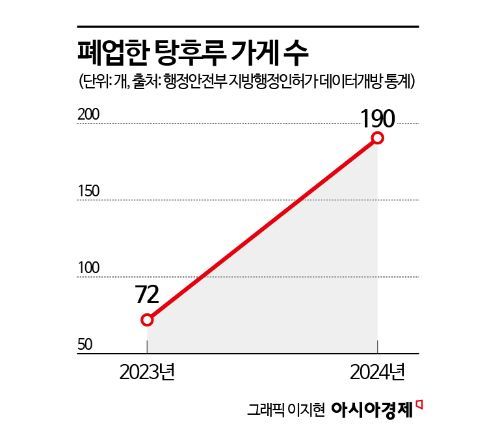

A similar trend can be seen in the startup market. According to the Ministry of the Interior and Safety’s local administrative permit data, the number of Tanghulu stores that closed this year was 190, more than double the 72 closures last year. Conversely, according to the Fair Trade Commission’s disclosure report, the number of Yoajeong stores surged from 166 last year to 298 this year.

Recently, Samhwa Foods’ acquisition of Yoajeong is also interpreted as a decision closely watching these trend changes. In July, Samhwa Foods, which operates the chicken brand 'Arachi,' acquired 100% of Yoajeong’s shares from the existing operator Trillians for 40 billion KRW. However, as seen in the fleeting popularity of Tanghulu, concerns are growing that Yoajeong’s popularity may quickly fade as the trend cycle of specific desserts is becoming shorter.

Professor Kim Si-wol of Konkuk University’s Department of Consumer Studies said, “Yoajeong offers a wide range of choices tailored to individual tastes, so it is likely to sustain consumption across a broader age group than traditional Tanghulu. However, the relatively high price point could act as a barrier to expansion.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)