Average Daily Trading Value in August Down 6.6% from Previous Month

Lowest Monthly Level Recorded

Customer Deposits Also Decline for Second Consecutive Month

Brokerage Firms' Second Half Performance Expected to Decrease Compared to First Half

As the stock market sluggishness leads to a continuous decline in trading volume, concerns are rising that this will negatively impact the performance of securities firms in the second half of the year. The monthly average daily trading volume recorded its lowest level this year last month. This is due to the poor stock market performance, with the KOSPI recently plunging again and falling below the 2600 level.

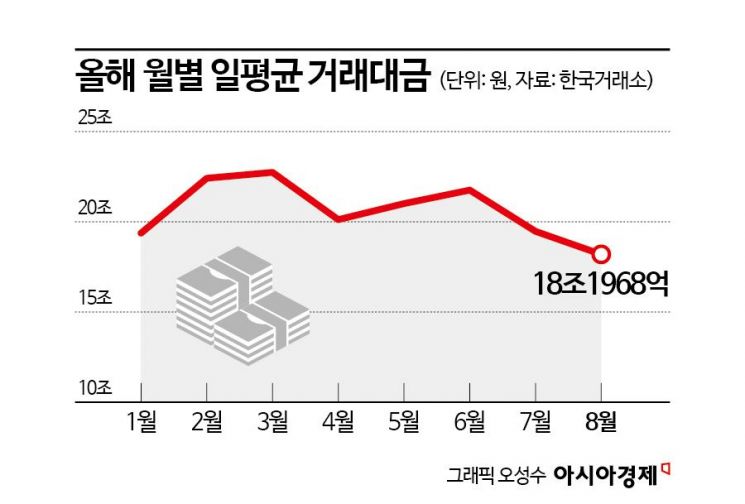

According to the Korea Exchange on the 6th, the average daily trading volume in August was 18.1968 trillion KRW, down 6.6% from the previous month. This is the lowest monthly figure so far this year. The monthly average daily trading volume had remained above 20 trillion KRW since February but fell below 20 trillion KRW in July and decreased further last month.

The cumulative trading volume for the third quarter up to August was 18.9 trillion KRW, marking a 9.9% decrease compared to the second quarter. Hyejin Park, a researcher at Daishin Securities, explained, "The trading volume, which had consistently exceeded 20 trillion KRW daily until June, shifted to a declining trend in the third quarter. On the 27th of last month, it even hit the year's lowest point at 14.8 trillion KRW."

The decline in trading volume is attributed to the sluggish stock market. Although the KOSPI rebounded and recovered the 2700 level after the crash on the 5th of last month, it failed to hold above 2700 and remained stagnant around the 2600 level. It then plunged again by 3% on the 4th, losing the 2600 level as well. Taejun Jung, a researcher at Mirae Asset Securities, analyzed, "The causes of the trading volume slump are estimated to be the ongoing stock market weakness since mid-July, the disappearance of leading industries causing expanded rotation trading, delayed liquidity expansion, and concerns over tax changes."

Investor deposits, which are standby funds in the stock market, are also on a downward trend. According to the Korea Financial Investment Association, investor deposits last month stood at 52.1293 trillion KRW. This is the second-lowest monthly figure after January (50.7434 trillion KRW). Investor deposits, which were in the 56 trillion KRW range in June, decreased to the 54 trillion KRW range in July and further dropped to the 52 trillion KRW range last month, showing a continuing decline. The balance of credit loans is also decreasing. Margin loans stood at 17.8557 trillion KRW last month, down 8.10% from the previous month.

Due to the sluggish stock market and the resulting decline in trading volume, securities firms' performance in the second half of the year is expected to decrease compared to the first half. Researcher Jung said, "Unlike the differentiation factor of performance being asset management results, the major driver of overall performance is revenue from the brokerage sector. The overall securities industry’s second-half performance will decline compared to the first half due to a slowdown in brokerage. The biggest cause is the decrease in trading volume, and overseas stock trading volume has also slowed down in the third quarter." He added, "The fact that the balance of credit loans has not recovered after a sharp drop will also affect the brokerage sector’s performance slowdown."

While a slowdown in brokerage performance seems inevitable, an increase in asset management (Trading) profits due to falling interest rates is expected to act as a factor defending overall performance. Ahae Jo, a researcher at Meritz Securities, said, "In August, the yields on 1-year, 3-year, and 5-year government bonds fell by 9bp (1bp=0.01 percentage point), 5bp, and 1bp respectively compared to the previous month. Based on the average for July and August, the 1-year, 3-year, and 5-year government bond yields fell by 30bp, 41bp, and 41bp respectively compared to the previous quarter. As the decline in interest rates expands, securities firms’ trading profit improvement is expected to continue." Seunggeon Kang, a researcher at KB Securities, said, "Although trading volume decreased and investor sentiment worsened due to increased stock market volatility in early August, the large-scale valuation gains from the bond yield decline in July will be sufficient to offset the deterioration in trading volume and stock-related securities valuation losses in August."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.