Concerns Over AI Overinvestment and DRAM Inventory Rise

Semiconductor ETF Significantly Reduced Weight Due to Rebalancing

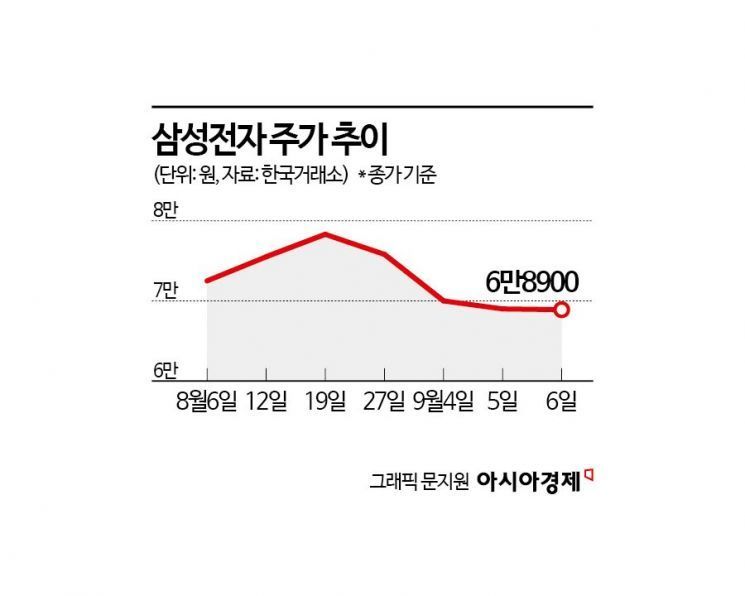

Samsung Electronics has fallen back to the 60,000 won level. Investor sentiment has deteriorated sharply due to continuous selling by foreigners and institutions. A report lowering the target price has also emerged in the securities industry. This is based on the analysis that it will be difficult for DRAM selling prices to rise amid mixed outlooks for the semiconductor market. This contrasts with the 'upward' revision of the target price just two months ago.

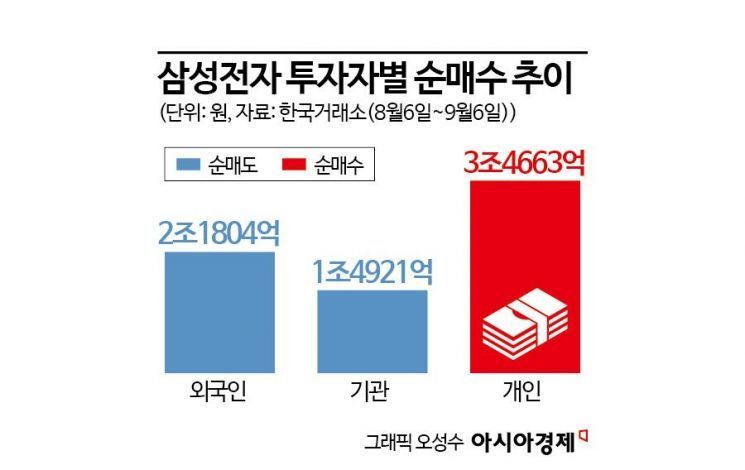

According to the Korea Exchange on the 6th, Samsung Electronics' stock price fell 4.9% from 72,500 won to 68,900 won over the past month (August 6 to September 6). Samsung Electronics stayed in the 70,000 won range after closing at 80,200 won on the 16th of last month but plunged to the 60,000 won range on the 5th (69,000 won). Over the month, foreigners and institutions sold 2.1804 trillion won and 1.4921 trillion won worth of shares respectively, dragging the stock price down.

The contraction of investor sentiment in the semiconductor sector stems from growing market concerns about the industry outlook. First, there is a forecast that server demand will structurally weaken due to overinvestment in artificial intelligence (AI). Alongside this, the DRAM inventory issue is also cited as a factor affecting the stock price.

The securities industry is also showing signs of realistically adjusting its view on Samsung Electronics. DB Financial Investment maintained its 'Buy' rating on Samsung Electronics but lowered the target price to 100,000 won. This is because it analyzed that Samsung Electronics' third-quarter sales and operating profit will fall short of market expectations by 6% and 19%, respectively.

Seung-yeon Seo, a researcher at DB Financial Investment, explained, "The target price was lowered due to changes in earnings estimates," adding, "this is because of expected weak B2C (business-to-consumer) demand, the reflection of DS bonus provisions, and a reduction in the reversal of memory inventory valuation loss provisions compared to the previous quarter."

DB Financial Investment forecasted Samsung Electronics' third-quarter sales to increase 17% year-on-year to 78.9 trillion won (+6% quarter-on-quarter), and operating profit to rise 355% year-on-year to 11.1 trillion won (+6% quarter-on-quarter). According to FnGuide, the consensus estimates for third-quarter sales and operating profit are 83.6808 trillion won and 13.6344 trillion won, respectively. These figures are slightly lower than the estimates from a month ago, which were 84.0491 trillion won for sales and 13.6373 trillion won for operating profit.

However, some view concerns about the semiconductor market as a short-term issue. Clear evidence of a slowdown in server demand due to AI overinvestment has not been confirmed. Kwang-jin Kim, a researcher at Hanwha Investment & Securities, stated, "The stagnation in third-quarter shipment bits cited as evidence of demand slowdown is reasonably interpreted as a minor adjustment in short-term sales plans to accommodate price increases," adding, "rather, demand from server customers for HBM and high-capacity D5 modules is still understood to remain strong."

Regarding HBM, it is explained that SK Hynix's production capacity for 2025 is already fully booked, and negotiations for 2026 volumes are underway, indicating very visible future demand.

Concerns about DRAM inventory should also be approached with caution. Researcher Kim diagnosed, "Since most of the industry's DRAM production facilities (CAPA) have already been converted to D5, new D4 supply is limited, and demand will naturally recover once the price spread with D5 exceeds a certain level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)