Domestic Demand Slows but Rapid Overseas Expansion

Shifted to High-Value Vehicles Like Electric Cars

"Precise Policies Needed to Support Domestic Electric Vehicle Industry"

Chinese electric vehicle (EV) companies are rapidly expanding into overseas markets by emphasizing support and price competitiveness. Voices are emerging that the domestic automotive industry must quickly enhance its EV competitiveness.

On the 8th, the Korea Automobile Mobility Industry Association (KAMA) released a report titled "Global Expansion of the Chinese Electric Vehicle Industry and Its Implications," which contains these details.

According to the report, in the first half of this year, Chinese automotive companies sold a total of 419,946 electric vehicles (including plug-in hybrid vehicles) in markets outside China. This represents a 33.9% increase compared to the same period last year, setting a new record for the first half of the year.

The report analyzed, "The Chinese automotive industry targeted emerging markets with relatively low trade barriers amid a slowdown in domestic demand and strengthened protectionism in the US and Europe," adding, "In particular, the recent export increase is largely due to the rapid growth of Chinese-made vehicle sales in the Russian market, from which major automakers have withdrawn."

In fact, the Chinese domestic automotive market peaked at 27.03 million units in 2018 and has remained at around 24 to 25 million units over the past five years since 2019. In contrast, exports surged more than fourfold during the same period, from 1.02 million units to 4.91 million units last year. The export ratio of Chinese companies in the first half of this year rose by 3.4 percentage points year-on-year to 16.3%.

Electric vehicles played a particularly significant role in this growth. Even in the stagnant domestic market, EV sales grew rapidly at an average annual rate of 61%, from 1.232 million units in 2019 to 8.278 million units last year. Export shipments of EVs also increased by 77.2% year-on-year to 1.203 million units last year. The share of EVs in total exports rose from 15.4% in 2021 to 24.5% last year.

The main export vehicles have also expanded from commercial vehicles to high value-added models such as sports utility vehicles (SUVs) and eco-friendly cars. Export destinations have shifted from countries like Iran, India, Vietnam, and Egypt in the mid-2010s to an increasing share of advanced countries such as Russia, Belgium, Australia, and the United Kingdom.

The report stated, "Chinese companies such as BYD, Geely, and Shanghai Automotive Industry Corporation (SAIC) are actively investing directly overseas not only through exports but also through local production, production and technology partnerships, based on their successful domestic market experience," adding, "In particular, to avoid tariffs, reduce logistics costs, and respond to strengthened protectionism in the US and the European Union (EU), they are increasing local production through methods such as establishing overseas factories, acquisitions, and joint ventures (JVs), making the market environment increasingly competitive."

The report cited the Chinese government's focused development of the new energy vehicle (eco-friendly vehicle) industry, along with a purchase subsidy system sustained for over 10 years, leadership in the supply chain of key EV materials, and securing price competitiveness as the secrets behind this competitiveness.

It emphasized that since Chinese EV companies are expected to actively target Korea as well, it is necessary for domestic companies to secure competitiveness. The analysis suggests expanding the EV ecosystem foundation that connects materials, batteries, and products, and calls for the government to establish precise policies. It also advised further enhancing EV competitiveness in emerging markets such as ASEAN and India.

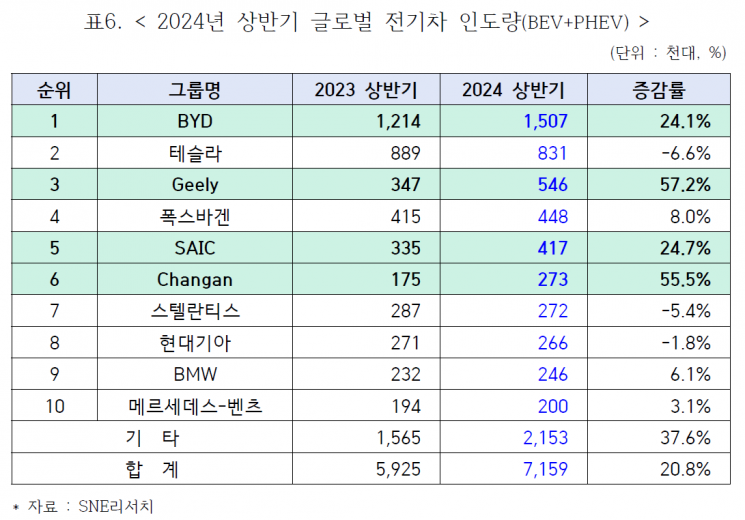

In fact, the recent growth of domestic companies in the global EV market has somewhat slowed. According to the report, the combined global (excluding China) EV sales of Hyundai Motor Company, Kia, and KG Mobility (KGM) in the first half of this year totaled 249,150 units, a 1.8% decrease compared to the same period last year.

Kang Nam-hoon, chairman of KAMA, said, "Although the EV market growth has recently slowed, EVs will become the mainstream in the future vehicle market," adding, "To secure leadership in the EV industry on the global stage, it is necessary to continuously support and foster the industry through national strategic technology research and development investment, expansion of EV subsidies, and workforce development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.