Woori Financial, Dongyang Life 'Undervalued' ABL Life 'Overvalued' Controversy

Dongyang Life Stock Plummets After Acquisition Announcement... Concerns Over Additional Losses in Merger

Attempt to Defend Capital Ratio Through Bargain Purchase Gains

Concerns and criticisms are growing inside and outside the financial industry regarding Woori Financial Group's planned acquisition of Dongyang Life Insurance and ABL Life Insurance. There are already worries about potential losses to minority shareholders due to improper valuation of the companies during the package acquisition process. Shareholder damages could increase further during the subsequent merger process, and labor-management conflicts may also arise. Financial authorities have announced a high-intensity regular inspection of Woori Financial.

Woori Financial's Acquisition Price for Dongyang and ABL Life Insurance: KRW 1.5494 Trillion... Was It Truly Appropriate?

On the 28th of last month, Woori Financial announced it would acquire a 75.34% stake in Dongyang Life Insurance for KRW 1.284 trillion and 100% of ABL Life Insurance for KRW 265.4 billion. After signing a memorandum of understanding (MOU) regarding the package deal in June, about seven weeks of due diligence were conducted, and a stock purchase agreement (SPA) was signed without major issues. Woori Financial emphasized that "the price-to-book ratios (PBR) for Dongyang Life and ABL Life Insurance at the due diligence reference date of the end of March were 0.65 and 0.30, respectively." Simply put, this means the companies were purchased at a discount corresponding to those ratios.

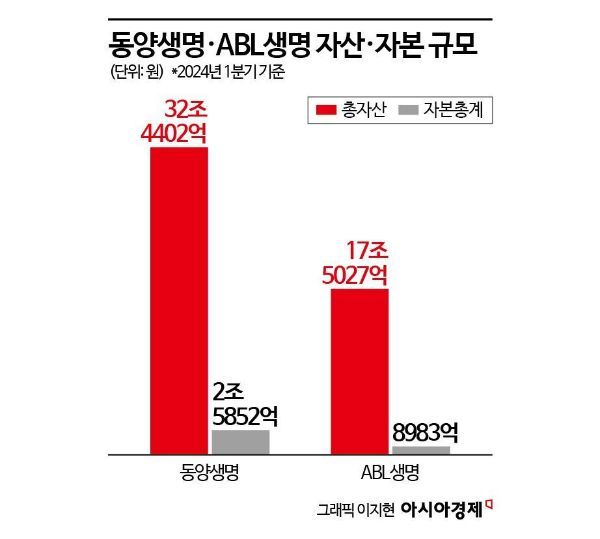

How did Woori Financial value the two life insurers? Based on the acquisition prices for the stakes, the 100% equity value of Dongyang Life is KRW 1.7042 trillion, and ABL Life is KRW 265.4 billion. Applying the respective PBRs of 0.65 and 0.30 to calculate the book value results in KRW 2.6219 trillion for Dongyang Life and KRW 884.5 billion for ABL Life. These figures are similar to the total equity capital on the financial statements as of the end of March, which were KRW 2.5852 trillion and KRW 898.3 billion for Dongyang Life and ABL Life, respectively. A financial investment industry insider explained, "The fact that the total equity capital from the existing financial statements and the book value derived from due diligence are not significantly different suggests that the seller’s financial statements were accepted as is without re-examination to expedite the transaction," adding, "Instead, reflecting the seller’s urgent need to sell, the actual transaction price was likely lowered."

Multilateral Insurance, the largest shareholder of Dongyang and ABL Life, has invested about KRW 2 trillion in the two companies to date. Multilateral Insurance (then Anbang Insurance) acquired Dongyang Life in 2015 for KRW 1.16 trillion and subsequently participated in a paid-in capital increase of KRW 528 billion. ABL Life was purchased for KRW 3.5 billion, with an additional KRW 308 billion invested through two paid-in capital increases. Comparing this simply to Woori Financial’s acquisition cost of KRW 1.5494 trillion for the two insurers, Multilateral Insurance appears to have incurred a loss of around KRW 450 billion (excluding dividends) on the sale.

Industry consensus is that ABL Life was overvalued while Dongyang Life was undervalued in this deal. ABL Life’s solvency ratio (K-ICS) for the first quarter of this year was 114.4%, far below the financial authorities’ recommended level of 150%. K-ICS is a soundness indicator showing an insurer’s ability to pay claims. The industry consensus is that ABL Life would need an additional investment of about KRW 500 billion to meet the 150% K-ICS target. ABL Life has also sold many high-interest savings-type insurance products in the past, resulting in significant financial burdens due to negative interest margins. An insurance industry official said, "Considering ABL Life’s situation, Woori Financial should have been paid to take it over," adding, "Since the price for the problematic ABL Life was set high, there was likely a behind-the-scenes agreement to discount Dongyang Life accordingly."

