Plan to Raise 200 Billion Won Through Rights Offering

Facility Investment Related to Secondary Battery Material New Business

Recent Stock Market Volatility...Concerns Over Reduction in Fundraising Scale

EcoPro HN, a comprehensive environmental systems company, has embarked on large-scale fundraising to produce secondary battery materials. Starting from the fourth quarter of this year, it plans to produce prototypes such as Sagger, a container for cathode materials, and Dopant, an additive to enhance the energy density of cathode materials. However, due to the sluggish stock market, there is a high possibility that the new share issuance price will decrease, raising concerns about whether the fundraising can proceed smoothly.

According to the financial investment industry on the 9th, EcoPro HN will conduct a rights offering followed by a general public offering of forfeited shares, allocating 0.298 new shares per existing share. It will also issue 1,134,000 new shares to the employee stock ownership association. The company plans to raise a total of 200.2 billion KRW.

EcoPro HN produces cleanroom chemical filters and provides solutions for fine dust reduction, greenhouse gas reduction, and water treatment. The cleanroom chemical filters remove harmful gases generated inside cleanrooms during semiconductor and display manufacturing processes.

The fine dust reduction solution removes volatile organic compounds (VOCs), which are the causes of fine dust generated in industries such as heavy industry, automotive, and chemical sectors. The greenhouse gas reduction solution decomposes perfluorocompounds (PFCs) gases generated in the semiconductor and display industries. The company also provides various water treatment management solutions required in industrial sites, including supplying industrial water production facilities, configuring treatment processes tailored to the characteristics of industrial wastewater, and supplying treated water reuse systems.

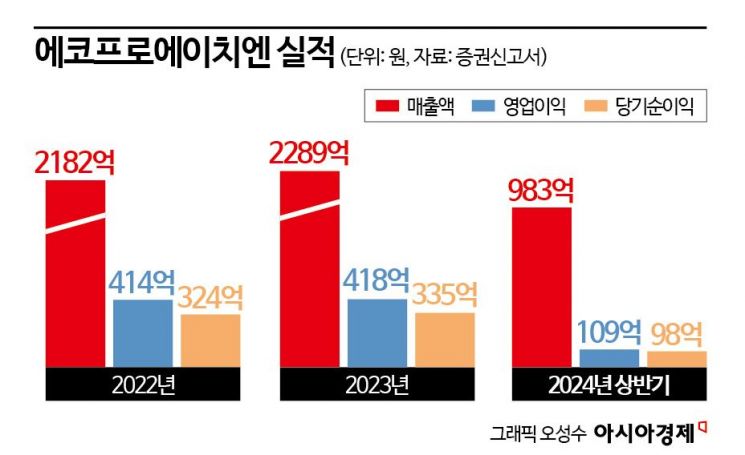

EcoPro HN achieved sales of 98.3 billion KRW and operating profit of 10.9 billion KRW in the first half of this year, down 15.2% and 52.8%, respectively, compared to the same period last year.

Sales in the fine dust reduction and greenhouse gas reduction solution sectors declined. This was affected by the downturn in the petrochemical industry and delays in new investments. Due to the recession in the upstream industries, EcoPro HN's order volume also decreased. As of the second quarter of this year, the average operating rate by product fell by 11 percentage points compared to last year.

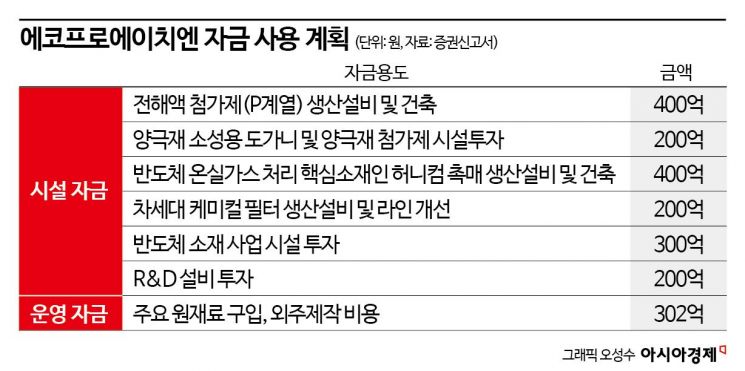

EcoPro HN has identified the secondary battery materials industry as a new growth engine and planned large-scale investments. The funds raised through new share issuance will be used for facility and operating capital. The company will invest 60 billion KRW in producing secondary battery materials. It will engage in technology development and product production related to electrolyte additives, Sagger, and Dopant.

EcoPro HN explained that it has been preparing the electrolyte additive business as a new business since 2021. The goal is to expand its business area by diversifying the types of electrolyte additives based on lithium from affiliated companies.Sagger and Dopant are closely related to the group's cathode material business. They plan to supply these to affiliated companies starting in 2025. EcoPro HN expects synergy effects by producing Sagger and Dopant and supplying them to affiliated companies.

The largest shareholder, EcoPro, will be allocated 1.43 million shares and plans to subscribe to 120% of the allocated amount.While this fundraising appears to be an unavoidable management decision to secure new growth engines, the problem lies in the recent stock market situation. Recently, volatility in the domestic stock market has increased, and the KOSDAQ index has continued to decline. Stock prices of secondary battery-related listed companies have also fallen sharply. There is a high possibility that the new share issuance price will decrease.

EcoPro HN's stock price is 38,650 KRW, about 9.5% higher than the expected new share issuance price of 35,300 KRW. Considering that a 20% discount rate is applied when calculating the first and second issuance prices, the new share issuance price may be lower than the expected price. If the stock price does not rebound, the scale of the capital increase is expected to decrease.

EcoPro HN plans to use its own funds and borrowings from financial institutions as resources if the amount raised falls short of the plan due to the new share issuance price being lower than the expected issuance price caused by stock market volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.