Dongyang Life 'Undervalued' and ABL Life 'Overvalued'... Minority Shareholders Face Growing Losses

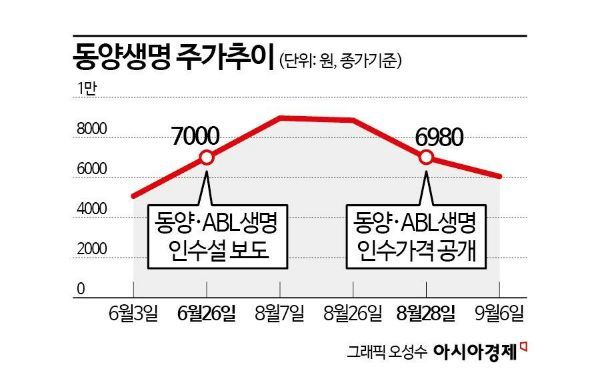

The problem is that minority shareholders of Dongyang Life are suffering losses due to Woori Financial’s transaction method. Dongyang Life is a KOSPI-listed company, and about 25% of shares excluding those acquired by Woori Financial are held by minority shareholders. Dongyang Life’s stock price, which was KRW 5,000 on May 31, surged to an intraday high of KRW 8,900 on August 27 amid rumors of Woori Financial’s acquisition. However, the next day, when Woori Financial disclosed the acquisition price, the stock plummeted to KRW 6,980. The price continued to decline steadily, falling to KRW 6,050 by the close on the 6th of this month. Minority shareholders complain that the share price dropped because the equity value set by Woori Financial was unreasonable, considering Dongyang Life’s asset value and management premium as the sixth-largest domestic life insurer by premium income.

Minority shareholder losses could worsen during the future merger of Dongyang and ABL Life. The industry currently views the merger as highly likely because it could resolve ABL Life’s low K-ICS issue and streamline overlapping businesses. There are two main merger methods: Woori Financial could buy out all minority shareholders of Dongyang Life to make it a wholly owned subsidiary and then merge it with ABL Life, or merge the two companies as they are and distribute shares of the merged entity to minority shareholders. If the merger proceeds, the undervalued corporate value and lowered stock price of Dongyang Life will inevitably be applied, resulting in losses for minority shareholders regardless of the merger method.

The merger could also trigger labor-management conflicts. Currently, employees inside Dongyang and ABL Life are anxious about whether employment succession will be properly maintained after the merger. The labor unions of both companies recently demanded that Woori Financial maintain employment relationships for employees after the acquisition and reach an agreement with the unions regarding personnel and organizational restructuring during the merger. They have stated they will take action if these demands are not met. A Dongyang Life union official said, "Although employment succession is promised outwardly, many employees worry that executive positions will be eliminated under the pretext of organizational restructuring and that a large number of parachute appointments from Woori Financial Holdings will be made," adding, "In ABL Life’s case, I have heard that some employees are already unable to take vacations for fear of being targeted by Woori Financial."

Did They Aim to Defend Capital Ratios Through Bargain Purchase Gains? Financial Authorities to Scrutinize Life Insurance Acquisition Risks

Some speculate that Woori Financial acquired Dongyang and ABL Life as a package to gain approximately KRW 800 billion in bargain purchase gains. Bargain purchase gain is an accounting profit that occurs when the acquisition price paid is lower than the net assets of the acquired company.

Bargain purchase gains are important because they can boost Woori Financial’s Common Equity Tier 1 (CET1) capital ratio. CET1 is a key indicator of a financial institution’s loss absorption capacity during crises, as defined by the Bank for International Settlements (BIS). Typically, CET1 decreases after a corporate acquisition, but if the acquisition is made at a low price in terms of PBR, as in Woori Financial’s case, the decline in CET1 is significantly reduced.

As of the first half of this year, Woori Financial’s CET1 ratio is 12.03%, the lowest among the five major financial holding companies. Domestic financial holding companies aim to maintain CET1 above 13%. When the ratio exceeds a certain threshold (usually 13-13.5%), they increase dividends and repurchase shares as part of shareholder return policies. During the July 25 conference call announcing first-half results, when due diligence on Dongyang and ABL Life was underway, Woori Financial set a CET1 target of at least 12.2% for this year. They also pledged to raise it to 12.5% by the end of 2025 and increase the shareholder return ratio to about 35%. At that time, Seongwook Lee, Woori Financial’s Chief Financial Officer (CFO), said, "We expect bargain purchase gains to occur upon acquiring the insurers," adding, "Bargain purchase gains help improve capital ratios."

Experts estimate that Woori Financial’s CET1 defense through bargain purchase gains is about 38 basis points (bp) (1 bp = 0.01 percentage points). Jo Ah-hae, a researcher at Meritz Securities, analyzed, "Considering Woori Financial’s impact from acquiring Dongyang and ABL Life (-46 bp) and bargain purchase gains (38 bp), the estimated CET1 decline is 8 bp," adding, "Assuming a 2% increase in Woori Financial’s profits and risk-weighted assets (RWA) in the second half, the year-end CET1 is estimated at 12.3%."

However, there is a possibility that Woori Financial may not fully reflect the bargain purchase gains. Approval from financial authorities is required to recognize bargain purchase gains in earnings, but the authorities’ view of Woori Financial has not been entirely favorable recently. Lee Bok-hyun, Governor of the Financial Supervisory Service (FSS), previously stated that "someone must be held accountable" regarding improper loans and delayed reporting related to former Woori Financial Chairman Sohn Tae-seung’s relatives at Woori Bank, targeting the current management. On the 4th, he also criticized Woori Financial’s life insurance acquisition, saying, "There was no communication with the authorities, and I am concerned whether acquisition risks were properly reflected." The FSS plans to advance the regular inspection of Woori Financial to October.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.